Apple Pay Cash Was Just Rated the Best P2P Mobile Payment System

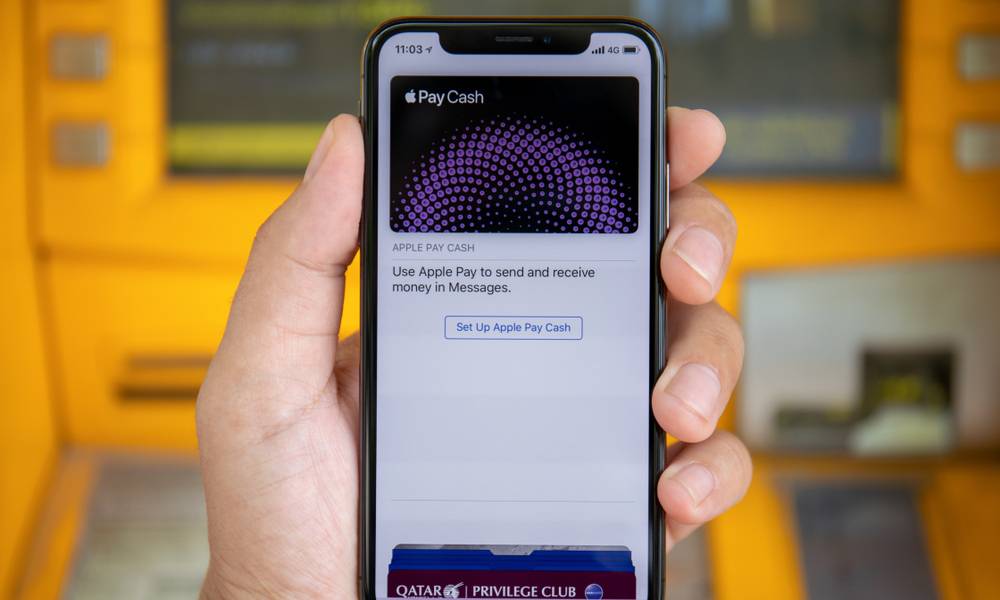

Credit: Denys Prykhodov / Shutterstock

Credit: Denys Prykhodov / ShutterstockToggle Dark Mode

Consumer Reports rated Apple Pay Cash as the top-scoring peer-to-peer mobile payment system in its first-ever comparison of the P2P sphere.

In its testing, CR looked at Apple Pay Cash, Venmo, Square Cash, Facebook Messenger, and Zelle.

It rated those P2P payment platforms on a variety of factors, including payment authentication; customer support; broad access; data privacy; and data security. It also scored them from worse to better.

The publication found that all of the P2P platforms it looked at rated high enough to be completely usable. But Apple Pay Cash came out on top with a score of 76, due to its much stronger data privacy, security features and policies.

“Apple Pay was the only service that got top marks from CR for data privacy, because its policies state that it limits the information it collects and shares on users and their transactions,” Consumer Reports wrote.

CR went on to say that Apple did not store debit or credit card information and that its policies explicitly state that it doesn’t sell information to third parties. Apple also scored higher marks because it requires strong two-factor authentication to use — the other platforms only offered those security measures on an opt-in basis.

Apple Pay Cash’s Worst Rating?

On the flip side, Apple’s proprietary platform faltered in one area: broad access, which CR defines as “use not limited to a particular bank or mobile device.”

The publication rated it as a “major drawback.”

That’s because Apple Pay Cash requires newer hardware and operating systems than the other platforms. (The oldest device that supports it is the iPhone 6 lineup, which was released in 2014).

Still, while broad access was Apple Pay Cash’s only downside, it still came out fairly neutral with a middle rating in that category.

Other Ratings

Again, the other platforms still scored above-average ratings. Venmo came in second with a score of 69, while Square Cash rounded out the top three with a 64.

Facebook’s first-party Messenger platform ranked at a close fourth with 63.

Zelle only scored 50 — mostly due to its poorer policies in data security and privacy, CR found.

The fact that the Cupertino tech giant’s P2P system rated highly in data privacy and security isn’t surprising. Apple has had a longstanding commitment to protecting its users’ privacy and implementing security measures to make users and their data safer.

Apple Pay Cash began arriving on iOS devices back in December 2017 as an extension of its existing Apple Pay platform. Currently, it’s only available for users in the U.S. who own devices running iOS 11 or later.

“Apple Pay Cash is unique from an ease of use, privacy, and security standpoint, as Apple Pay Cash functions seamlessly through hardware, software, and the service all combined,” an Apple spokesperson told CR in a statement.