Apple Savings Account vs. Robinhood Gold | Which One is Better

Credit: Unsplash+ / Piggybank

Credit: Unsplash+ / Piggybank

Toggle Dark Mode

Apple has launched a savings account that’s available to just about anyone in the U.S. who’s also in the Apple ecosystem. Moreover, it offers a very attractive 4.15% APY, which, according to Apple, is more than ten times the national average.

Of course, Apple isn’t the only company with a compelling high-yield account on offer. You’ve probably heard of a few other players, with one of the best-known being Robinhood, which offers a Robinhood Gold plan designed to appeal both to investors and those looking for a good interest rate.

Which one should you go for? Read on for the pros and cons of each.

What Is Apple’s Savings Account?

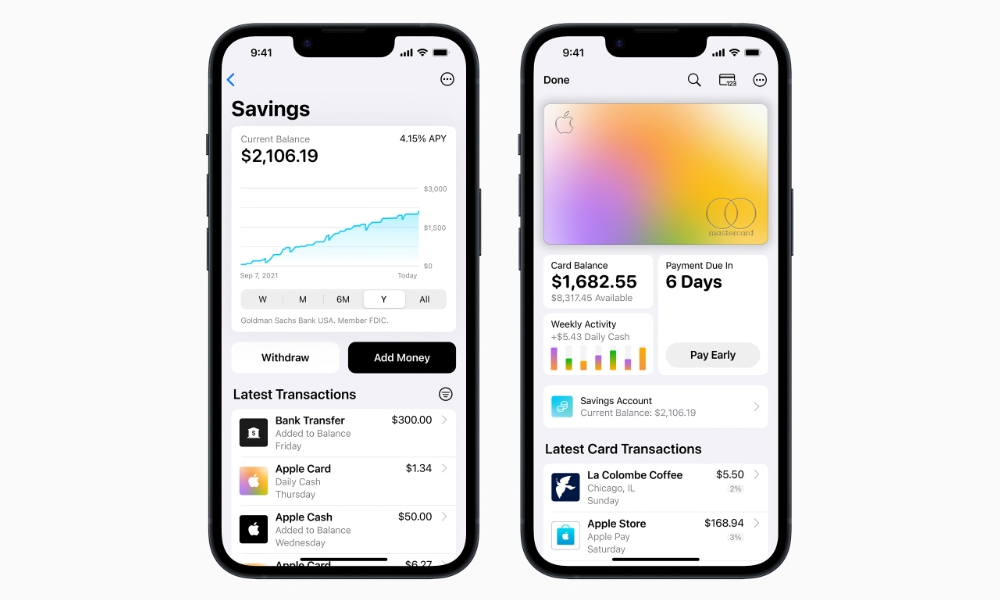

Apple decided to launch a new savings account from Goldman Sachs — the same banking partner that backs its Apple Card. If you’re an Apple Card holder, it takes only a minute or two to open an Apple’s savings account directly from your iPhone, and there’s no minimum deposit or minimum balance required — just the FDIC-insured maximum limit of $250,000, which should be more than enough for most of us.

What Is Robinhood Gold?

California-based financial services company Robinhood also offers a competitive savings plan called Robinhood Gold.

The company calls it “a suite of powerful tools, data, and features designed to take your investing to the next level,” although that doesn’t really explain what Robinhood Gold is about.

Basically, Robinhood Gold is a subscription service that gives you a ton of benefits in your Robinhood account — which we’ll talk about later. One of those benefits is a high-yield interest rate that gives you good returns on your savings.

Apple Savings Account vs. Robinhood Gold: Annual Percentage Yield (APY)

As we mentioned earlier, Apple’s new savings account offers an amazing 4.15% annual percentage yield (APY), which is more than most banks offer.

Although it’s not a complete savings account, Robinhood Gold also gives you a nice return for your money, with a slightly higher 4.4% APY.

Apple Savings Account vs. Robinhood Gold: How Easy Is It to Create an Account?

Both Apple and Robinhood make it easy to access their offerings. However, Apple is a bit more “exclusive” than Robinhood.

Firstly, to open an Apple savings account, you need to already be the owner or co-owner of an Apple Card, and you obviously also need to have an iPhone. Not only that, but Apple’s savings account is only available in the U.S. — and that probably won’t change anytime soon.

However, if you meet these requirements, you can create your own Apple savings account in under five minutes.

However, Robinhood Gold is even more accessible. While it’s not as integrated into your iPhone the way Apple’s financial services are, that also means you don’t need any Apple products. The only requirement is that you already have a Robinhood account. From there, you can upgrade to Robinhood Gold on any platform you want.

This right here will make your decision a lot easier. If you’re not an Apple user, or you don’t want to rely on Apple for your savings, Robinhood Gold might be the better choice.

Apple Savings Account vs. Robinhood Gold: Are There Any Fees?

When it comes to fees, Apple comes out on top. As we mentioned before, you don’t need to make any minimum deposits to open your account. You can create one — and keep it — with nothing in it, and you won’t have any problems.

Robinhood Gold, on the other hand, charges a $5 monthly fee, as this is more of a subscription service than a bank account, which means you’ll need to pay to have access to the service.

Apple Savings Account vs. Robinhood Gold—What Benefits Do They Offer?

Robinhood Gold is a much more full-featured service, with a wealth of benefits — but you may not need most of them.

For instance, Robinhood Gold offers professional research from Morningstar, level II market data from Nasdaq, access to margin investing at 7.5%, and bigger Instant Deposits of up to $50,000 (depending on the size of your portfolio).

All these features might sound great if you’re an active investor, but they’re likely not worth it if you just want to invest causally and get the benefits of a high-yield account.

With that said, Apple’s savings account doesn’t really offer any special benefits beyond its high annual percentage yield.

After you create your account, all your daily cashback rewards from using your Apple Card will go directly into your new savings account instead of being held in a zero-interest Apple Cash account. From there, you can transfer funds back to your Apple Cash account to spend via Apple Pay or move them to another bank account by setting up a standard ACH Transfer.

Beyond that, you get Apple’s security and privacy features that will keep your account and your money safe.

Another benefit it’s the availability of the accounts. Apple’s savings account is accessed through your iPhone and managed through Apple’s built-in Wallet app, whereas Robinhood has its own app and website that lets you access Robinhood Gold from just about any device.

Apple Savings Account vs. Robinhood Gold: Which One Should You Go For?

There’s no doubt that both accounts offer a lot of benefits, so you can’t really go wrong with either of them.

If you’re in the U.S. and love everything Apple does, then Apple’s savings account might be best for you. For doing nothing more than keeping your money in your account, you’ll get a high APY—something that not every bank offers—and you’ll have quick and easy access to your money whenever you want.

On the other hand, if you don’t want to trust Apple with your money or you’re more of an active investor in the stock market, Robinhood Gold is the best option for you. Not only will you get a really high APY, but you also get a ton of benefits that will potentially help you make more money just by spending $5 extra a month.

The best part is that if you’re an active trader and an Apple fan, you can just get both accounts. Since Apple doesn’t charge any fees, you can try it out for yourself and see if it’s worth your time and money. If nothing else it’s a better place to keep your daily cashback rewards from your Apple Card; you’ll at least earn a bit of interest while you decide what to do with that money.