Apple Ends Credit Card Funded Person-to-Person Payments, Goldman Hopes to Launch Apple Card Internationally

Credit: Denys Prykhodov / Shutterstock

Credit: Denys Prykhodov / Shutterstock

Toggle Dark Mode

Apple’s new credit card hasn’t even seen the light of day yet, and Apple is already changing the terms of its Apple Pay Cash service — quite possibly to drive adoption of the new Apple Card. Meanwhile, Goldman Sachs has provided the first hint that the Apple Card will eventually make it outside of the U.S.

Apple Pay Cash Changes

In an email sent out to Apple Pay Cash users yesterday that was first reported by Cheddar anchor Hope King, Apple has advised users that, effectively immediately, they will no longer be able to fund person-to-person payments using a credit card.

In the past, users could withdraw additional funds from a linked credit card when sending a person-to-person payment via Apple Pay Cash. As of yesterday, that ability is no longer available, meaning users will only be able to fund their Apple Pay Cash balance with a debit card, and of course make person-to-person payments with any existing money on the Apple Pay Cash card, whether it was added from a debit card or received from another user.

Apple of course spins this change by suggesting that it will make life easier for Apple Pay Cash users, adding that “This will ensure Apple Pay Cash customers never have to worry about cash advance fees that may be charged by issuing banks.” While that’s a valid point, there’s also arguably no need for Apple to play nanny here for those users who have no problem with the additional fees involved, leading to speculation that this is more about promoting Apple’s own new credit card than anything else.

While the release makes no mention of the Apple Card, the fact that Apple is promoting it as a “no-fee card” makes it likely that it will be an exception to the rule, since Apple’s comment about users never worrying about fees wouldn’t apply to its own Apple Card. Apple doesn’t specifically mention cash advance fees, but it’s a safe bet that it the Apple Card doesn’t charge annual fees, late fees, international transaction fees, or over-limit fees, that cash advance and Apple Pay Cash transactions would also be free.

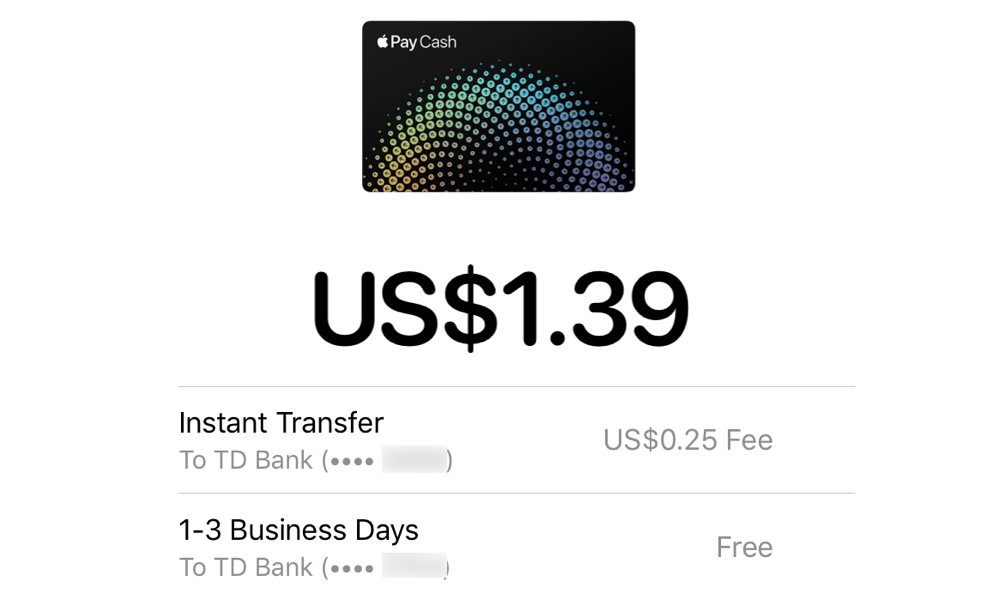

In the same announcement, Apple also announced that users can now instantly transfer money from their Apple Pay Cash card to an eligible VISA debit card that’s already stored in Apple Wallet. Much like PayPal’s instant transfer feature, there’s a fee for this service — $0.25 or 1% of the amount transferred, up to a maximum of $10 — however users will have the money in their bank account within minutes rather than days, so it may be worth it in those cases where money is needed quickly. Standard ACH bank transfers are of course still supported as well, with no feeds, but a processing time of up to three business days.

Apple Card International Rollout

In another report, CNBC revealed that Goldman Sachs is already making plans to roll out the Apple Card internationally.

Richard Gnodde, CEO of Goldman Sachs International, told CNBC that the introduction of the Apple Card in the U.S. is only a start, but that the company is already thinking about opportunities to expand the unique new card internationally.

With that product (Apple Card) we are going to start in the U.S. but over time, absolutely, we will be thinking of international opportunities for it.

Richard Gnodde, CEO, Goldman Sachs International

Gnodde confirmed the summer launch of the new card, adding that he expects it to catch on quickly, and added that the investment bank is already planning to bring its online retail bank, Marcus, to Germany in the coming months. Marcus also launched in the U.K. six months ago, where it has already gained over 200,000 client and $10 billion in deposits, according to Gnodde.