FAQ | What Is Apple Pay’s New ‘Enhanced Fraud Protection’ Feature and How Does It Work?

Credit: Jesse Hollington

Credit: Jesse HollingtonToggle Dark Mode

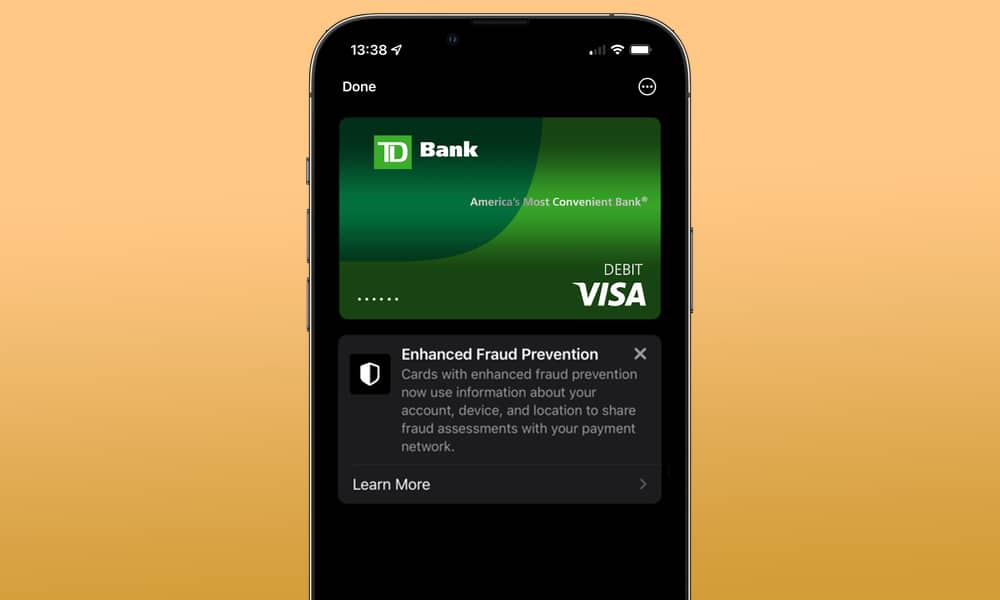

It looks like Apple has partnered with at least one payment network to roll out enhanced fraud protection measures in Apple Pay. Although Apple has offered Advanced Fraud Protection for the Apple Card since the beginning, it appears that this is now expanding to encompass at least some Visa payment cards.

We noticed it pop up yesterday on a Visa debit card in our Apple Wallet app. While we initially thought this might be another new Wallet feature in iOS 15.5, several folks have also reported seeing it on Twitter even with iOS 15.4.

Some are seeing this appear as a notification badge in their Wallet app, while others have noticed a message appearing beneath some of their payment cards.

So far, this only seems to be available for Visa cards; it’s unclear if this is an exclusive arrangement or if Apple will eventually roll it out to other payment networks.

What This Means

The notification in the Wallet app suggests that Apple will begin tracking location information when you make purchases with one of these cards using Apple Pay, along with details about the purchase amounts, currency, and date of the transaction.

Cards with enhanced fraud prevention now use information about your account, device, and location to share fraud assessments with your payment network.

Tapping Learn More explains that this information will be used when attempting a transaction to “develop fraud prevention assessments,” although it’s not entirely clear what that means.

While the description says these are “used by Apple to identify and prevent fraud,” it also notes that these assessments are “shared with your payment network.”

For cards with certain enhanced fraud prevention, when you attempt an online or in-app transaction, your device will evaluate information about your Apple ID, device, and location (if you have enabled Location Services), to develop fraud prevention assessments, which are used by Apple to identify and prevent fraud.

Apple

Reading between the lines and knowing Apple’s penchant for privacy, it sounds like Apple won’t be sharing your raw data with payment networks, only the results of its internal analysis of that data — these so-called “fraud prevention assessments.”

Apple does say that it will share some information with the payment network. However, the examples it uses are things that the payment network would have to know about anyway — details such as the purchase amount, currency, and date aren’t exactly a big secret.

Can I Opt-Out?

Unfortunately, there doesn’t appear to be any way to opt-out of this feature. If your payment card is included in this “enhanced fraud protection,” it’s on by default, and Apple says if you’re concerned about your privacy, the only way “to prevent the sharing of fraud prevention assessments with your payment card network,” is to “select another card.”

- This isn’t something that most folks should find alarming for in-person transactions. Payment networks have long known exactly where you’re using your card based on the merchants’ location.

- Using your iPhone’s location services won’t usually give them any more information than they already have anyway. They also naturally need to know how much you’re spending and when you’re making the transaction.

Online and in-app transactions are another matter entirely, however. Traditionally, payment networks don’t get this information; they know the merchant processing your transaction, but since that company is likely hundreds of miles away from your actual location, they don’t get to see where you are.

This enhanced fraud protection stands to change that. While this is undoubtedly more about keeping your finances safe, it’s understandable how some folks may prefer not to share this information. Fortunately, Apple is upfront about it, so at least you’ll know when a card you’re using is affected — and you can avoid using that card when you don’t want to — but depending on how widely this expands, you may not have that choice in the end.