Here’s How Apple’s New Credit Card Will Actually Work

Credit: Apple

Credit: Apple

Toggle Dark Mode

Apple’s new Apple Card was the sole physical product that the company announced at its media event earlier this week — an aesthetically gorgeous titanium credit card that acts as a close companion to Apple Pay and the iOS Wallet app, and essentially feels like the culmination of something Apple has been aiming for ever since it introduced its original Wallet app (née Passbook) almost seven years ago.

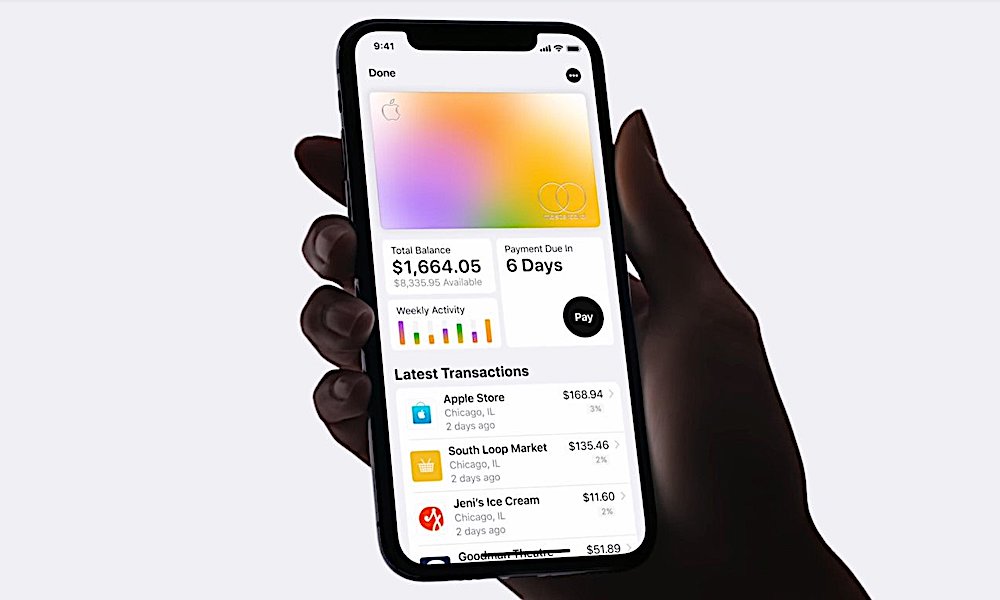

While Apple was of course quick to tout the benefits of its sexy new credit card: iOS-integrated financial health tools, cash back, zero fees, and of course privacy, we took a look at the pros and cons of Apple Card shortly after the event, observing that it wasn’t all wine and roses.

In touting the new card, however, Apple’s announcement was somewhat scant on the more technical details of exactly how it would all fit together. Fortunately, TechCrunch’s Matthew Panzarino has done the legwork to fill in some of those gaps, providing some additional insights on what we can expect once the card lands in our hands this summer.

Setting up the Apple Card

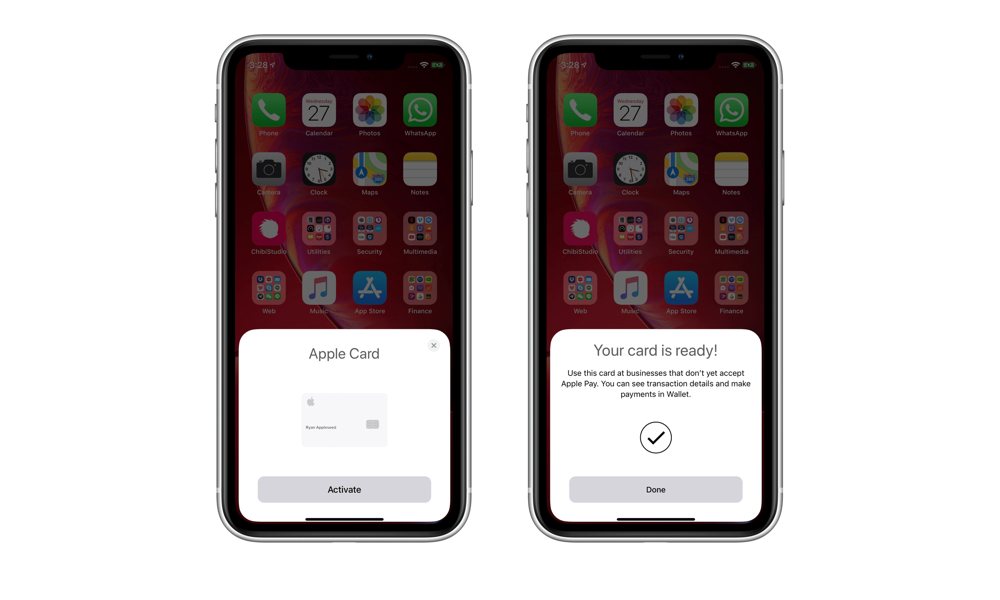

Panzarino confirms an earlier report from 9to5Mac that the Apple Card will actually be activated by placing it in proximity to the iPhone, presenting an interface similar to the one used to pair AirPods or HomePod, or transfer everything to a new iPhone.

