Apple Begins Issuing Apple Card to Employees, Here’s What It Looks Like

Credit: Ben Geskin

Credit: Ben Geskin

Toggle Dark Mode

One of Apple’s big announcements in March was the Apple Card, a revolutionary new zero-fee credit card that heralded the first real intersection of physical payment cards and digital technology. Even before the card was announced, however, we heard rumours of its debut back in February, including reports that Apple was preparing to give it out to its own employees for initial testing.

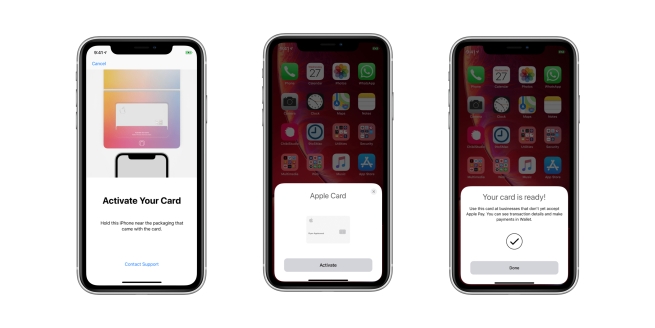

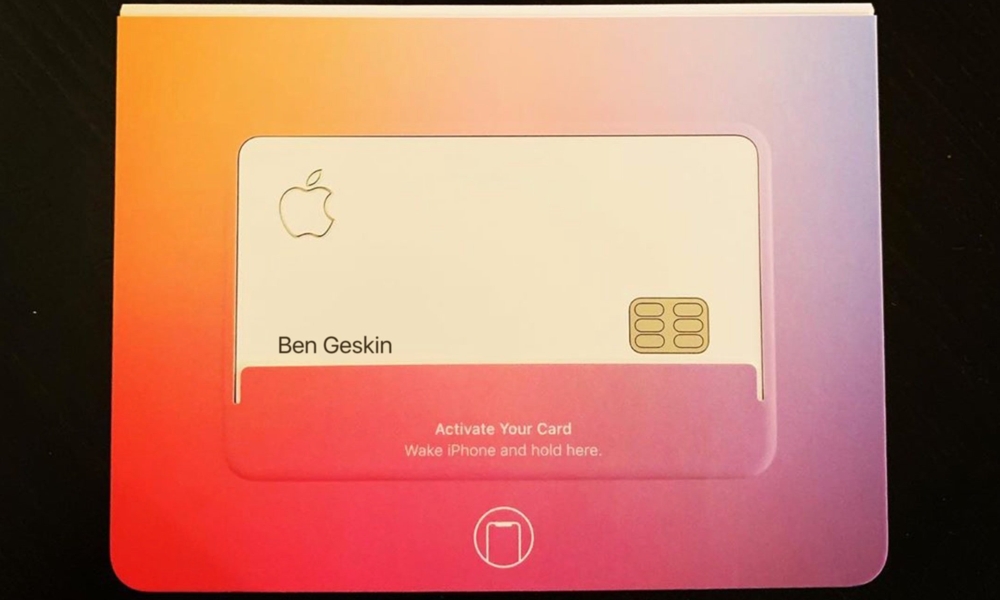

It looks like this initial rollout has begun, with a leak from Ben Geskin over the weekend revealing some first images of what the card will actually look like in the box and what the activation process will be like.

The images Geskin posted were from an actual employee who had received one of the cards, although Geskin edited out the name and replaced it with his own in order to protect the source. The cards appear to be delivered in colored packaging that incorporates an NFC tag that can be used to activate the card by holding it near their iPhone.

Prior to receiving the physical Apple Card, the customer should already have a digital version of the Apple Card in their iPhone Wallet app, since this is set up as soon as the customer’s application is approved so that they can start using the card via Apple Pay right away, without needing to wait for the physical card to arrive. The NFC pairing process, which appears to work much like pairing Apple’s AirPods or HomePod speaker, simply links the physical card with the digital version that’s already in the Wallet app.

While the set up process was previously reported by 9to5Mac, Geskin’s photos show the first evidence of the actual physical card and packaging that matches the setup screens found in the iOS 12.3 betas.

It’s typical for physical credit cards to arrive with the requirement for some form of activation in order to prevent fraud from stolen credit cards. This is usually done over the phone by calling into the bank or credit card issuer, although more progressive companies have started to allow this to be done in their own apps or web sites. Of course, Apple is able to use its home field advantage to incorporate this capability right into iOS, making the Apple Card quite possibly the easiest credit card activation we’ve ever seen.

The card itself will also lack any identifying features other than the user’s name — there’s no credit card number, no expiry date, no CVV number, and no place for a signature. The front of the card will simply include the user’s name, Apple logo, and EMV chip, while the back includes the Goldman Sachs and MasterCard logos and the archaic but necessary magnetic strip.

For security reasons, the number on the magnetic strip will be the only actual fixed number used by the Apple Card — a necessary requirement for how traditional magnetic swipe terminals work. However, this number won’t be printed anywhere else, and to make traditional online payments — those where users are required to key in a credit card number — users will be required to general a virtual credit card number using the Apple Wallet app.

The virtual numbers can be changed at any time, and a lost physical Apple Card can be easily cancelled directly from the Wallet app. However, online purchases also normally required a three- or four-digit CVV code, and in the case of the Apple Card, this will be regenerated after every purchase. Of course, purchases made with Apple Pay will take advantage of the same security features that have been available for all Apple Pay cards since the service first debuted.

As attractive as the physical Apple Card is, it’s also clearly a concession to the U.S. market where many retailers still don’t offer support for Apple Pay, or really any contactless payments, while also offering a very attractive card for those who still perceive physical credit cards as a sort of status symbol. It’s unclear right now how widely Apple is rolling out the Apple Card to its own employees, but it’s expected to become available to customers in the U.S. this summer, and Goldman has already stated that it hopes to roll it out to other countries in the future, although specific plans for this have yet to be revealed.

[The information provided in this article has NOT been confirmed by Apple and may be speculation. Provided details may not be factual. Take all rumors, tech or otherwise, with a grain of salt.]