How Apple Card Family Will Work | Owners, Co-owners, Participants

Credit: Apple

Credit: Apple

Toggle Dark Mode

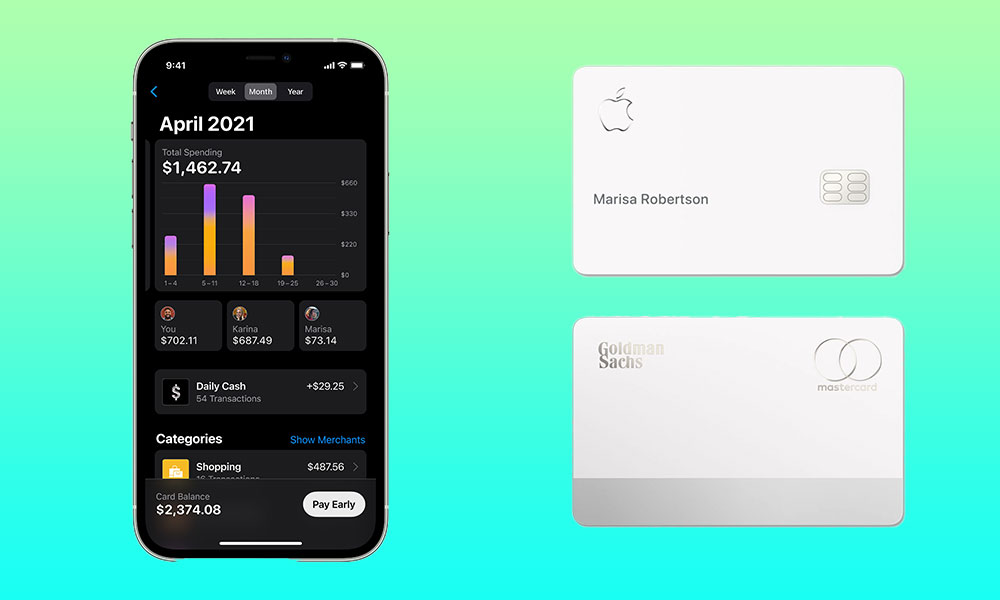

We first saw hints in early iOS 14.5 betas back in February that Apple was planning on improving its Apple Card program to allow sharing with other family members, so it wasn’t a huge surprise when Apple announced Apple Card Family on its virtual stage last month. The new program, Apple said, would allow multiple family members to have an Apple Card, with co-owners able to build credit together.

In fact, Apple added that it would tie into the standard Family Sharing feature, allowing up to five other people to share a single Apple Card account — including children aged 13 and over. Cardholders would also be able to set spending limits and monitor purchases.

Beyond this brief announcement, however, Apple didn’t really share too many other details beyond the fact that it would be coming in May via another iOS update. In other words, despite its appearance in the early iOS 14.5 betas, it’s not quite ready to go in the release version of iOS 14.5.

Our guess is that we’ll probably see it switched on in an iOS 14.6 update, which quickly entered beta before Apple had even issued the final public release of iOS 14.5.

Apple is clearly getting ready for an imminent launch of the feature, as it’s also just published a new support document offering some more detailed insight into exactly how the Apple Card Family feature will work.

More on Apple Card Family

The support document opens with a banner at the top that makes it clear that “Apple Card Family is not yet available but is coming soon,” but otherwise gives us a taste of how the features will work once it actually does arrive later this month.

Apple begins by reiterating a few points that we already know:

- You’ll be able to add every eligible member of your Family Sharing group to your Apple Card account — that means up to six people can share a single Apple Card.

- Any “eligible customer” who is 18 years or older can be set up as a “co-owner” which means they’ll be able to participate in building credit history together with the primary cardholder.

- Family Sharing members between 13 and 18 years of age can also have access to the family’s Apple Card, with spending controls and monitoring features automatically enabled.

- Apple Card holders over 18 can also opt into credit reporting, even if they’re not “co-owners.”

- Existing Apple Card customers will be able to merge their Apple Card accounts, in which case they’ll get a higher credit limit but keep the lowest APR of the two accounts.

