The Apple Card May Be Getting CANCELLED | Here’s What We Know

Credit: Elijah Fox

Credit: Elijah Fox

Toggle Dark Mode

Earlier this week, Apple officially proposed an end to its partnership with Goldman Sachs, leaving the future of the Apple Card and Apple Card Savings Account uncertain at best.

While it wasn’t exactly news that the relationship between the two companies had been cooling off over the past few months, the sudden revelation that the two companies were calling it quits came as a bit of a shock — especially considering it came with no indication as to Apple’s fallback position.

Even though Apple is a multi-trillion-dollar company, that’s not enough on its own to crack into the financial services industry. There are numerous regulatory issues to deal with, not to mention getting licensed and certified to operate as a “bank.” That’s why Apple needed an existing bank — Goldman Sachs in this case — to act as its financial partner for the Apple Card. Apple does the same with Apple Cash, where deposits are handled by Green Dot Bank.

When the two companies married up to launch the Apple Card in 2019, it was seemingly a match made in heaven. Apple was looking for a partner that would give it a relatively free hand to run things its own way, with room for fresh ideas and more flexibility than a traditional bank would offer. For its part, Goldman — an investment bank that was relatively unknown in consumer finance — relished the idea of reaching Apple’s customers — a market of wealthy and tech-savvy young adults.

Nevertheless, earlier this year, it became apparent that things weren’t working out for Goldman as it had hoped. Despite several positive statements about the Apple partnership from CEO David Solomon, behind the scenes, the bank was looking to divest itself of its consumer lending business and reportedly courting American Express as a possible suitor for the Apple Card.

Not much is known about how far those talks progressed, although some sources suggested AMEX was a less-than-ideal partner due to its insistence on keeping its own branding and business in the forefront and that Apple would have to look elsewhere.

Will the Apple Card Be Cancelled?

Interestingly, Apple may be running into the same problem it’s reportedly had with the Apple Car. Two years ago, Apple approached several automakers to see if they’d be interested in signing up as a manufacturing partner, including Hyundai and Nissan. While talks with Nissan ended as soon as they began, Hyundai agonized over the decision for a bit longer. Still, in the end, both companies came to the same conclusion: neither wanted to be assimilated into the Apple collective and lose their own brands in the process.

It’s likely American Express and other major banks feel the same way. AMEX is quite compatible with Apple in terms of prestige, and it’s already the best third-party card to use with Apple Pay, thanks to tighter integration with the Wallet app. However, a co-branded card that would have Apple calling the shots would be anathema to AMEX, one of the world’s strongest prestige card brands.

However, it’s important to note that Apple has yet to make any public statement about the status of its partnership with Goldman. The news that the two companies are starting divorce proceedings came from “people briefed on the matter” who spoke to The Wall Street Journal. When asked for a statement, Apple responded in the vaguest PR speak possible, saying nothing at all about an end to its relationship with Goldman.

Apple and Goldman Sachs are focused on providing an incredible experience for our customers to help them lead healthier financial lives. The award-winning Apple Card has seen a great reception from consumers, and we will continue to innovate and deliver the best tools and services for them.

Apple

The WSJ is a highly reliable news source, so we can bank on the accuracy of its reporting here, but it’s also clear Apple isn’t ready to say anything officially. It’s also worth keeping in mind that none of this will happen overnight; according to WSJ sources, Apple’s proposal suggests an “exit from the contract in the next roughly 12 to 15 months.” This means that Goldman will continue to back the Apple Card for most of 2024 and possibly even into early 2025.

That also assumes Goldman accepts the proposal. That part seems likely, as every report suggests that it’s Goldman that wants out more than Apple; if anything, Apple’s proposal was likely submitted in response to Goldman’s dissatisfaction. In financial services arrangements such as this, it’s usually the merchant that plays the controlling role, and in this case, that’s Apple.

So, the bottom line is that Apple has plenty of time to find a new partner for the Apple Card and the Apple Card Savings Account that goes with it.

It seems reasonable that Apple at least has some promising deals on the horizon, as we wouldn’t expect it to propose an end to its current relationship unless it has another one waiting in the wings. However, little is known about Apple’s proposal, so it could be conditional on finding a new financial services partner.

Some analysts believe that Apple will seek out a lesser-known financial services company as its new partner, avoiding the branding conflicts that would come from a bigger player like AMEX. Earlier this week, the folks at 9to5Mac uncovered a recent job posting where Apple was looking for a software engineer based in New York who would work with “Apple Processing, LLC” to “design and develop key components on a new platform being created as the foundation for future Apple Pay products.”

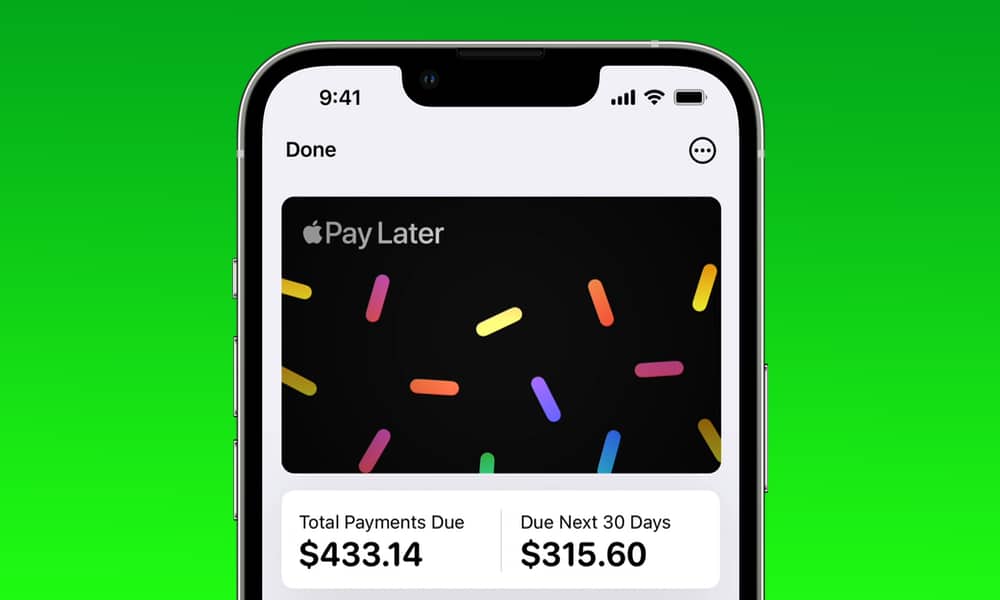

Apple Processing, LLC is a wholly-owned subsidiary of Apple that focuses on payment solutions, so at first glance, this sounds like it could be more about Apple Pay (or Apple Pay Later) than the Apple Card. However, as 9to5Mac points out, the job description also specifically says that the position will be working with Pismo, a Brazilian fintech company that specializes in issuing cards and was recently acquired by Visa.

There’s also no indication that talks with American Express have yet fizzled out, and other reports have indicated Apple has been in talks with Synchrony Financial, the largest issuer of store credit cards in the US, about taking over the Apple Card business. Synchrony originally bid against Goldman for the Apple Card program and already counts Amazon and PayPal among its customers.

It’s also possible Apple could take a stronger position in running the Apple Card, taking on front-end responsibilities like customer service, which are handled by Goldman right now, and leaving another company to manage only the banking and processing side of things. Apple Pay Later, which offers shorter-term loans, is already being underwritten by a wholly-owned Apple subsidiary, with Goldman’s only role providing access to the Mastercard network. It doesn’t seem unreasonable that Apple could take a similar approach with the Apple Card, signing on a new partner only to ensure the necessary regulatory requirements are met.