Is Apple Card Worth It? Here Are the Pros and Cons to Consider

Credit: Apple

Credit: Apple

Toggle Dark Mode

Apple on Monday officially debuted the Apple Card. It’s an Apple-branded credit card issued with Goldman Sachs. And it may just look an extremely attractive option for anyone looking for a new credit card.

But should you get the Apple Card? Like any credit card, that’ll depend on your specific circumstances. Continue reading to learn the Apple Card’s pros and cons before you decide one way or the other.

Pros

Apple being Apple, you wouldn’t expect it to just debut any old piece of plastic with an Apple logo. The Apple Card carries a number of benefits and unique features that help it stand out.

Baked-in Support & Financial Health Tools

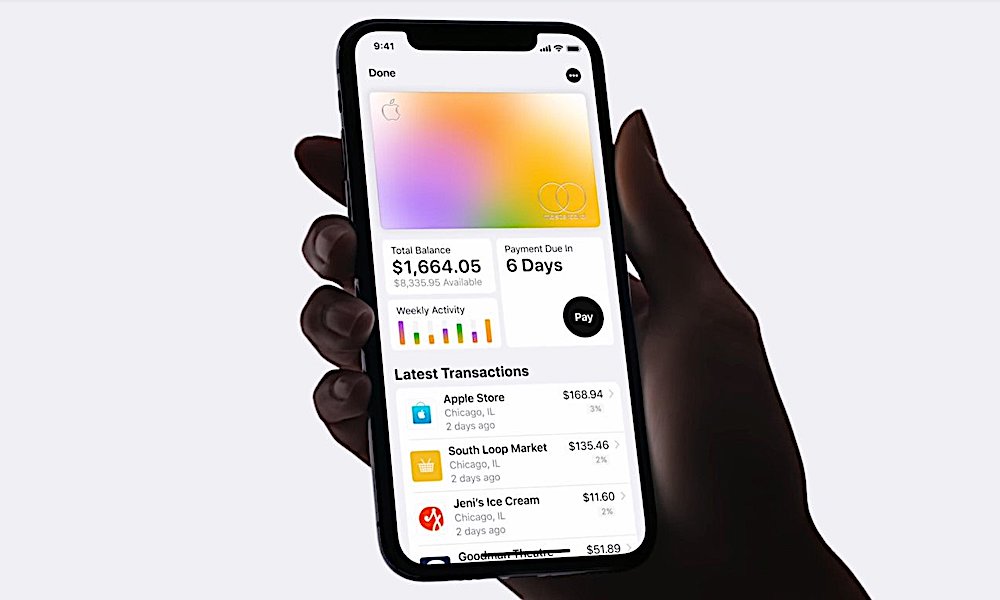

One of the primary benefits of the Apple Card is its extremely tight integration with the Apple ecosystem, the Wallet app, and Goldman Sachs (Apple’s co-issuer). That manifests in several different ways.

For example, there are some excellent “financial health” tools baked into the Wallet app, letting users see a broader picture of their Apple Card usage at-a-glance. That includes budget monitoring and interest calculations that are easily accessible.

Users who hate phone calls can also stand to benefit from the tight Apple integration. If you’d like to talk with Goldman Sachs about your card, you can contact the issuer through Messages.

