Apple Cash Is Switching from Discover to Visa Debit | What This Means for You

Credit: Apple

Credit: AppleToggle Dark Mode

In addition to the other changes to Apple Cash that are coming in iOS 15.5, it appears that Apple is also quietly switching payment networks.

Since its inception in 2017, Apple Cash (originally known as “Apple Pay Cash”) has relied on the Discover network to handle payment processing. However, as of this week, all new cards generated for Apple Cash will now use the Visa payment network.

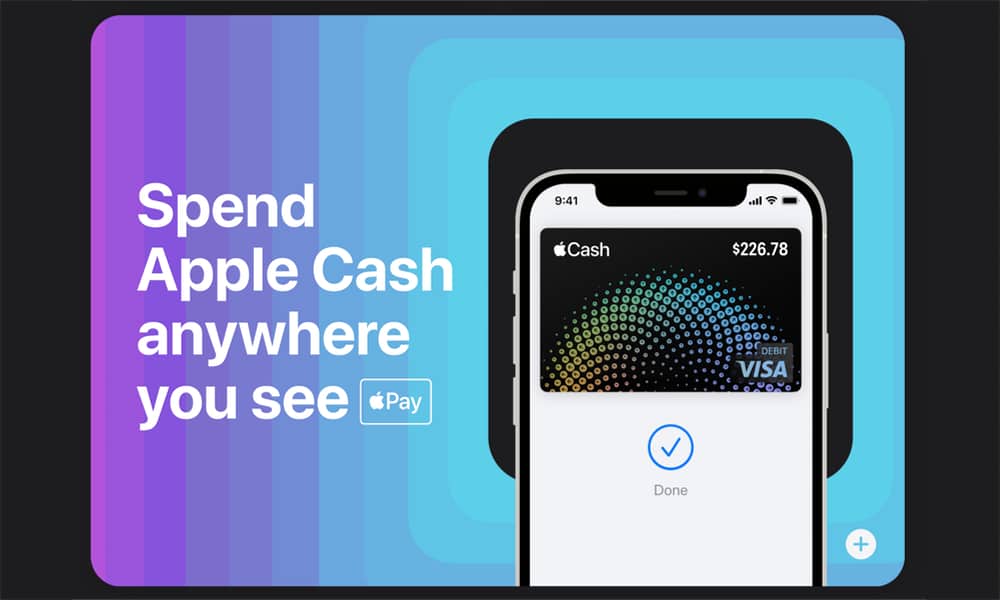

The change was first noticed by Twitter user @Kanjo, who discovered that several images on Apple’s Apple Cash page now clearly include “VISA Debit” branding on the ?Cash card.

It’s likely not a coincidence that this change comes at the same time that Apple is enabling a new “Enhanced Fraud Protection” that appears to be exclusively for Visa payment cards.

As Joel Breckinridge Bassett (@Kanjo) notes in his blog, Ata Distance, this change appears to have occurred the same day that the Enhanced Fraud Protection notifications began appearing to Visa card users.

