The Apple Card Savings Account Keeps Getting Rate Bumps — It’s Now 4.35% APY

Credit: Apple

Credit: Apple

Toggle Dark Mode

Apple and Goldman Sachs may be getting ready to part ways, but that doesn’t mean the two companies aren’t willing to sweeten the pot for holders of their Apple Card Savings Accounts.

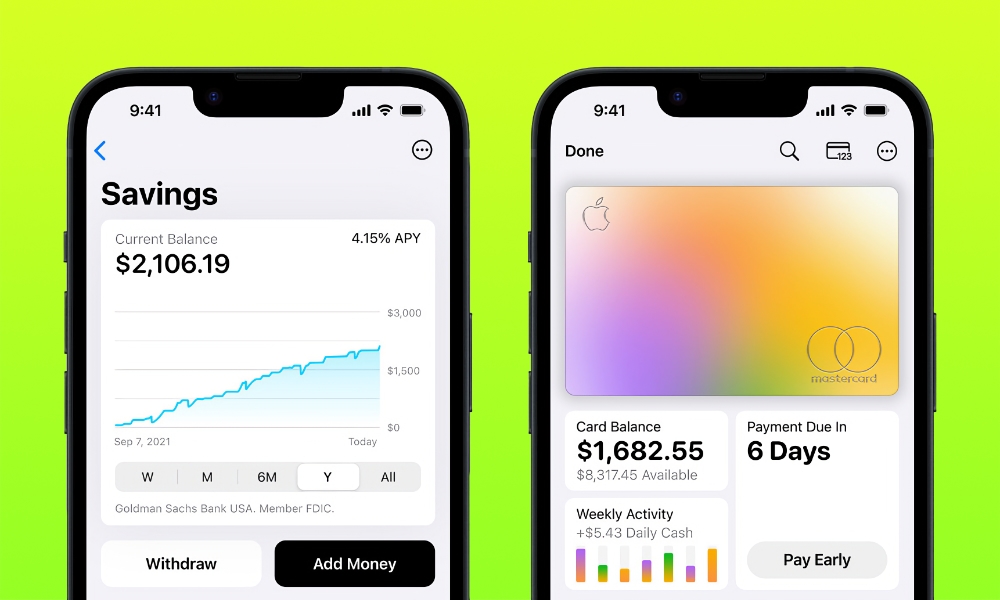

Announced in late 2022 and launched last spring, the Apple Card Savings Account provides an alternative place for holders of the Apple Card to stash their Daily Cash and earn interest while doing so.

Initially, the Apple Card Savings Account offered an already impressive 4.15% Annual Percentage Yield (APY) that was over ten times the average in the US. However, just before Christmas, it received a bump to 4.25% APY, and now MacRumors reports that account holders have just received another notification this week of an increase to 4.35%.

This puts it on par with other high-yield savings accounts by financial giants like American Express and Discover, although it’s not necessarily at the top of the pack. As we pointed out last year, you can do slightly better with Robinhood Gold. Further, Goldman Sachs’ own Marcus online accounts offer even higher APYs in the 4.5% to 5% range.

Nevertheless, one of the perks of the Apple Card Savings Account is that you don’t need a minimum balance to get the best interest rate, nor are there any fees. Apple’s account can be opened in minutes right from your iPhone’s Wallet app, with the only requirement that you already be the owner or co-owner of an Apple Card (which, in turn, means you also need to be a US resident who is at least 18 years old).

While the Apple Card Savings Account can be used to automatically deposit your Daily Cash from Apple Card purchases, it’s also possible to transfer money into the account directly using ACH Transfers from other bank accounts or moving funds in from your zero-interest Apple Cash account.

Money can be withdrawn from the Apple Card Savings Account in a similar manner, and while there’s no way to spend money directly from the account, moving it over to Apple Cash is simple and quick, where the virtual card can be used to make purchases with Apple Pay. There are no transfer fees in any direction.

Goldman Sachs currently handles Apple Card Savings Accounts, and that’s likely to continue to be so for at least the rest of this year. Apple and Goldman are working on an end to their arrangement, but it will take at least until early 2025 before all the details are ironed out, and they can move things over to whatever new partner Apple comes up with.

Tax Forms are Coming

While that interest boost is a nice bonus if you’re an Apple Card Savings Account holder, just keep in mind that now that Apple is paying interest, you’ll be on the hook to meet reporting requirements with the Internal Revenue Service (IRS).

As 9to5Mac reported earlier this week, Apple has begun emailing customers to let them know that 1099-INT tax forms are being sent out and will arrive by January 31, “as required by IRS guidelines.” Apple notes that users will receive an email once the form has been issued, where it can be found in the Apple Wallet app on the iPhone. Users who prefer a paper document can call Apple at 1-877-255-5923 to request one be sent to them.

You’ll only get a 1099-INT if you’ve earned more than $10 of interest in your Apple Card Savings Account, as amounts under that aren’t considered reportable. Apple Card Daily Cash isn’t included as this is regarded as a rebate rather than taxable income.