Synchrony Officially Turns the Key on Apple Pay Later Support

Toggle Dark Mode

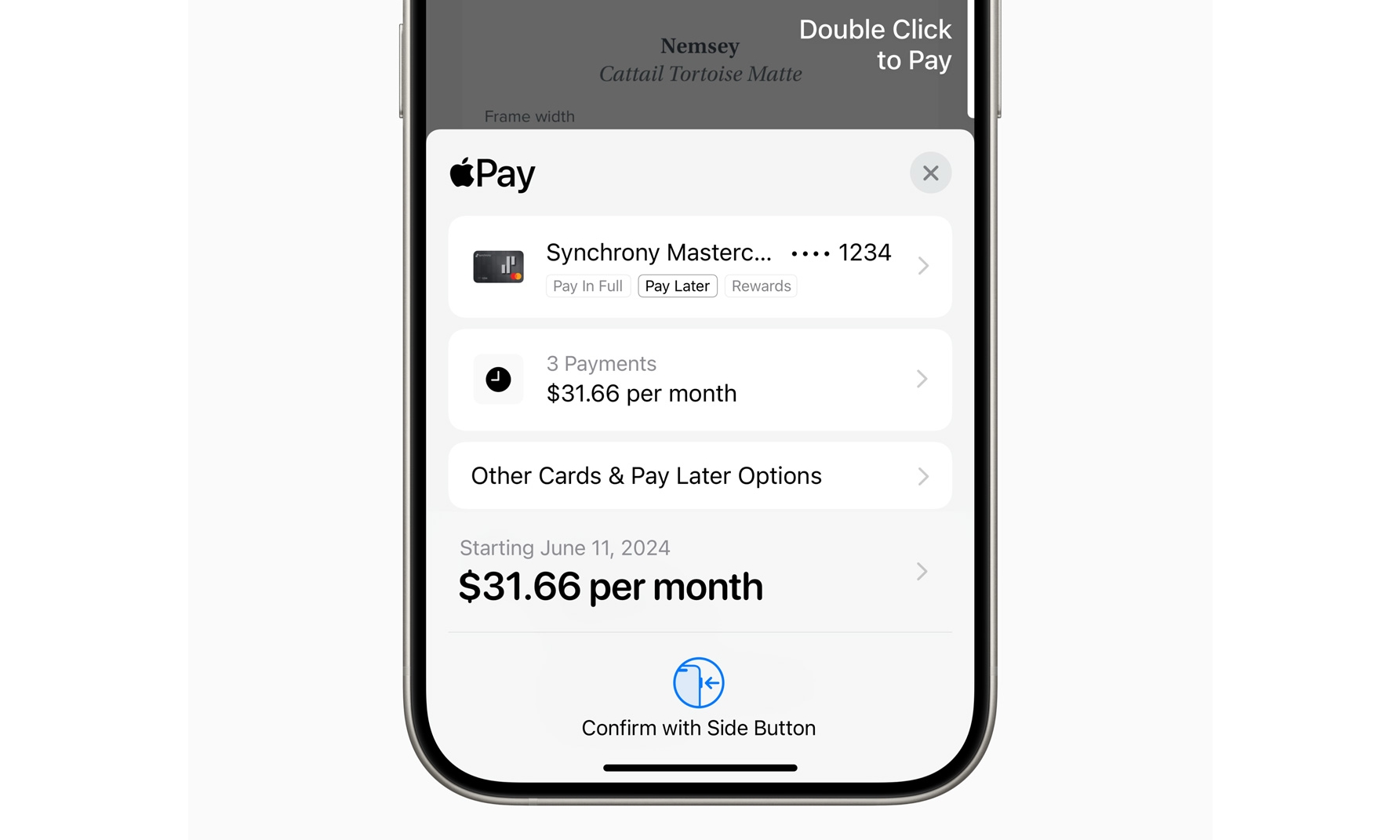

Following a false start last week when someone at Apple jumped the gun and prematurely listed Synchrony as a “Pay with installments” partner, the financial service has officially announced that it’s online and available through Apple Pay.

Synchrony joins other buy-now-pay-later (BNPL) payment providers, Affirm and Klarna, to offer integrated short-term loans when making purchases via Apple Pay. The new services replace the remarkably short-lived Apple Pay Later service that the company announced in 2022, rolled out in 2023, and killed off in 2024.

In its original form, Apple Pay Later had Apple itself — or, more specifically, a wholly-owned subsidiary of Apple — handling six-week loans whereby eligible customers could divide nearly any purchase under $1,000 into four equal payments. It was a clever solution for being tightly integrated into Apple Wallet and Apple Pay, presenting merchants with a virtual Mastercard to transparently pay the full balance of the purchase, with the first payment immediately deducted from the user’s debit card and three subsequent payments debited at two-week intervals over the following six weeks.

Nevertheless, at some point, Apple decided it wasn’t worth dealing with the headaches of running its own BNPL service. In iOS 18, it announced that it would be allowing other BNPL companies like Affirm to tie into Apple Wallet and Apple Pay in much the same manner. A few weeks later, it announced that these would replace its Apple Pay Later service.

When iOS 18 launched in September, partnerships with Affirm and Klarna were ready to go in the US. However, one advantage of Apple’s new strategy is that, unlike Apple Pay Later, third-party partnerships could scale globally. The UK came on board with Monzo and Klarna, the latter of which eventually expanded into Canada. Apple has also said that ANX in Australia, CaixaBank in Spain, and HSBC in the UK will eventually join the program, along with Citi, Synchrony, and Fiserve in the US.

Apple maintains a list of participating banks, with BNPL partners listed in the “Pay with installments” section. This is where the first hint of Synchrony’s participation appeared last week, but that was quickly removed only hours after it showed up there. Ironically, it still hasn’t reappeared, but Synchrony itself has said that its customers now have access to “the Pay Later Feature of Apple Pay” (it occurs that Apple may have done itself a disservice by using “Apple Pay Later” to refer to its own solution, as it fits just as well with these other integrations).

However, this new integration comes with a catch: only specific Synchrony card holders will be eligible to participate at this stage. That includes “Eligible Synchrony Preferred Mastercard, Synchrony Plus World Mastercard, or Synchrony Premier World Mastercard holders,” where the payment arrangement will tie into “the standard terms of their credit card.” Synchrony also says that it will have promotional offers for “eligible well qualified cardholders.”

The good news is that there’s more to come. Synchrony has promised that it will expand the feature later this year “to more Apple Pay users across the company’s portfolio of co-branded cards” and also take advantage of the new rewards redemption features that Apple also added in iOS 18, letting customers “view and redeem rewards from eligible Synchrony-issued cards when checking out online and in-app on iPhone and iPad with Apple Pay.”

The timing of today’s announcement is fascinating, as it accompanies reports that Apple has been in talks with Synchrony about a possible partnership for the Apple Card, along with Barclays and possibly still JPMorgan.