Apple Pay Later Rolls Out Across the US

Credit: Apple

Credit: Apple

Toggle Dark Mode

While we didn’t see the anticipated release of iOS 17.1 today, iPhone users in the US are getting a surprise perk: after months in an early access beta, Apple has finally taken the brakes off its long-delayed Apple Pay Later service, rolling it out far and wide.

Like nearly all of Apple’s financial services, Apple Pay Later is still limited to users in the United States, but it’s no longer an invitation-only beta but is available to nearly anybody in the US with the latest version of iOS or iPadOS on their iPhone or iPad. The exceptions are Hawaii, New Mexico, Wisconsin, and the U.S. territories.

Apple first announced Apple Pay Later at the unveiling of iOS 16 during its June 2022 Worldwide Developers Conference (WWDC). While it technically made the cut for the iOS 16 cycle — rumors of the imminent launch of Apple Pay Later appeared in February, and it began rolling out via “early access” invites in April — it took until the eve of the iOS 17.1 release for it to actually be ready for prime time.

What is Apple Pay Later?

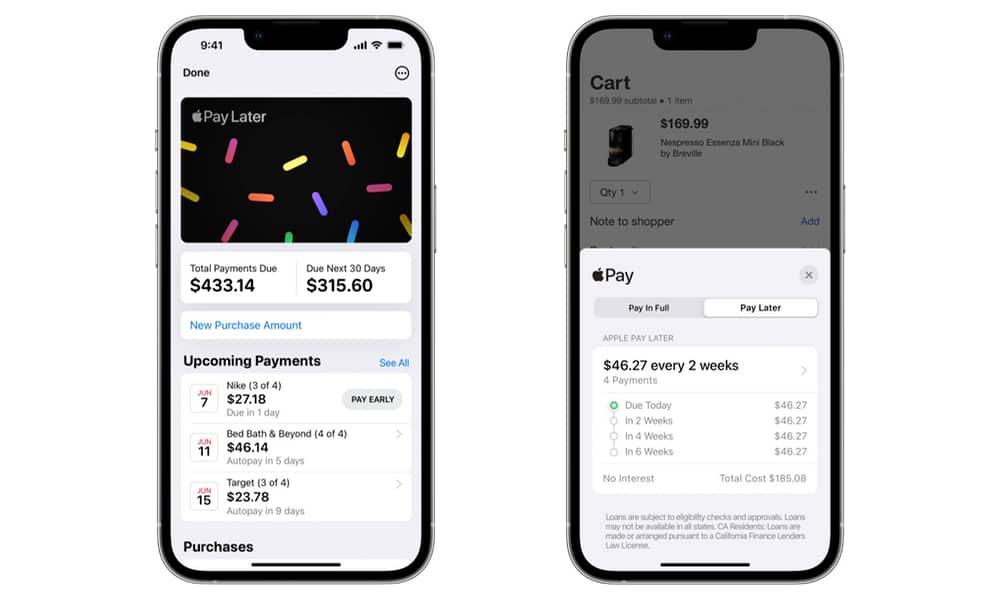

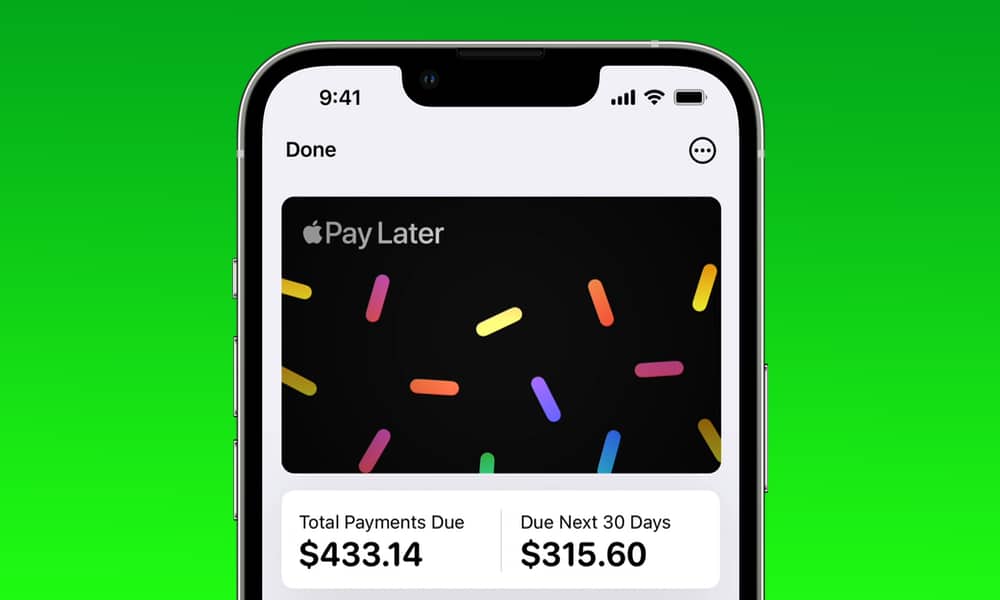

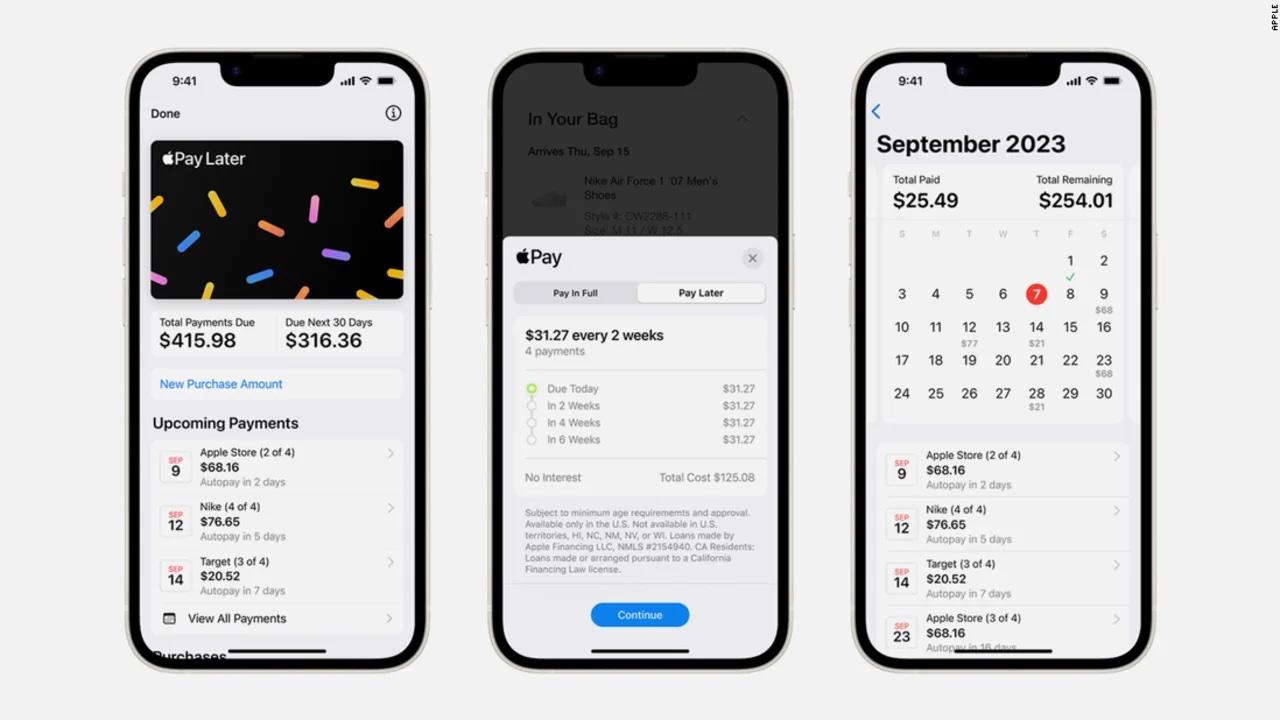

In case you haven’t been following along, Apple Pay Later is Apple’s take on a buy-now-pay-later (BNPL) service that lets you split purchases made with Apple Pay into four equal payments over six weeks.

What makes Apple’s implementation different from other BNPL services is that it’s entirely integrated into your iPhone’s Wallet app, letting you apply for authorization and make the purchase right on your iPhone without fussing with any other apps or filling out more complicated application forms.

Apple Pay Later can be used for in-person Apple Pay purchases from your iPhone or iPad and online purchases in any app that supports Apple Pay. You can’t split up purchases smaller than $75, and the maximum eligible amount is $1,000.

What Do I Need to Use Apple Pay Later?

