Apple Card Once Again Takes Top Honors for Customer Satisfaction

Credit: Apple

Credit: Apple

Toggle Dark Mode

For the fourth year in a row, US consumers have rated the Apple Card as among the best credit cards available, according to a survey by J.D. Power.

While the Apple Card’s number one place comes with a slight asterisk — it’s awarded in a specific and relatively narrow segment of co-branded credit cards with no annual fee — Apple’s credit card has taken first place in that category nearly every year since it was first introduced in 2019.

Many co-branded credit cards do carry an annual fee, so the Apple Card isn’t being compared to those, nor is it up against generic Mastercard, Visa, and American Express cards issued by banks and other financial institutions.

Still, the Apple Card sets itself apart from the co-branded card pack by offering a staggering number of benefits for a card devoid of any traditional fees. For instance, you can get up to 3% cash back on all Apple purchases, whether that’s hardware bought at an Apple Store, a subscription to Apple Music or Apple One, or even App Store purchases — including in-game currency.

Apple also offers 3% cash back from many other select merchants, including Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens, while you’ll get 2% cash back every else, as long as you’re using the digital version of the Apple Card with Apple Pay on your iPhone or Apple Watch. Pull out the physical titanium card, and that drops to only 1%.

However, the best part about Apple’s cash back program is that it’s paid out daily. You don’t have to wait for an anniversary date or even your next statement; cash is deposited to your Apple Cash account as soon as a transaction gets posted to the Apple Card.

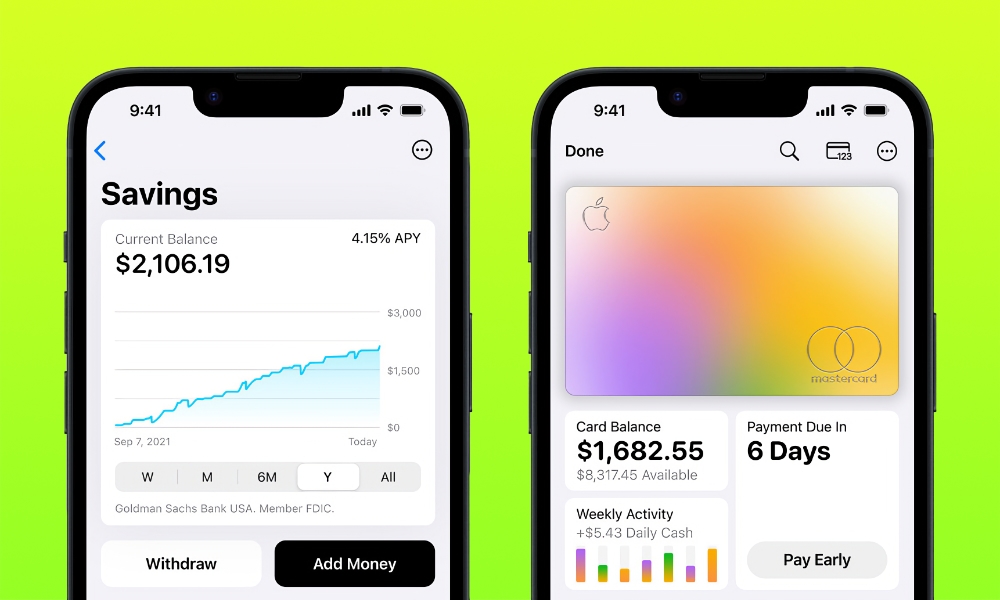

Apple Card holders can also sign up for a high-yield Apple Card Savings account and have their Daily Cash directed there to earn interest. Apple has provided annual percentage yields (APYs) between 4.15% and 4.5%, adjusting these rates from time to time. It now sits at 4.4% as of this writing. That’s not the highest APY you’ll find, but it’s pretty good, especially considering how easy it is to sign up for and use an Apple Card Savings account. It’s also an incredibly popular option that attracted $10 billion in deposits in just four months.

That part is likely the key to the Apple Card’s high satisfaction numbers. As Apple shared in its announcement, the J.D. Power U.S. Credit Card Satisfaction Study takes into account categories like account management, customer service, and new account experience — all areas in which the Apple Card excels.

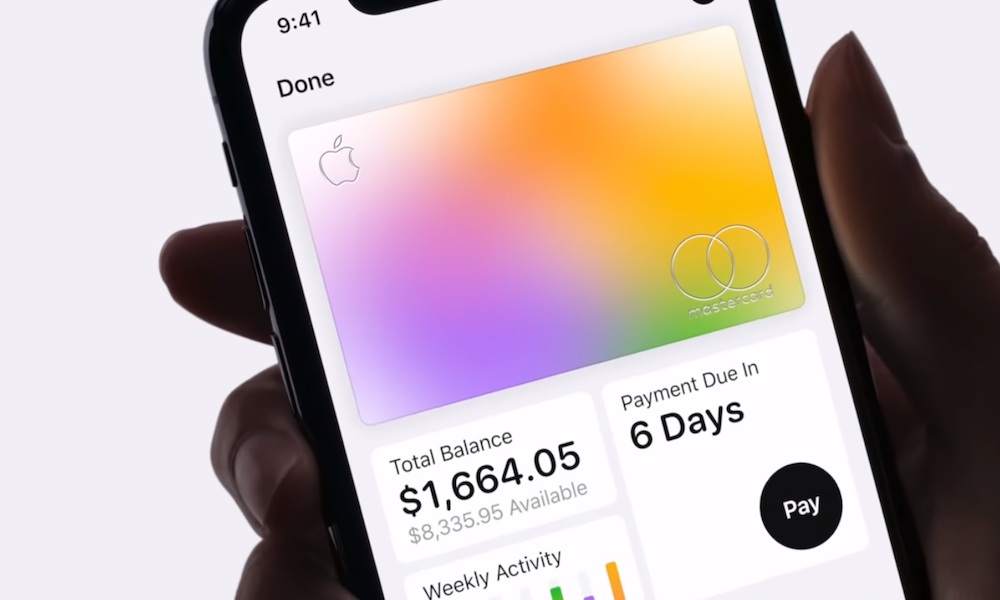

When it comes to features, the Apple Card is an excellent choice for iPhone users, as you can manage the entire experience directly from Apple’s Wallet app. That includes everything from applying for the Apple Card in the first place to monitoring expenses, tracking purchases, managing spending, calculating potential interest charges, making payments, and even setting up interest-free financing for Apple hardware purchases.

Three years ago, Apple introduced Apple Card Family as a way to allow up to six people in your household to share a single Apple Card account, including designating a co-owner like a spouse or domestic partner and providing kids aged 13 to 18 with their own spending-controlled additional Apple Cards tied to the same family account.

The Apple Card is currently backed by Goldman Sachs, whose CEO once praised it as the most successful credit card launch ever. While several reports last year revealed that Goldman is looking for a way out of the partnership, the situation is more complicated than the Apple Card itself. Goldman has reportedly been divesting itself of its consumer lending business almost entirely; it is, after all, primarily an investment bank.

We haven’t heard much about Apple and Goldman’s plans for the Apple Card lately, but they’re believed to be shopping around for a new partner. While consumer popularity isn’t the only factor that other financial institutions have to consider, it’s a feather in Apple’s cap that should help to attract at least some interest.