Revolutionary ‘Apple Card’ Announced with Zero Fees, Daily Cash Back and More

Credit: Apple

Credit: Apple

Toggle Dark Mode

Apple has announced the company’s new credit card called Apple Card, which will integrate perfectly with the Wallet app for iPhone and is scheduled for an official launch this summer.

Apple Card offers many benefits over traditional cards like budget monitoring, easy interest calculations and the ability to chat with the credit issuer (Goldman Sachs / Mastercard) over Messages for painless interaction without making a single phone call.

Apple Card allows users to sign up on their iPhone and start using their Apple Card right away. Apple Card is available across the user’s multiple Apple devices and allows them to easily see in the Wallet app what they spent and exactly when their payment is due.

Even better yet Apple Card uses machine learning to translate odd transaction names into recognizable merchants, so it’s easy to remember exactly where users are spending their money.

The Wallet app will also show trending spending, week over week or month over month in categories like food, travel, entertainment and more.

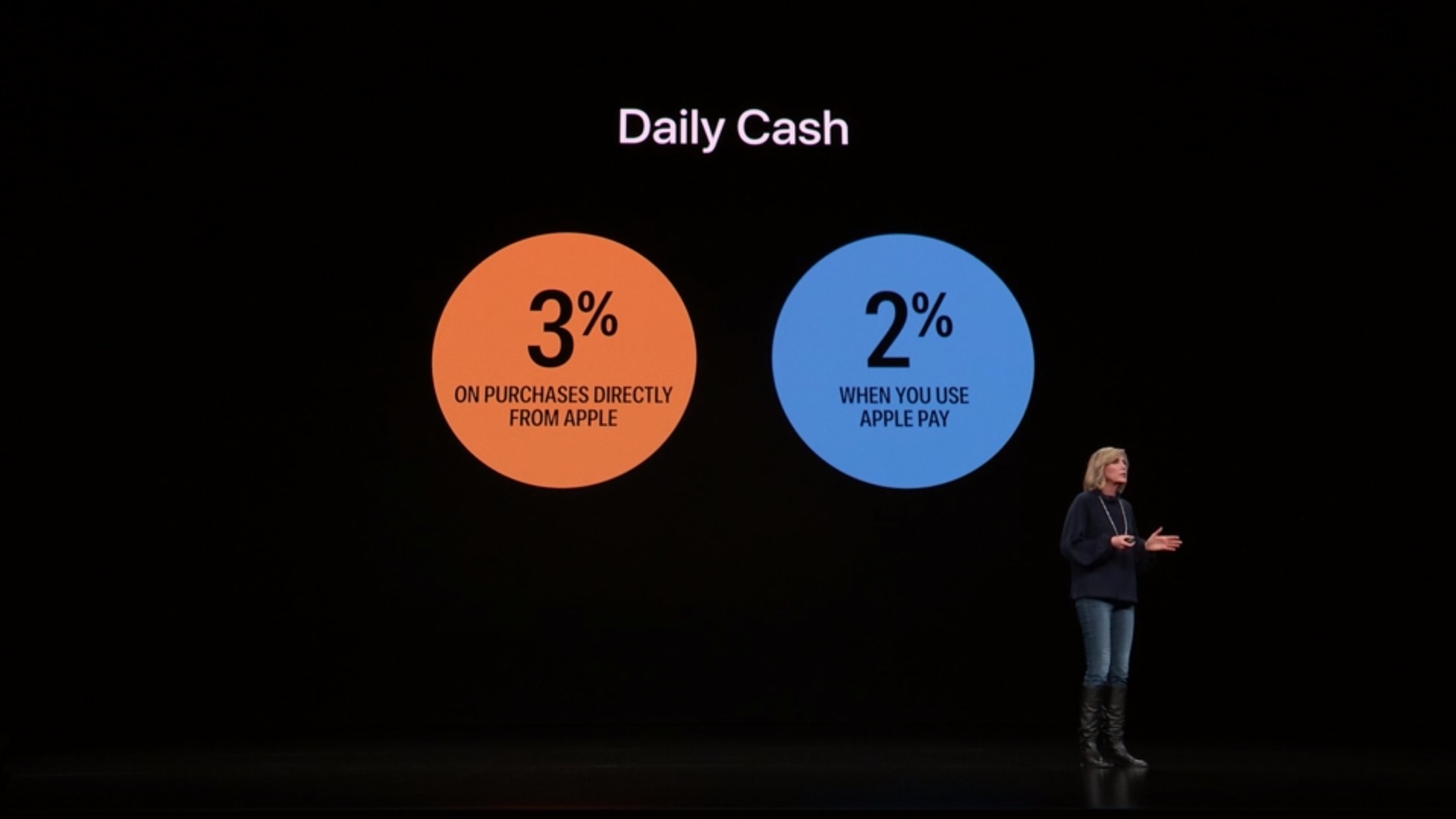

Arguably Apple Card’s best feature is its revolutionary new rewards system which gives users cash back, every single day, rather than waiting for rewards between billing statements. Apple Card’s rewards program is called Daily Cash and cash back is added directly to users Apple Cash card.

Users will receive 2% Daily Cash back on Apple Pay purchases, 3% Daily Cash back on Apple purchases, and 1% Daily Cash on purchases made with the physical Apple Card. Users will also receive unlimited Daily Cash without limits.

Also one of Apple Card’s other great features is its lack of fees. Apple Card has no late fees, no international fees, no penalties for late payments and reportedly offers lower interest rates than other banks.

Apple Card is also built with total privacy in mind as it offers a unique per-device card numbers, stored in the secure element, along with a one-time dynamic security code for each purchase to protect the card from being used again without permission. Like standard Apple Pay transactions, users will authenticate with Touch ID or Face ID. In addition, Goldman Sachs will never share or sell user data for marketing or advertising.