Ouch! Apple’s High-Yield Savings Account APY Dips Below Its Launch Rate

Alexey Novikov / Shutterstock

Alexey Novikov / Shutterstock

Toggle Dark Mode

Although it’s surely a sign of the economic times more than anything else, it’s still disheartening to see that Apple has once again dropped the interest rate for its Apple Card Savings Account — and this time, it’s plummeted to the lowest it’s ever been.

It’s also the second rate cut in less than three weeks after Apple lowered the APY to 4.25% in September. Unlike past rate shifts, that move wasn’t entirely surprising this time around, as it followed the US Federal Reserve slashing interest rates by half a point a week earlier.

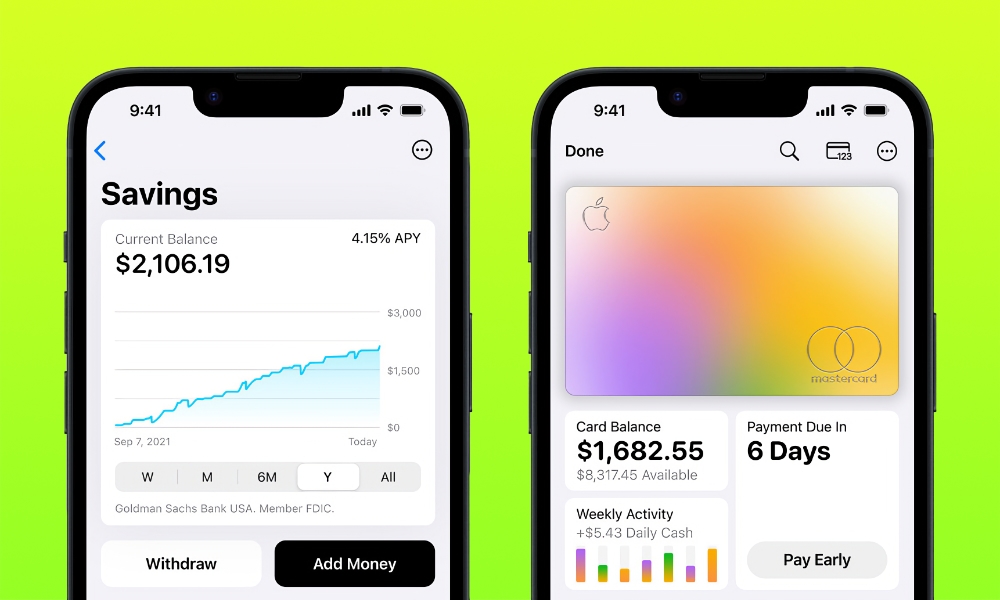

However, Apple and its banking partner, Goldman Sachs, have now dropped the APY to a record low 4.1%, putting it below the 4.15% rate that the Apple Card Savings Account launched at in early 2023.

Unlike the September change, this latest drop seems to be based more on anticipated rate cuts. Reuters reports that cooling inflation and a potentially deteriorating job market have led Federal Reserve policymakers to hint that more cuts are coming over the next few months.

Of course, as the old saying goes, what goes up must come down. However, we’re hoping the reverse is also true. The Apple Card Savings account has ridden a bit of a roller coaster in the 18 months since its launch. For a while, the APY rates seemed to be poised to keep on climbing precipitously as three rate increases arrived over two months, starting with a bump to 4.25% before Christmas and followed by another to 4.35% at the start of the new year before settling at 4.5% APY.

Sadly, that pinnacle turned out to be relatively short-lived. By April 1, Apple had adjusted the rate downward to 4.4%. That still placed it slightly higher than the first two increases, but then last month it settled back down to 4.25%.

While other high-yield investment accounts will undoubtedly follow this trend in their own ways, the Apple Card Savings Account has always offered a slightly lower APY than most others. However, when factoring in the additional costs and requirements of competing high-yield savings and investment options, it’s not a bad deal.

For example, Robinhood Gold was offering 4.4% when the Apple Card Savings Account launched at 4.15%, and it raised its APY to 5.0% around the same time Apple went through its rapid-fire cycle of 4.25-4.5% increases earlier this year. However, that service has since lowered its APY back down to 4.5% — a slightly sharper drop from its 5.0% height.

Services like Robinhood Gold are also geared toward more serious investors. You’ll only get the best interest rate if you’re a member, which costs $5 per month, in addition to other fees for things like withdrawals. Other high-yield accounts may have similar membership plans or require minimum balances to get their best interest rates.

The Apple Card Savings Account is unique in that there are no fees or minimums involved. You get Apple’s best APY — currently 4.1% — on the first dollar you put in, and you won’t pay anything to take your money out. In fact, you can easily shift funds over to your Apple Cash card in seconds and spend them via Apple Pay or using the virtual debit card feature in Apple Wallet.

As the name suggests, the Apple Card Savings Account is geared specifically toward Apple Card users. You need to have an Apple Card to open an Apple Card Savings Account, but once you do, you can have the Daily Cash from your Apple Card automatically go into the high-yield savings account, where it will begin earning interest right away. While that’s the simplest way to use the Apple Card Savings Account, you can also move your own money in via ACH transfers.

The Apple Card Savings Account can be opened and managed entirely from your iPhone, although you have to first be an Apple Card holder to qualify. By extension, you must also be a US resident and at least 18 years of age.