The Apple Card May Switch to American Express

Credit: American Express

Credit: American Express

Toggle Dark Mode

It looks like Goldman Sachs may have bitten off a bit more than it could chew when it forged a landmark partnership with Apple to launch the Apple Card four years ago.

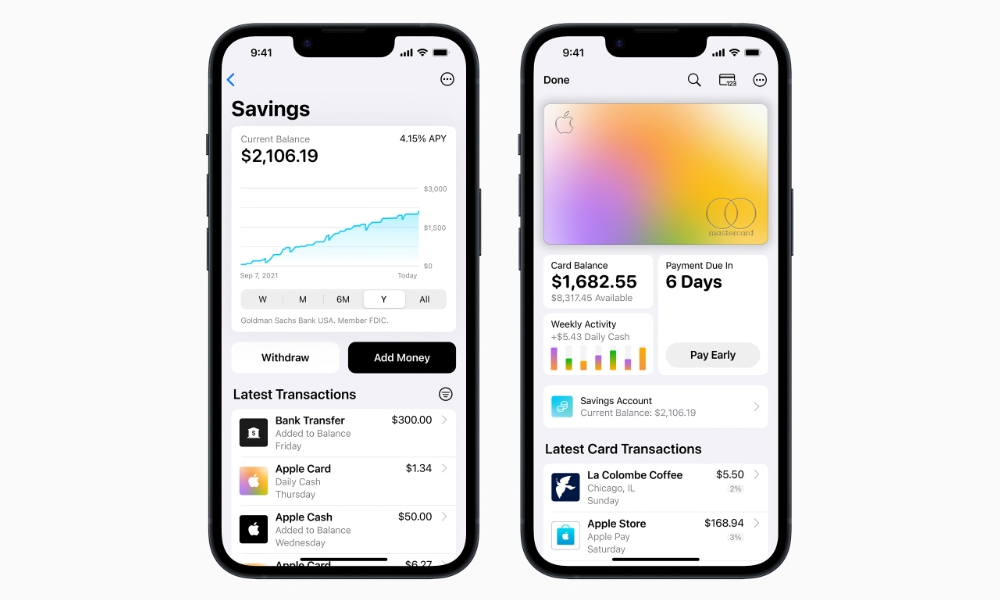

Goldman’s CEO praised the event as the most successful credit card launch ever, and the two companies have more recently worked together to launch Apple Pay Later and the Apple Card Savings Account. However, despite these advances, the relationship between the two companies has begun to cool, as Goldman has begun scaling back its consumer business.

According to The Wall Street Journal (Apple News+), Goldman Sachs has now entered into discussions with American Express about handing over the Apple Card and other aspects of the Apple partnership.

The partnership between Apple and Goldman was considered an unusual arrangement from the very start, as the latter was an investment banking firm relatively unknown in the consumer finance world. Goldman had just started exploring that market with Marcus, an online-only bank it had introduced three years earlier.

For Apple, the partnership seemed to be one that provided more room for fresh ideas and flexibility than a traditional consumer bank would offer, while Goldman undoubtedly saw this as a way to reach its target market of wealthy and tech-savvy young adults that make up a large part of Apple’s loyal customer base.

In January, Bloomberg reported that the Apple Card partnership had cost Goldman over $1 billion since the card launched in early 2019. Executives predicted that it would take until 2025 before the firm’s Platform Solutions division, which includes the Apple Card, could even hope to break even.

Even so, Goldman said it remained committed to the Apple Card. In February, as The Wall Street Journal (Apple News+) reported that Goldman was backing off expanding its credit card offerings, CEO David Solomon said that its partnership with Apple was expected to provide “meaningful dividend for the firm over time.” At the same time, Goldman had ended advanced discussions about launching a T-Mobile credit card and had dropped a proposal for a Hawaiian Airlines credit card. However, a source confirmed to the Journal that the bank remained committed to not only the Apple Card but also its GM credit card program.

An Amex Apple Card?

It seems that Goldman has rethought its position since then, with sources indicating last week that the investment banking firm is looking to offload both the Apple Card and GM card to another issuer.

The front-runner right now seems to be American Express, but people familiar with conversations between Goldman and Amex told the Journal that it’s far from a done deal.

Further, even if the two companies were to come to an agreement tomorrow, it would still require Apple’s blessing, particularly considering that Goldman announced in October that it had extended its partnership with Apple through 2029. While a deal like this surely has an escape clause for both companies, it just adds to the complexity of transitioning the Apple Card, which would undoubtedly move from Mastercard to Amex branding.

The deal would presumably include the transfer of the Apple Card Savings accounts, but that’s less clear. Goldman appears to be primarily looking to get out of the lending business; it’s already stopped issuing personal loans and is also trying to sell off a home-improvement lending company it bought last year. However, Goldman told the Journal that it has no plans to stop taking consumer deposits for its Marcus savings accounts.

Since the savings account is tied closely to the Apple Card, moving it to Amex or wherever else the Apple Card ends up may be desirable. However, that’s not strictly necessary. Before the Apple Card Savings account arrived a few months ago, Apple Card holders had their Daily Cash deposited into an Apple Cash account — the one Apple financial service that Goldman isn’t directly involved in.

Apple Cash launched in 2017, so it predates the Goldman partnership. Instead, Apple partnered with Green Dot Bank to hold the deposits and set up an arms-length subsidiary, Apple Payments Inc, to handle the payment processing for the Apple Cash card, which was initially on the Discover network before moving to Visa Debit last year.

Apple Pay Later is also a slightly different matter, as Apple handles the loans directly under a wholly-owned subsidiary, Apple Financing LLC. For this initiative, Goldman acts as a middleman, providing access to the Mastercard network to handle the virtual Apple Pay card transactions that deliver the total payment to the merchant.

A move of Apple Pay Later to Amex could complicate things for the buy-now-pay-later (BNPL) initiative, as the payment card used for BNPL payments would almost certainly become an American Express card, which isn’t as widely accepted as Mastercard.