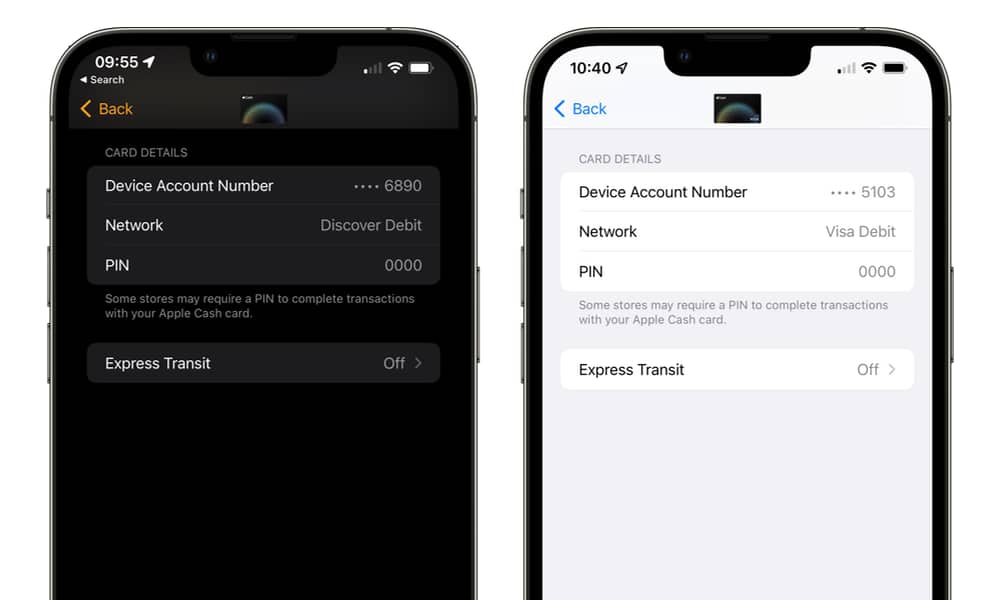

There also appears to be a tighter tie-in with the Visa payment network. Previously, the Apple Cash card had no branding beyond the ?Cash logo. Despite its reliance on the Discover network, there was no Discover card logo anywhere to be seen; the only indication that it was using the Discover network was found in the “Card Details” section, under the Device Account Number.

However, now the Apple Cash card appears to be more clearly brandishing the Visa Debit logo in the bottom-right corner, just like it’s shown on physical Visa Debit cards. So far, this doesn’t appear on the main card in the Wallet app, although it does show up in the thumbnail view of the card that appears in the Settings > Wallet & Apple Pay and on the Apple Watch version of the card.

At this point, Apple doesn’t appear to be migrating existing Discover-based Apple Cash cards over to the Visa network. However, any new Apple Cash cards set up from April 19 onward will be on the new payment network.

Further, if you turn off your Apple Cash card in Settings on your iPhone and set it up again, it will be recreated as a Visa Debit version with a new Device Account Number. This will also automatically propagate to your Apple Watch.

Here’s how to check which payment network your Apple Cash card is using:

- Open the Wallet app on your iPhone.

- Tap on your Apple Cash card to open it.

- Tap on the More button in the top-right corner with three dots inside a circle.

- Scroll down to Card Details and note the “Network.” This should say either “Discover Debit” or “Visa Debit.”

Toggling your Apple Cash card off and back on again will not erase any balance you already have on the card. Apple maintains your balance; Discover and Visa are merely the payment networks used to access that money.

What This Means for You

In addition to supporting the new Enhanced Fraud Protection features, the transition from Discover to Visa will also increase the number of retailers where you can make purchases directly from your Apple Cash balance — especially when traveling internationally.

In the United States, Visa boasts slightly higher acceptance than Discover, but it’s still pretty uncommon to find a retailer that doesn’t take both. Internationally, however, it’s a very different story — you’ll have a hard time finding any retailer that accepts Discover cards, while pretty much everyone on the planet takes Visa.

Even with America’s nearest neighbor, Canada, Discover is accepted at only a handful of big retail and restaurant chains and almost nowhere else. Amazon Canada and Walmart Canada don’t even accept Discover cards, which should give you a pretty good idea of how bad of an idea it is to rely on the Discover payment network when traveling outside of the U.S.

Another big advantage for those who want to use Apple Cash when traveling internationally is that the Visa Debit version doesn’t charge any foreign transaction fees.

On those rare occasions that you could find a retailer abroad who accepted Discover, you’d be subject to a whopping 3% foreign transaction fee added on top of the current exchange rate. This doesn’t exist with Visa Debit — you’ll get whatever the day’s Visa Exchange Rate is without incurring any additional fees.

For the same reasons, the switch to Visa Debit may finally pave the way for Apple Cash to expand outside of the U.S. While we wouldn’t expect that to happen overnight — there are still other banking and regulatory hurdles to be overcome — at least Apple Cash is now using a payment network that’s available and accepted by the rest of the world.