FAQ | What Is Apple Pay Later?

Credit: Apple

Credit: Apple

Toggle Dark Mode

One of the more exciting features Apple announced during its iOS 16 unveil yesterday was Apple Pay Later, a new feature that will allow iPhone users to spread out big-ticket purchases into a deferred payment schedule.

Corey Fugman, Apple’s Senior Director of Wallet and Apple Pay, shared the highlights of the new service, noting that it would involve four equal payments with zero interest and no fees, but didn’t go into much more detail than that.

So, you may be wondering exactly how it’s going to work. It doesn’t sound much different from some of the programs Apple already offers to Apple Card holders. However, unlike those, this promises to be available to a much wider audience. It should work with almost any Apple Pay payment card, not just the Apple Card, and it appears that merchants don’t even need to know about the program since it’s handled entirely by Apple.

How Does Apple Pay Later Work?

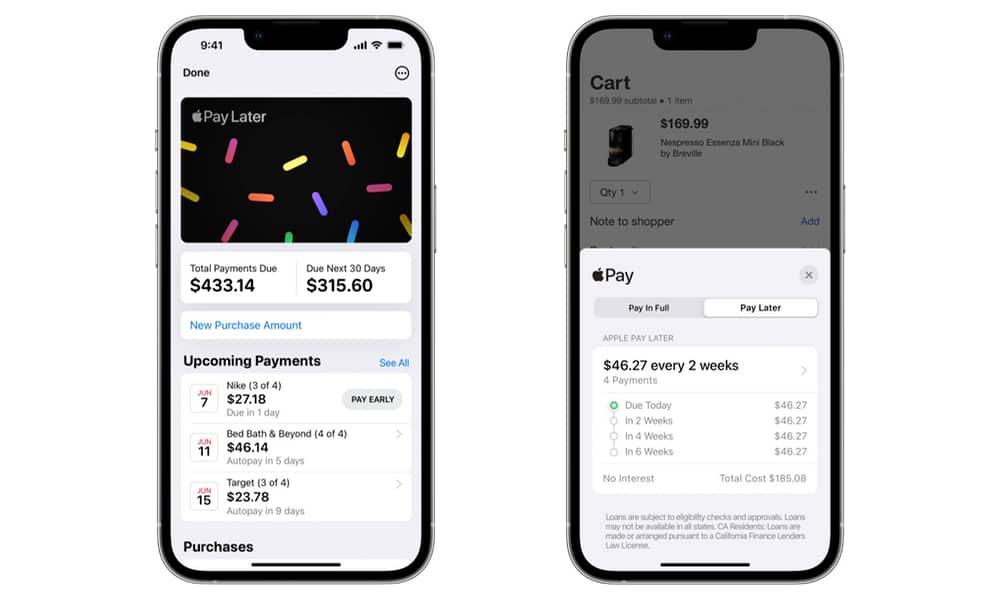

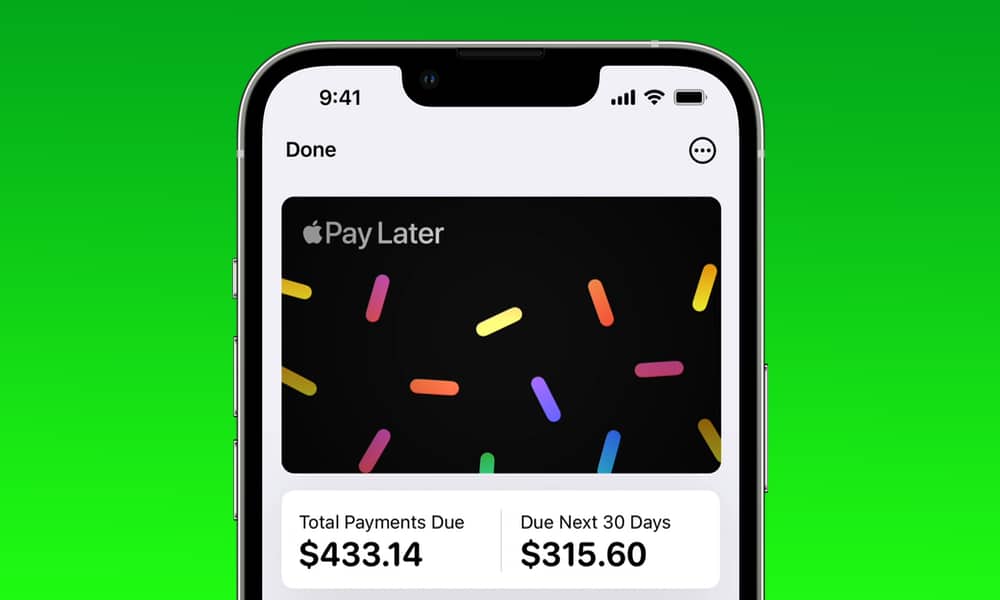

From what little Apple has shown us, it appears that the Wallet app in iOS 16 will offer an option to either “Pay in Full” or “Pay Later” when completing an Apple Pay transaction.

