Apple’s ‘Pay Later’ Service Is Launching Soon | Here’s What to Expect

Credit: Apple

Credit: Apple

Toggle Dark Mode

Following a report last week that Apple retail employees are now actively testing Apple Pay Later in the U.S., it appears the company is now gearing up for a public launch of the service, and with that, we’re getting some more insight into exactly how Apple will decide who qualifies for these pay later loans.

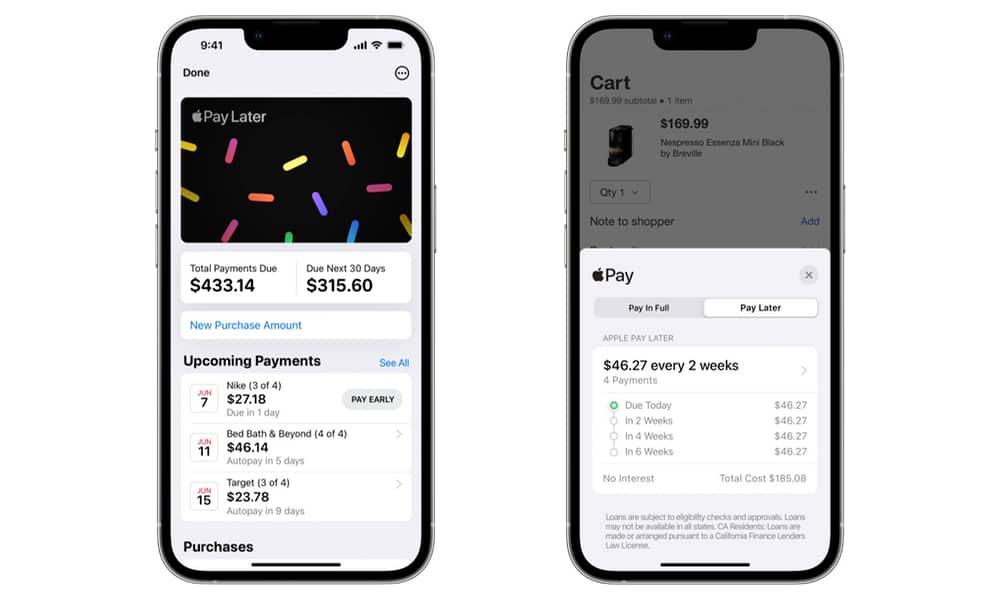

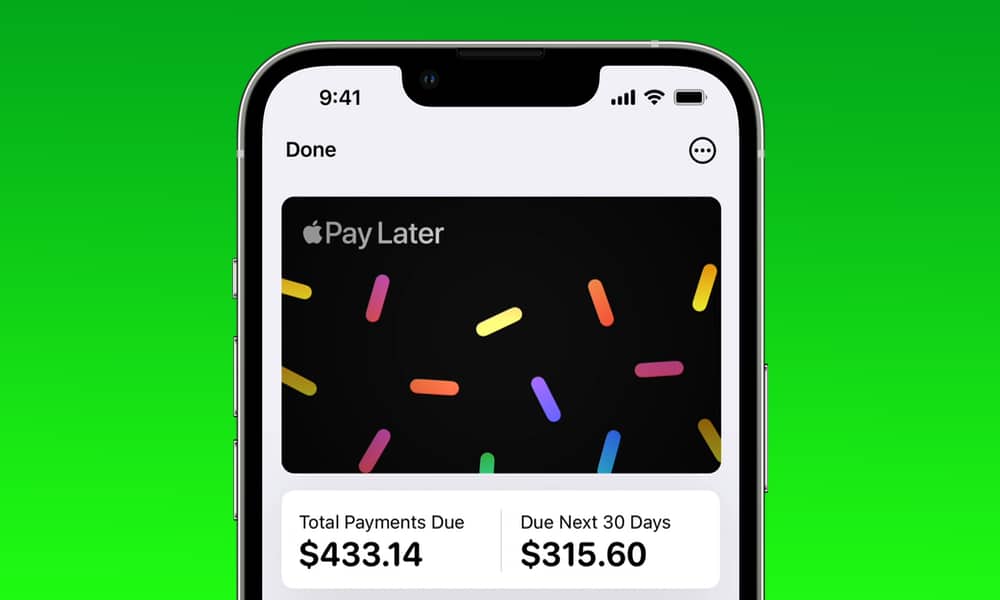

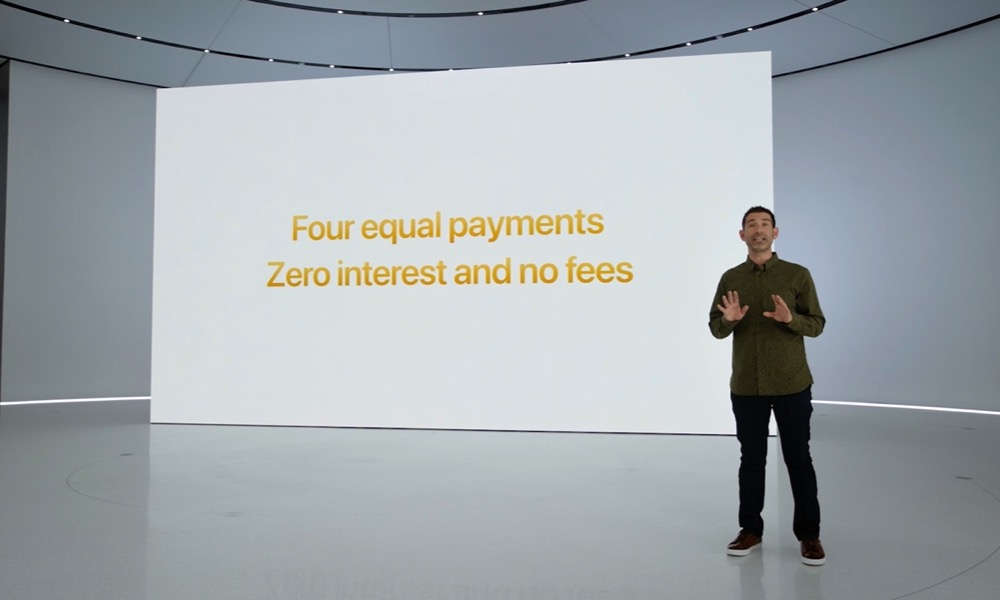

Apple Pay Later was first announced as part of the iOS 16 unveiling at last year’s Worldwide Developers Conference (WWDC) as a way to allow Apple Pay users to divvy up large purchases into four equal payments over six weeks.

In that sense, it’s not much different from some of the programs already enjoyed by Apple Card holders. The key difference with Apple Pay Later is that it will work with nearly any payment card that’s compatible with Apple Pay. We also already know that it should work with any merchant that accepts Mastercard payments, and it’s handled entirely in Apple’s Wallet app on your iPhone, so the store you’re visiting isn’t involved at all; the merchant receives the full payment immediately from Apple through a virtual Mastercard, and then Apple collects the installment payments from your preferred payment method.

How Much Will I Be Able to Spend with Apple Pay Later?

While Apple explained most of the technical details of Apple Pay Later last year, it was much vaguer about exactly how the credit checks and loan approvals for the service would work. Presumably, Apple isn’t going to advance funds to just anybody, so it’s reasonable to assume that there will be a credit check to ensure that you’ll be able to make the necessary payments.

Thanks to the widespread trials ongoing among Apple retail employees, we have a slightly better idea of what that will look like. According to Bloomberg’s Mark Gurman, one of the key factors will be your customer history with Apple itself.

