Apple Integrates ‘Pay Later’ Option Directly into Wallet App

Toggle Dark Mode

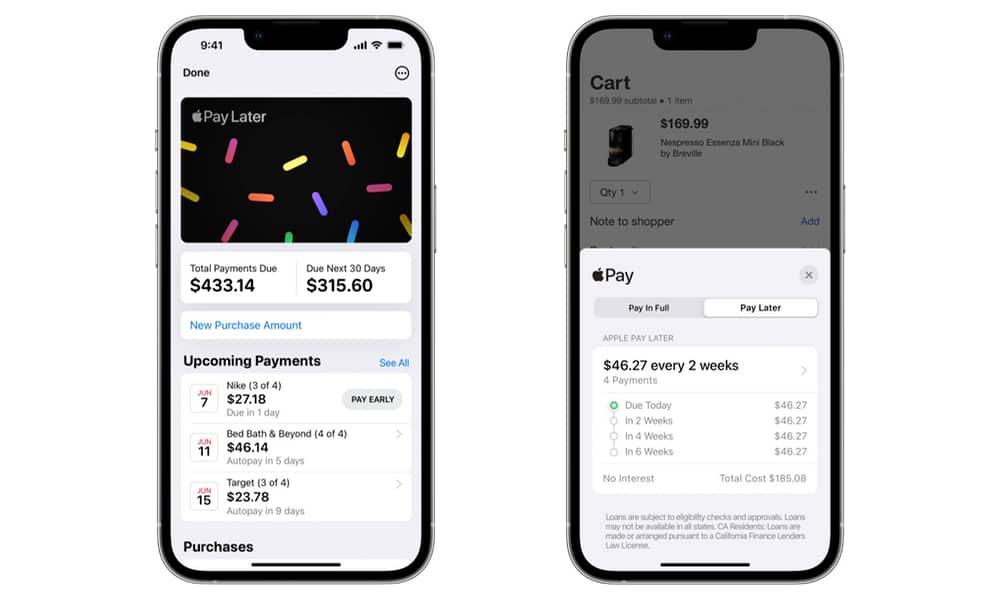

In 2022, Apple announced a foray into BNPL services with Apple Pay Later, allowing iPhone users to split purchases into four equal payments over eight weeks. However, that turned out to be a remarkably short-lived initiative; after announcing it in June 2022, it took nearly a year to even begin rolling out, and wasn’t broadly available until late 2023. Less than a year later, in June 2024, Apple announced it was killing off Apple Pay Later.

This meant that even the earliest adopters had the service for a little over a year. However, Apple didn’t leave BNPL fans entirely in the cold; although it was retiring its own service, Apple opened the door for third-party BNPL companies in iOS 18, letting them tie into the same Apple Pay features that it had developed for its own service.

The magic of Apple Pay Later wasn’t so much that Apple was running a short-term loan service. Those had been around for years. What stood out about Apple’s solution was the same thing that made the Apple Card unique: tight integration with the iPhone payments experience.

As the name implies, Apple Pay Later could be used to pay for a purchase as effortlessly as a credit or debit card through Apple Pay. After choosing to use the pay later service, the iPhone would present a virtual Mastercard to the payment terminal.

Since this went through like any other Mastercard, it wasn’t necessary for the merchant to be involved or even know that the customer was using a BNPL service. They’d receive the full payment immediately, and Apple would split it into four equal payments over the next six weeks, deducting the amounts from the user’s debit card.

As Apple ended Apple Pay Later, it allowed third-party financing companies to fill the gap. This began with Affirm and Klarna in late 2024, and by early 2025, others like Synchrony and Citi had joined the party.