If you opt to Pay Later, you’ll need to make the first installment payment when checking out. The remaining three payments will automatically be taken from your chosen payment method every two weeks after that until the total amount is paid six weeks later.

You’ll also be able to view and manage your payment schedule in the Wallet app, and a “Pay Early” button will let you make the next payment sooner if you like.

Although Apple promises zero fees for using Apple Pay Later, a footnote on the iOS 16 announcement in Apple’s Newsroom adds that your bank may charge you a fee if you choose to pay later using a debit card and it has insufficient funds to cover one of the payments.

Can Anybody Use Apple Pay Later?

Naturally, Apple is excited about this new service and wants to make it available to as many folks are possible. However, ultimately this is still a loan made to you by Apple and its banking partner.

This means not everyone is going to qualify. The fine print in the Pay Later screen that Apple shared notes that “Loans are subject to eligibility checks and approvals,” while adding that they also “may not be available in all states.” Further, a footnote on Apple’s iOS 16 Preview Page adds that Apple Pay Later is “Available for qualifying applicants in the United States.”

Presumably, Apple and its lending partner will perform a quick credit check on the spot when you opt to pay later. While the bar for this will almost certainly be lower than applying for an Apple Card and is also likely geared to the transaction amount, those with poor credit may still find themselves declined. Let’s just hope that Apple has sorted out its approval algorithms from the early days of the Apple Card.

Do Stores Need to Support Apple Pay Later?

No. Although Apple still hasn’t explained this in detail, presumably, Apple will pay the merchant the total amount up-front and handle the financing internally.

This is why stores don’t need to specifically support Apple Pay Later or even know about it. They’ll receive the full amount of the transaction immediately, just as if you’d paid normally with your credit or debit card. Apple will then collect the money back from you in four equal payments over six weeks.

We heard the first rumors of the initiative last year from Bloomberg, which noted that Goldman Sachs, Apple’s banking partner for the Apple Card, will be handling the financing part of the loans. While Apple hasn’t said anything about its lending partner for Apple Pay Later, Goldman is the most likely one.

Apple emphasizes that Apple Pay Later is “available everywhere Apple Pay is accepted online and in apps,” although it also notes that the feature will use the Mastercard network. This doesn’t necessarily mean it will only work with Mastercard payment cards, but it likely won’t be available for retailers like Costco that don’t typically accept Mastercard.

There are two sides to an Apple Pay Later transaction. When presenting your iPhone to pay with Apple Pay Later, the terminal will see a virtual payment card from Apple’s lending program to cover the total amount of the transaction.

The merchant’s terminal won’t see your credit or debit card since Apple makes the payment on your behalf. From what Apple has said so far, it appears this will be a virtual Mastercard. If the retailer doesn’t accept Mastercard, you won’t be able to use Apple Pay Later any more than you could use the Apple Card.

Once the full payment has been made via Apple’s Pay Later virtual Mastercard, Apple will use your card’s payment network — Visa, Mastercard, or Amex — to draw each installment payment from your credit or debit card as it comes due.

How Much Can I Spend With Apple Pay Later?

Apple hasn’t said whether Apple Pay Later will have any transaction limits. Many other deferred payment services set both a lower and upper limit; the bottom end prevents people from splitting up trivially small transactions, while the ceiling limits the lender’s exposure.

Since Apple and its lending partner will presumably run a credit check before approving an Apple Pay Later transaction, the upper limit will likely vary based on individual credit history. However, we don’t know yet whether there will be a fixed limit beyond that.

Where will Apple Pay Later Be Available?

Like most of Apple’s financial initiatives, don’t expect this one to arrive outside of the U.S. anytime soon. Apple already says it will only be “available for qualifying applicants in the United States” with the release of iOS 16, and it will probably stay that way for the foreseeable future.

Apple Cash launched in 2017 and has yet to find its way beyond the U.S. borders. A recent transition from Discover to Visa Debit has raised some hope that this may finally come, but the payment network is only half the problem; Apple still has to find banking partners in other countries willing to handle the funds behind Apple Cash.

Likewise, although there have been reports that Goldman is hoping to expand the Apple Card internationally, that has yet to happen for the same reasons. Setting up foreign banking and lending arrangements isn’t trivial. Banks and lenders have to be established or chartered under the rules and regulations of each country where they want to operate.

As a credit arrangement, Apple Pay Later falls into the same category as the Apple Card. While it’s a bit simpler than a credit card, it will require that Apple’s chosen U.S. banking partner be authorized to operate in foreign countries or that Apple finds local banking partners in each new country it wants to expand the service into. While there’s no doubt Apple is working on this, these things take time.