- Co-owners and participants will each receive daily cash on their Apple Cash card for their Apple Card purchases.

Owners, Co-owners, and Participants

Thanks to Apple’s new support document, however, we now know a bit more about how this will all work in practical terms.

Essentially, there will be two types of Apple Card users in your family sharing group: owners/co-owners and participants, with different levels of access.

Owners and co-owners would appear to be basically the same thing. Apple doesn’t indicate whether the original card owner has any higher level of control over the account once they’ve designated a co-owner, or whether it’s possible to remove a co-owner once they’ve been added.

In fact, it seems quite possible that removing a co-owner may not be a simple thing, since both owners and co-owners “share full responsibility for the account balance and all payments.” While it would certainly seem possible to remove a co-owner by calling Apple or Goldman Sachs directly, it’s easy to see why Apple wouldn’t want that relationship to be easily changeable.

Account owners and co-owners will also have their credit reported equally in their own names and on their own files, which will hopefully resolve some previous allegations of discrimination, and co-owners will have all the other privileges of the original account owner, including requesting credit limit increases, closing the shared Apple Card account entirely, and viewing all relevant information about the card.

Under the new Apple Card Family setup, owners and co-owners will also be able to add and remove participants, set transaction limits, lock their spending ability, and get notifications on their spending. Again, these privileges will be equally available to both owners and co-owners.

However, you’ll also be able to add anybody in your family as a “participant” rather than a “co-owner,” and what’s particularly notable is that participants can also opt into credit reporting to help build their credit.

In other words, it’s possible to allow another family member to build their credit on your shared Apple Card without giving them full control over the account.

Participants over 18 years of age can also order their own physical Titanium Apple Card, and view their own transactions and information. Ultimately, however, the big difference is that participants are not in any way responsible for payments.

While Apple is using slightly different terminology, this is actually not all that different from how most credit cards already work. Generally, if two people apply for a credit card together (i.e., they both sign the application), they will essentially be “co-owners” of that card and have shared responsibility and shared credit history. Many other credit card companies call these “joint cardholders.”

If, on the other hand, if you already have a credit card account and order an “additional card” for another family member, they essentially become what the Apple Card calls a “participant.” Most other credit card companies call these “additional cardholders,” or “authorized users.”

Apple’s terminology is somewhat more clear, but what’s even more significant about what Apple is doing here is that existing Apple Card holders can much more easily add “co-owners” (or “joint cardholders”) after the fact, and it’s as simple as pressing a button.

That said, account co-owners will have to go through the normal Goldman Sachs credit approval process, and accept the offer, in much the same way they would if they were applying for their own Apple Card. However, the Apple Card already has one of the fastest and easiest application/approval processes available.

Unlike co-owners, participants don’t need credit approval, since they’re not taking any responsibility for the account — just like an “additional cardholder” or “authorized user” with other credit cards, any charges they rack up become the responsibility of the actual cardholder. So, naturally Goldman Sachs doesn’t need to care about their creditworthiness.

Apple also notes that participants who are 18 years or older can leave the Apple Card Family account by applying for their own Apple Card. If their application is approved, they’ll get their own account and will be automatically removed from the shared Apple Card account. However, they can still participate in other aspects of Family Sharing, such as Apple Music subscriptions, shared iCloud Storage, and shared purchase histories.

What You’ll Need

The requirements for Apple Card Family are mostly the same as the requirements for the Apple Card itself, although you’ll presumably need iOS 14.6 (or whatever Apple calls the upcoming iOS version that enables the family sharing aspects).

You’ll also need to have a Family Sharing group in place. Apple Card Family relies on this, and just like Apple’s other services, you won’t be able to add co-owners or participants who are not part of your Family Sharing group.

Account co-owners will need to be 18 years or older, while participants can be 13 years or older. You’ll also need to set up Apple Cash Family so that co-owners and participants can use their daily cash.

Lastly, Apple Card continues to be available only in the United States, so these options will only appear if your device region is set to the U.S.