This implies that the actual physical Apple Card must have some kind of NFC or BTLE chip inside, yet Panzarino notes that despite this, the physical card will not support contactless payments. This is obviously a deliberate but reasonable limitation on Apple’s part, since of course it would prefer everyone to use Apple Pay from their iPhone or Apple Watch whenever possible as it’s more secure.

Interest Rates and Payments

When Apple said that the Apple Card would have zero fees and penalties, it meant it. Although some reports have suggested that there could be increased “penalty” interest rates due to late payments, Panzarino has confirmed that this is patently untrue, stating plainly that “Apple Card has no late fees and no penalty rates.” Of course, users will still need to pay whatever interest rate they agreed upon at sign-up — which can vary widely — but the interest rate will not increase. Apple does of course do standard credit bureau reporting, however, so late payments may still impact overall credit scores, and therefore the interest rates available when applying for other credit cards.

While there’s a wide range of potential interest rates for Apple Card, which will generally be assigned based on users’ credit history, Apple has said that users will be placed at the lowest possible rate for whatever tier they land in, which may save customers a couple of percentage points compared to competing credit cards that place users at a more exact position based on their score. In other words, if you’re credit history would put you in a 17–20 percent bracket, Apple will set your interest rate at the 17 percent number, while others might charge 18 or 19 percent.

While Apple Cash can be used to pay your Apple Card balance, it’s not specifically required — although users may want to take advantage of the cash back rewards they they have in there. The Apple Card can still be paid via ACH bank transfers, however, although this will presumably need to be done directly from the Wallet app. There don’t seem to be any other options for payment, such as via online banking services.

There’s also no foreign transaction fee for using Apple Card, but of course the actual daily exchange rate that’s paid on foreign transaction will be the same as for any other Mastercard, as it’s determined by the payment network, not Apple or Goldman Sachs

Using the Apple Card

As noted above, the physical Apple Card cannot be used for contactless payments — you’ll need to use your iPhone or Apple Watch instead. Other than simply looking cool, the physical card is really only necessary for those places where Apple Pay simply isn’t available, so you won’t even need to carry it with you if you only frequent places that offer contactless payment support.

There are also no signatures required to use Apple Card. Recent changes to payment networks have eliminated the need for signatures at point of sale for all credit cards, and the Apple Card takes advantage of this by not even bothering to give users a place to sign their name. Stores can of course still ask to see ID when using the card, but the lack of a signature shouldn’t prevent the physical card from being used at any retailer who supports the Mastercard payment network.

Apple Card is also currently a single-user card. There’s no provision for co-applicants, or additional cardholders, or even sharing the single card between multiple family members. Of course each family member can apply for their own Apple Card, but at this point it’s one card per person, per account.

Security and Privacy

As one might expect from Apple’s focus on security and privacy, this is the area in which Apple Card breaks the most new ground. While some kind of actual card number is still required to identify the card and process payments, Apple has done everything it can to obfuscate those numbers.

The physical Apple Card itself has no number embossed on it, which not only makes the card look more elegant, but also avoids one of the most common access points of credit card fraud. Sadly, although the card incorporates an EMV chip, it also still needs the less secure magnetic stripe for compatibility with older payment terminals. However, the fixed number that is stored on the mag stripe isn’t shown anywhere, and can therefore only be accessed with a magstripe reader. The number isn’t used anywhere else, though, and the physical card can be easily frozen or cancelled directly from the iOS Wallet app should it be lost, stolen, or otherwise compromised. Apple also offers replacement cards for free.

Within Apple Pay, of course, the Apple Card uses the same Device Account Number (DAN) as any other card added to Apple Pay — a virtual, tokenized number that’s unique to each device, not actually shown anywhere, and can only be used for transactions from that specific device.

For making more traditional online purchases — ones where you need to punch in a credit card number — Apple provides the ability to generate virtual card numbers, similar to what Bank of America, Citi, and Amex have been doing for a while. Unlike other banks, however, you’ll be required to generate a virtual card number, since there’s no other card number available to use.

Virtual card numbers can be semi-permanent, meaning that they can be reused as often as you like — there’s no support yet for single-use numbers or single-merchant numbers — but users can regenerate the virtual card number at any time without affecting the ability to use the physical Apple Card or the cards stored in Apple Pay. Security-conscious users could even choose to do this after every online purchase. However, since the traditional CVV code — the three- or four-digit number usually printed on the back of a normal credit card — is rotated after every purchase, there’s little reason to be concerned about regenerating the actual card number on a regular basis.

Panzarino does note that regenerating the card number could cause problems with recurring subscriptions that users have signed up for online with the physical number, but adds that the new “Card on File” systems offered by Mastercard should be able to automatically pull the new number to ensure that recurring payments aren’t interrupted after the old number is completely invalidated.

In short, however, the way Apple Card is set up is that every purchase using anything other than the physical card requires some level of biometric authentication. Apple Pay itself naturally requires Touch ID or Face ID in the same way as for any other payment card stored in Apple Pay, but for online payments, users will still need to unlock their iPhone in order to consult the Wallet app to get the virtual card number and dynamic CVV.