Daily Cash Back

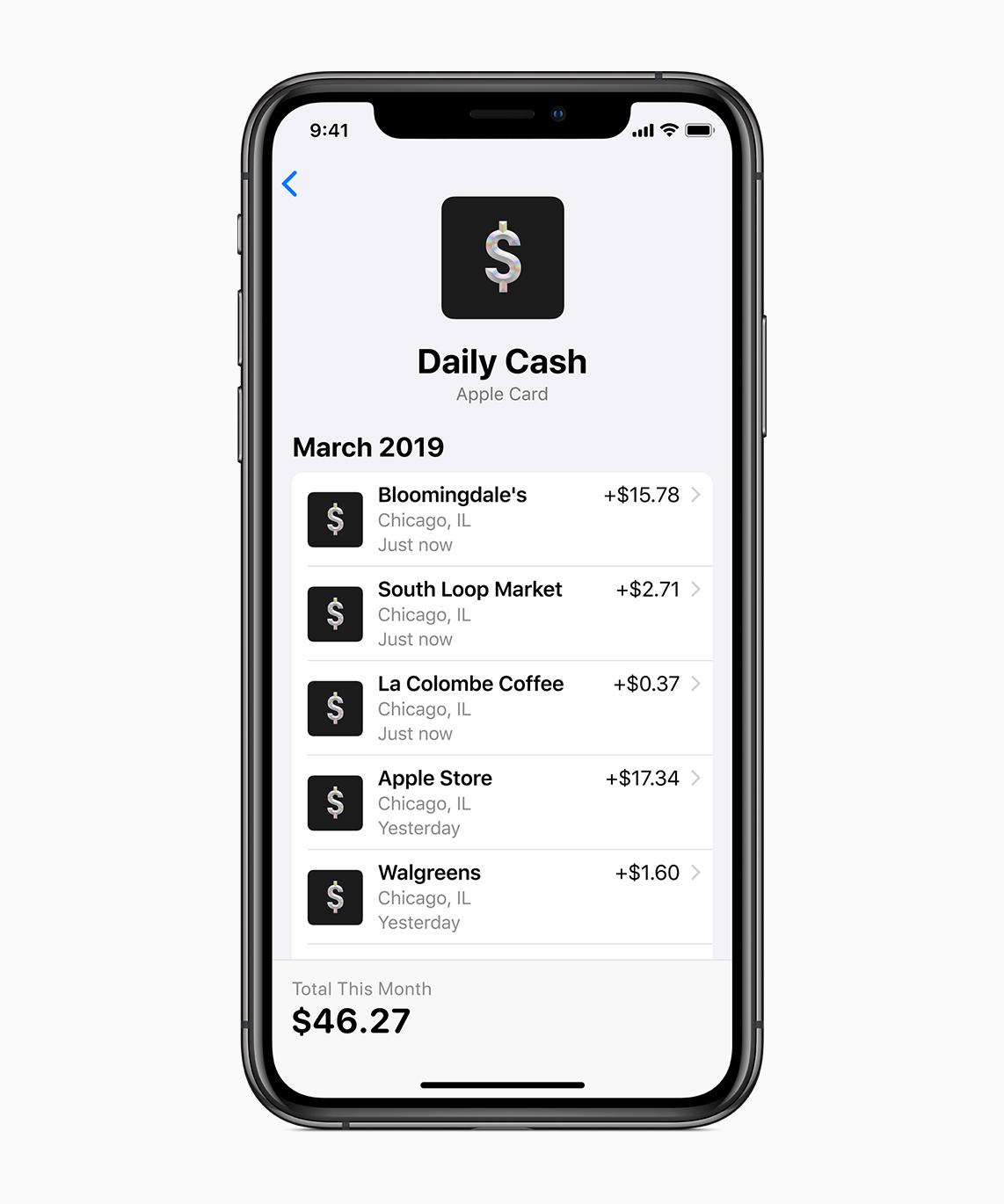

Arguably, the one feature that makes Apple Card stand out in a crowded marketplace is the so-called Daily Cash rewards system. At this point, there just isn’t anything else like that on the market.

Daily Cash will reward users based on their usage (with no cash back limits). But the best part is that cash back will be deposited directly into a user’s Apple Cash card at the end of each day. From there, users can spend that amount just like cash.

To be clear, the rewards rates are not perfect. But the fact that you can get access to your cash back rewards so quickly is a great feature — and likely one of the Apple Card’s biggest boons.

Lack of Fees

The Apple Card may be worth signing up for if you’re in the market for a new card, particularly since there aren’t any fees.

The lack of an annual fee means that you can carry it around on your iPhone without worrying about putting it to use.

There are many cards that forego an annual fee, but the Apple Card also lacks any sort of international transaction fees. That’ll make the card more attractive to frequent overseas travelers.

Apple also noted that there are no late fees or penalties on late payments, which could be great for users who aren’t savvy on keeping up-to-date with their credit card balances. (Though there is a caveat here, which we’ll get to in the Cons section.)

Privacy & Security

Other than Daily Cash, one of the most compelling reasons to get an Apple Card is security and privacy. Those are both principles Apple hammered home on Monday — and we wouldn’t expect any different from an Apple-branded credit card.