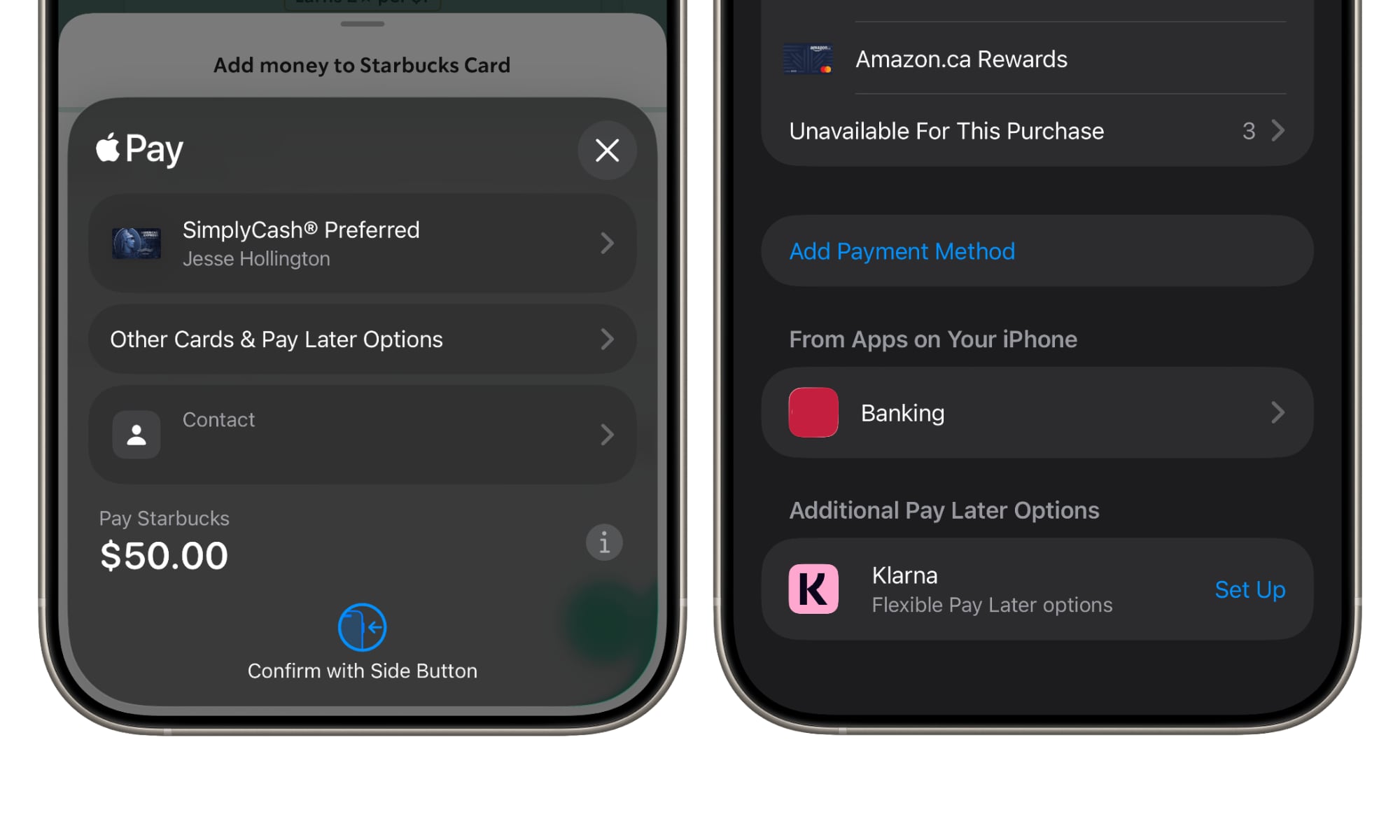

These BNPL services have always been awkward to access. There’s no clear indication of them in the main Wallet app. Instead, users need to initiate a payment and then select “Other Cards & Pay Later Options” from the payment sheet to view the available BNPL methods, which can only be found by scrolling to the bottom of the list of other eligible credit and debit cards.

One might argue that’s a good thing in that it discourages folks from going for the BNPL option too easily, but it also means you can’t even find out which BNPL options are available until you initiate a payment. Further, since you generally need to set up a BNPL service before you can use it to make a payment, this meant you’d need to go through that process at the point of sale.

