Apple Pay Adds Another BNPL Option: Citi Flex Pay

Credit: Citi

Credit: Citi

Toggle Dark Mode

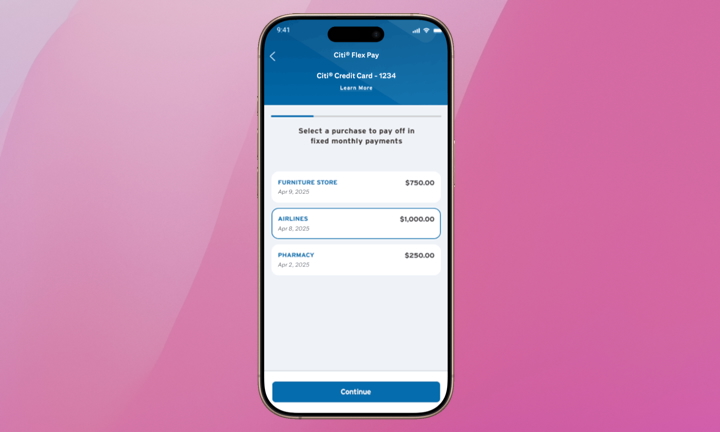

There’s good news today for Citi credit card holders. Apple Pay now supports “Citi Flex Pay” for Apple Pay purchases over $75. The default pay-back period is three months. Longer durations are available, but there will be a fee. A couple of weeks ago, we covered Apple Pay adding a BNPL option for Synchrony customers. Citi is the latest to accommodate buy-now-pay-later (BNPL) services through Apple Pay in iOS 18.

If you’re curious, Apple publishes a complete list of banks supporting BNPL via Apple Pay by country. Check it out. I’m afraid to count how many there are for the US. Remember, these are in addition to the BNPL options available at checkout of many online merchants, like PayPal, Klarna, Affirm, and AfterPay.

It’s looking like sooner or later, there will be a pay-over-time option for just about every bank or credit card via Apple Pay. While we believe BNPL is a great option for consumers, be careful. Try not to make a habit out of BNPL, as you’ll likely be incurring fees on top of fees. It will be all too easy to lose track of what you owe and where if it’s overused.

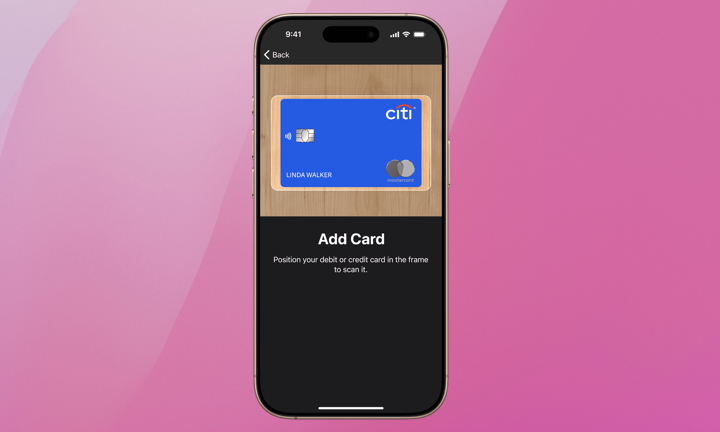

If you’re an eligible Citi cardholder, you can add your credit card to Apple Pay from the Citi Mobile App, Citi Online, or directly in Apple Wallet. When shopping on your iPhone or iPad, add a purchase of $75 or more to your cart. Select your Citi credit card and tap “Pay Later” (for eligible purchases) to view the available Citi Flex Pay options. Select the plan that works for you and confirm your purchase with Face ID or Touch ID, and wallah! Layaway city…I mean Citi.

Again, remember that most BNPL options still require you to be within your credit limit to exercise the pay later option. Citi is no different. The BNPL payment is added to your minimum monthly payment during each billing cycle until paid in full. So, although you’re gaining considerable financial flexibility, it’s essential to understand precisely how BNPL works for each merchant before using it. Despite the seemingly endless BNPL options, we encourage everyone to practice saving, not spending.