This will include your spending history with Apple — from retail stores to the App Store — and even which of the company’s devices you own. It will also consider whether you’ve applied for an Apple Card, how many other cards you have set up for Apple Pay, and your history of person-to-person payments with Apple Cash.

While that may seem a bit too specific, it’s not an unreasonable approach. It’s preferable to Apple running a more comprehensive credit check every time a customer wants to opt for Apple Pay Later, and it’s considerably less invasive since Apple is looking at the data it already has on its customers rather than pulling in personal data from other sources.

Since Apple is also the lender in this case — it’s set up its own subsidiary financing company to handle this — it has a lot of flexibility in evaluating customers to decide who it’s willing to loan money to — and how large of an amount it will approve.

While the details of that process are still somewhat opaque, Gurman notes that many of the employees testing the service are seeing loan approvals for $1,000 and under. That’s in line with what many rival pay-later services offer, and Apple likely wants to encourage customers looking for larger amounts to apply for an Apple Card instead.

According to Gurman, the Apple Pay Later loan offers are valid for up to 30 days, but they may not be as instantaneous as we’d hoped. In some cases, customers will be required to provide a copy of a government identification card and their full social security number. The Apple account also needs to have two-factor authentication enabled for security reasons.

Fortunately, it appears that loan status with Apple Pay Later — whether you’re approved, declined, or carrying a balance — won’t affect access to other Apple services. Customer information, such as transaction histories, will be stored only with Apple Financing LLC, an arms-length subsidiary of Apple, along with Goldman Sachs and Mastercard. For privacy reasons, Apple itself won’t have access to this information.

Although Apple has not confirmed a release date for Apple Pay Later, Gurman suggests it will arrive “in the coming weeks,” at least in the U.S. There’s no word at all when — or if — it will ever expand internationally, but if Apple Cash and the Apple Card are any indications, we’re not holding our breath for that.