The Apple Card Savings Account Gets Another Rate Increase to 4.5% APY

Credit: Apple

Credit: AppleToggle Dark Mode

It’s been less than a year since it launched, and Apple’s new high-yield savings account is already seeing its third interest rate increase in that time — and its second in less than a month.

On Friday, Apple notified customers that its savings account is now paying a 4.5% Annual Percentage Yield (APY), following prior increases to 4.35% in early January and 4.25% in December.

Announced in late 2022, Apple opened the doors of its Apple Card Savings Account last spring. The new savings account was designed exclusively for holders of Apple’s credit card as an extension of its longstanding partnership with Goldman Sachs.

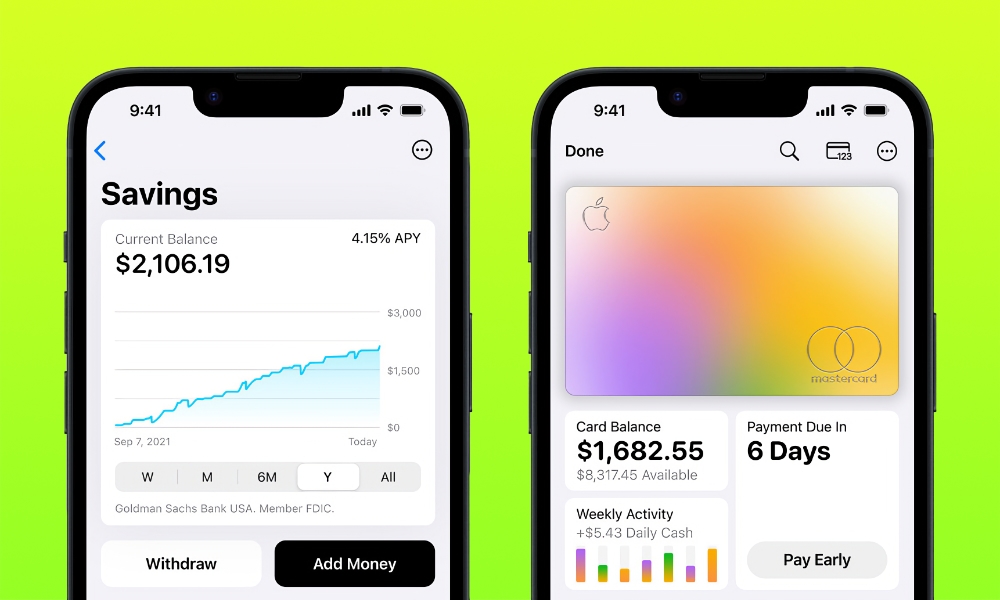

More significantly, it offered an impressive 4.15% APY when it launched, giving Apple Card holders a more lucrative place to stash Daily Cash earned from their credit card purchases rather than directing it to a zero-interest Apple Cash account.

Although Apple Card holders can easily send their Daily Cash into the new savings account, that isn’t the only way to get money into it. With a 4.5% APY, there’s more reason than ever to sign up for an account — if you haven’t already — and to move some of your savings into it from elsewhere.

Like most accounts, you can link an external bank account to your Apple Savings account and use it to withdraw or deposit funds via ACH transfers. You can’t make purchases directly from the Apple Savings account, but you can quickly move money over to your Apple Cash account and then spend it from there via Apple Pay.

Best of all, there are no associated fees to detract from those returns on your investment. There are no fees to maintain the account and no transfer fees to move money in or out — at least from Apple’s side.

The 4.5% APY puts it in the same league as other high-yield savings accounts, but the lack of fees gives it an edge, even if it isn’t offering the highest APY in the industry.

For example, although Apple’s increases are significant, its savings account is struggling just to keep pace with the rest of the market. When we discussed Robinhood Gold last year, it had an APY of 4.4% against Apple’s 4.15%. In December, Robinhood raised its APY to 5.0%, while Apple was still only paying 4.25% at that time. It’s no wonder Apple has been steadily increasing its rates of return.

Some high-yield savings accounts go even higher, with APYs of up to 5.5%, although the average for high-yield accounts seems to be hovering around 5%, putting Apple slightly behind the curve here. Even Goldman Sachs’ own Marcus online accounts have offered a 4.5% APY for a while now.

However, the catch is that many investment accounts require minimum balances to avoid fees — assuming you can avoid them at all — whereas Apple has none, making it an excellent choice for those just getting started. Robinhood’s basic APY is only 1.5%; to get the higher 5% APY, you have to subscribe to Robinhood Gold, which charges a $5 monthly fee plus other fees for withdrawals.

The only requirement to open an Apple Savings account is that you already be the owner or co-owner of an Apple Card. This means the account is only available to US residents at least 18 years old, but there are no other criteria to open one beyond that. You can open it right from the Wallet app on your iPhone, and you don’t even need to have a starting balance.

Goldman Sachs currently handles Apple Card Savings Accounts, and while it’s working on an end to its arrangement with Apple, that’s not likely to happen before early 2025, by which time Apple will have found a new partner.