For one, Apple won’t track your purchases (like how much you spent on or where you made them). It also made clear that Goldman Sachs won’t share or sell user data for advertising purposes. Those are all very Apple-esque policies.

As far as security, it’s just as stringent. Card numbers are stored locally on a device and each purchase is protected with a one-time dynamic security code, among other clever security features. The physical Apple Card lacks any identifying features like card numbers or CVV.

Aesthetics

Let’s be clear here. This is a really minor point and it really shouldn’t entice you to get an Apple Card. But for users who are already considering the credit card option, it’s still worth noting.

Put simply, the Apple Card looks great. It’s made from titanium and features a stark white and minimalist design. On the front, there’s only a laser-etched Apple logo, a similarly etched name, and a chip.

It’s a striking design and is sure to get noticed wherever you use it. In other words, it’s probably exactly what you’d expect from an Apple credit card.

Cons

Of course, the Apple Card isn’t perfect and it won’t be a great fit for everyone. While these are listed as “Cons,” it may be more accurate to say they are things to consider before going ahead and applying for it.

The Interest Rate Varies

One of the things Apple touted during its Monday event was Apple Card’s “lower than average” interest rates. But there are a few things you need to know about that.

Apple didn’t go into specifics about the interest rate, but the APR on the Apple Card can vary between 13.24% and 24.24%. That’s actually a wider range than the interest on most credit cards, analyst Ted Rossman told CNBC.

Essentially, that means people with good credit could actually get lower interest rates than competing cards. But those with credit on the lower side of things may find a better APR on another card (if they can even get approved for the Apple Card in the first place).