According to Apple, Apple Pay Later is only available to users who are 18 years of age or older (19 in Alabama) and are US citizens or lawful residents with a valid, physical US address.

You must also have an eligible debit card registered with Apple Pay on your device. This is what your Apple Pay Later installment payments will be drawn from.

You’ll also need to have two-factor authentication setup for your Apple ID for security reasons, and you may need to verify your identity with a Drivers License or other State-issued photo ID.

Certain types of purchases aren’t eligible for Apple Pay Later, including those related to firearms, weapons, ammunition, gambling, casinos, lotteries, tobacco products, gift cards, investment or credit services, money transfers and other cash equivalents, and more. A complete list can be found in Apple’s Apple Pay Later Program Terms.

How Does Apple Pay Later Work?

Under the hood, Apple Pay Later works by presenting a virtual Mastercard as a payment method to the retailer, who has no idea that you’re using Apple Pay Later. They receive the total amount as a regular transaction, just as if you had paid with your own Mastercard.

To use Apple Pay Later, you can either apply on the spot during checkout or pre-apply to get an approved amount valid for up to 30 days. If you apply in advance, you’ll be offered a virtual Apple Pay Later card that you’ll need to add to Apple Wallet to use later when making the purchase.

When you make the Apple Pay Later transaction, Apple takes the first 25% of the amount from your registered debit card as the downpayment. By default, the remaining three payments are collected automatically from the same debit card at two-week intervals.

You can view your loan details and change the debit card used for future payments in the Wallet app, pay off all or part of your Apple Pay Later loan early, or disable automatic payments if you’d rather make them manually. However, turning off automatic payments doesn’t affect their due dates, and there’s no way to adjust the terms of your Apple Pay Later loan without contacting an “Apple Pay Later Specialist” via Apple Support.