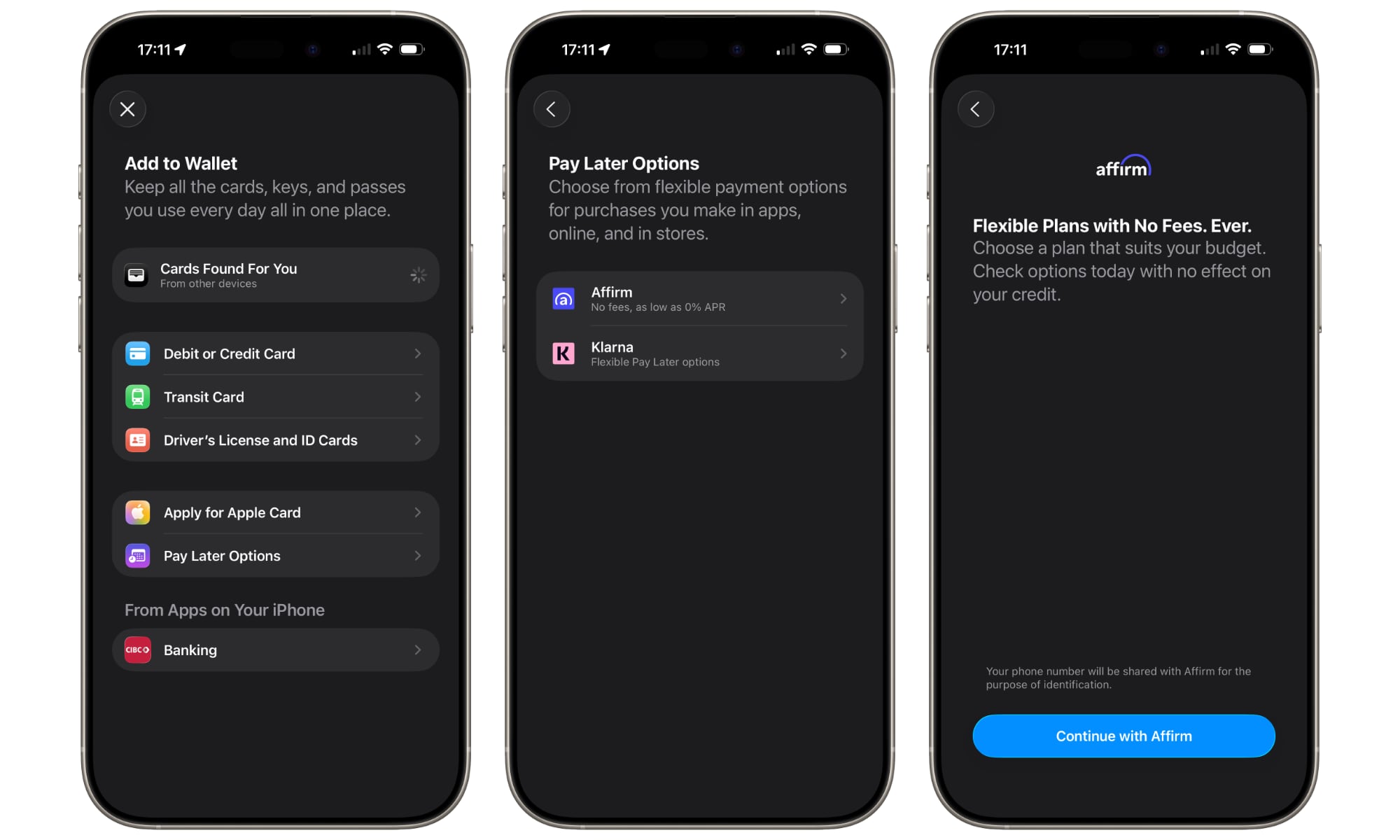

Thankfully, it looks like this is changing, at least for folks in the US. Now, you can set up your pay later accounts in the same way you’d add any other digital card, from credit and debit cards to transit cards and digital driver’s licenses.

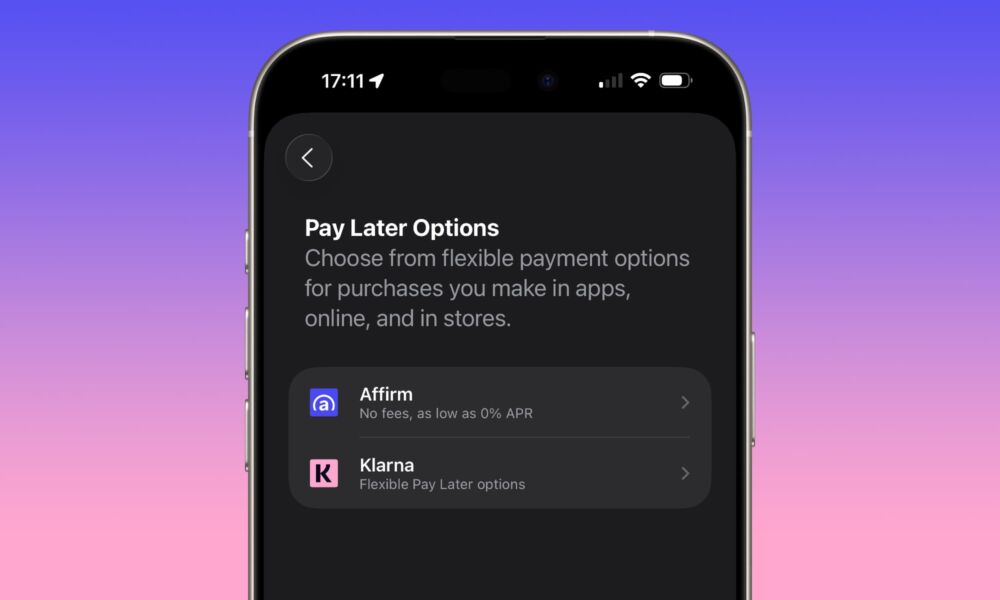

When tapping the Plus button in the top-right corner of the Wallet app to add a new card, a new “Pay Later Options” entry should now appear for iPhone users in the United States, in the same section where you apply for an Apple Card or add an Apple Account card.

This section lists options for setting up accounts with both Affirm and Klarna, although we imagine others will eventually show up here also. Choosing them will walk you through the same process that was used from the payment sheet, but the difference is that you’ll be able to do this on your own time, so it’s ready to go when you want to use it, rather than trying to awkwardly do it while standing at a checkout counter.

While several reports say this is rolling out to both iOS 18 and iOS 26, I have yet to see it appear on any of my devices running iOS 18, and several Redditors have reported the same. It’s possible that the rollout on iOS 18 may be slower; however, the final release candidate of iOS 26 is expected to arrive tomorrow, with a public release scheduled for next week.