Subpar Cash Back Rates

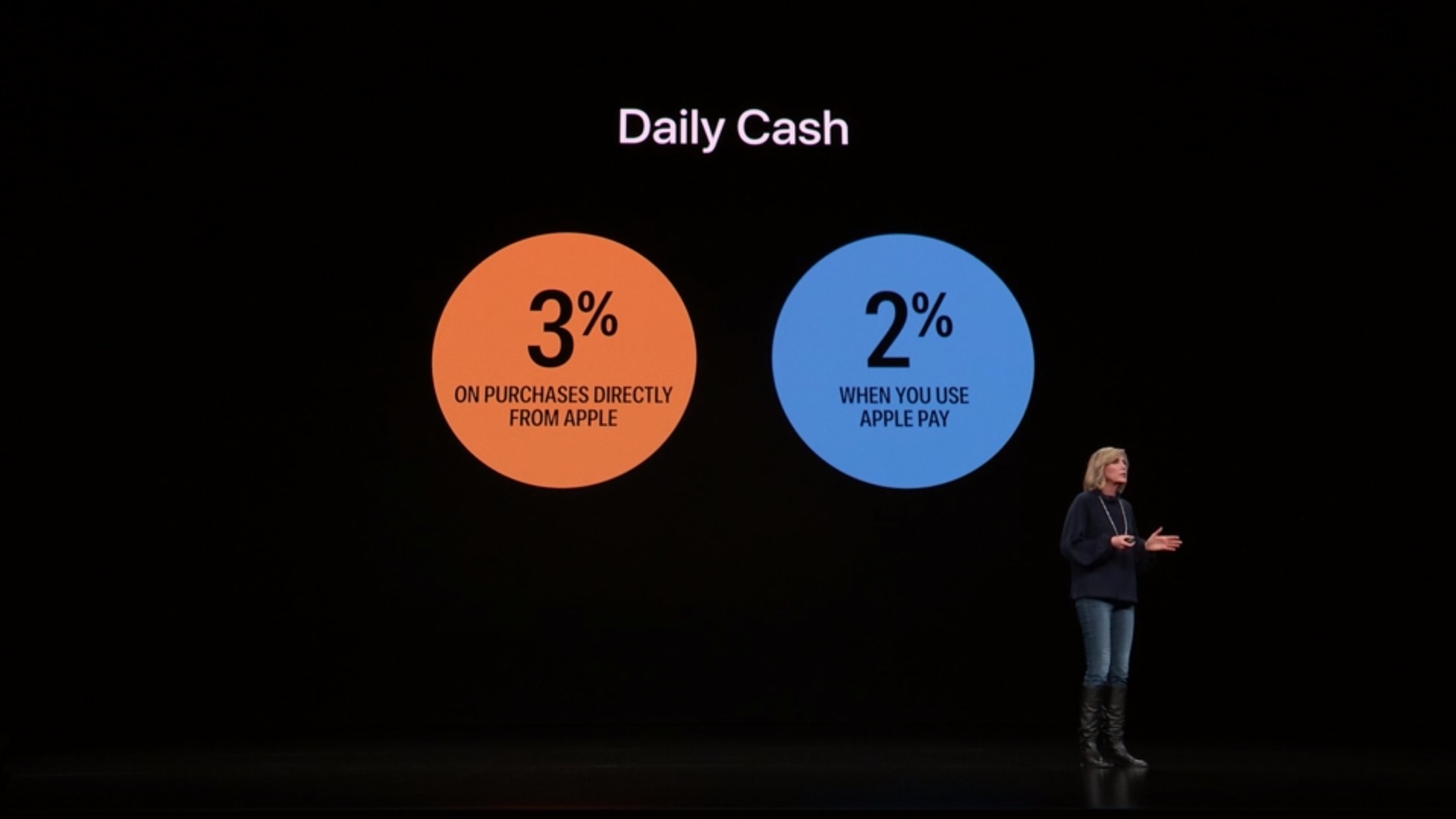

Daily Cash is a great and admittedly innovative idea. But the actual amount of cash back Apple Card holders can earn is a bit lower than many of the rewards credit cards out there.

Using Apple Pay, you can get up to 2% cash back. That’s the same as a card like Citi Double Cash, which is accepted at a much wider range of retailers. (Using the physical Apple Card will only net you a paltry 1% cash back.)

Sure, 3% on Apple purchases is decent. But you can get up to 5% cash back on rotating categories with many of the best rewards cards.

Discover It, for example, rewards users up to 5% cash back on that quarter’s specific categories (like electronics stores, Amazon or gas stations).

Lack of Perks

The Apple Card has a variety of unique features. But compared to some other credit cards that are out there today, Apple’s credit card offering just doesn’t feature the same breadth of rewards.

For example, there isn’t an introductory APR for purchases or balance transfers. That’s something included with most if not all decent rewards cards on the market today.

If you have good credit, some of the top-tier cards even offer deeper rewards that the Apple Card just doesn’t. Discover It, for example, will match the cash back you earn in your first year — with no limits.

Apple Pay Isn’t Widespread (Yet)

Apple Pay is steadily expanding its sphere of influence. But contrary to what Apple says, it’s still not accepted everywhere. In fact, depending on where you live, you may not be able to use it in nearly as many places as you could a normal credit card.

Many sit-down restaurants won’t have an Apple Pay option, for example. And there are undoubtedly still retailers in more rural or suburban areas that haven’t adopted the payment standard.

The Apple Card will be great for users who live in an area with lots of Apple Pay-supporting retailers and merchants. Sure, there’s the physical card for those other items. But, as we’ve covered, the perks for the physical card just aren’t very compelling.

The Fine Print

At its event this week, Apple made the Apple Card seem like the easiest thing in the world to get. But it glossed over the fact that you still need to apply for and get approved by the issuer. You don’t just automatically get it because you’re an Apple user.

Similarly, Apple touted the fact that the Apple Card features no late payment fees. But that isn’t the whole story. According to the fine print, a late payment will still penalize you — Apple itself notes that late payments will result in additional interest on balances.

These aren’t dealbreakers or necessarily unexpected, of course. But they’re all things you need to research and keep in mind if you’re considering the Apple Card. It isn’t quite as simple as Apple made it out to be.

Bottom Line

The Apple Card is not an average credit card. It sports quite a few innovative and exclusive features that you won’t find anywhere else — which may make it a great option to add to your credit card arsenal.

But that’s really only true for Apple users with good credit who live near plenty of merchants that accept Apple Pay. For people who don’t fit that specific criteria, there are a number of issues with the card that make it a little less compelling.

You can find plenty of other credit cards that are accepted at more retailers and that offer better perks and rewards rates. In other words, just like any other credit card, you should do your research and complete side-by-side comparisons before you sign up for the Apple Card.