The Apple Card Savings Account is Getting a Rate DECREASE

Credit: Apple

Credit: Apple

Toggle Dark Mode

After a surprising three rate increases in less than two months, it looks like the Apple Card Savings account may be set to see its interest rates go down for the first time.

While it’s not a sure thing yet, MacRumors reports that contributor Aaron Perris has discovered data on Apple’s backend servers that reveals the Average Percentage Yield (APY) for the Apple Card Savings account will drop to 4.4% on April 3.

If accurate, this will mark the first APY drop for the new savings account, coming in only a few days short of the account’s first anniversary.

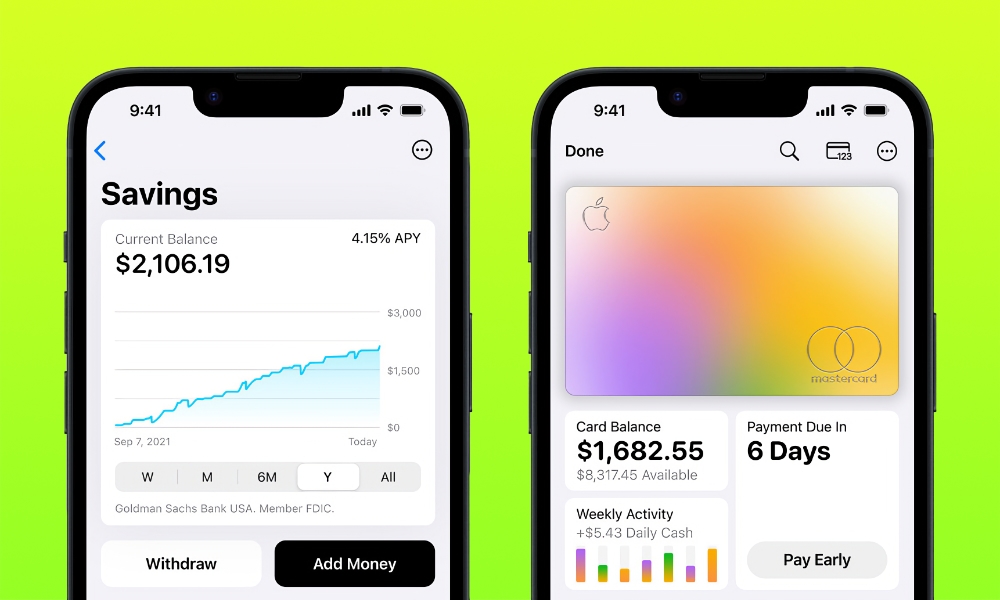

While Apple announced its plans for the new savings account in late 2022, it didn’t launch until April 17, 2023. At that time, it came with a healthy 4.15% APY. That wasn’t the best high-yield account in the game, but it was reasonably competitive for an account with no minimum balance or annual fees.

However, as others raised their rates, Apple did the same. For example, when the Apple Card Savings Account launched last April, its 4.15% APY was competing against services like Robinhood Gold, which was offering 4.4%. By December, Robinhood had raised its APY to 5.0%, while Apple announced its first-ever rate increase to 4.25%. A month later, Apple increased it again to 4.35% on January 5 and then 4.5% on January 29.

So, even if Apple drops its APY back down to 4.4%, it’s still only partially dialing back on that recent increase. While Robinhood Gold and others haven’t done anything similar (at least not yet), it’s fair to say that Apple’s savings account has an edge over those even at a lower APY.

For example, while there are high-yield savings accounts that offer APYs of up to 5.5%, nearly all of these have extra requirements to reach them. Robinhood only provides 1.5% unless you subscribe to Robinhood Gold, which charges a $5 monthly fee plus other withdrawal fees. Other services require that you maintain a minimum balance to get their best interest rates.

On the other hand, like the Apple Card itself, the Apple Card Savings Account has no monthly fees or other hidden charges. Daily Cash from your Apple Card can be deposited automatically into the Apple Card Savings account instead of an Apple Cash account, where it will immediately benefit from Apple’s best interest rates — a lot better than the zero percent that Apple Cash offers.

Daily Cash isn’t the only way to deposit money into an Apple Card Savings account; you can also link an external bank account and use it to withdraw or deposit funds via ACH transfers. You can quickly move money from it into your Apple Cash account if you want to make purchases, either via Apple Pay or the new Virtual Card feature in iOS 17.4.

The account can also be opened and managed entirely from your iPhone, although you have to first be an Apple Card holder to qualify and, therefore, by extension, be a US resident and at least 18 years of age.

Goldman Sachs continues to handle both the Apple Card and the Apple Card Savings accounts, and although that might change by early 2025, it’s unlikely to happen before Apple has found a new financial partner.