Could the Apple Card Move to Chase?

Credit: 9to5Mac

Credit: 9to5Mac

Toggle Dark Mode

Now that Apple and Goldman Sachs are parting ways, it’s clear that the Apple Card is going to need a new home. While the field is still open to several possibilities, one that’s coming to the forefront as a likely candidate is Chase.

In this week’s Power On newsletter, Bloomberg’s Mark Gurman shares some insight into the direction Apple could eventually go in, outlining the reasons why Chase may now be a much better fit than it was in the early days of the Apple Card.

Along with American Express and Citigroup, JPMorgan Chase was one of the big financial powerhouses Apple approached when it was trying to get the Apple Card off the ground five years ago. However, all three passed, which was where Goldman Sachs came in.

An unlikely candidate from the beginning, Goldman was a big investment bank that was trying to work its way into consumer products. It had already dipped its toes in the water with Marcus, a digital banking platform intended to cater to wealthy and tech-savvy individuals. So, a partnership with Apple seemed like an ideal match at the time.

Along the same lines, Apple undoubtedly liked the idea of being able to sit in the driver’s seat with Goldman, giving it more flexibility than a traditional bank would have allowed it. However, in the end, the arrangement didn’t work out nearly as well as Goldman had hoped, and last month, Apple decided to give it the divorce it’s been asking for.

Apple could have theoretically forced Goldman to hold on — but it has a lot to lose too. The iPhone maker doesn’t want to link its brand to a bad experience or a partner that’s no longer committed to the project. So Apple recently offered Goldman Sachs a deal to get out early.

Mark Gurman

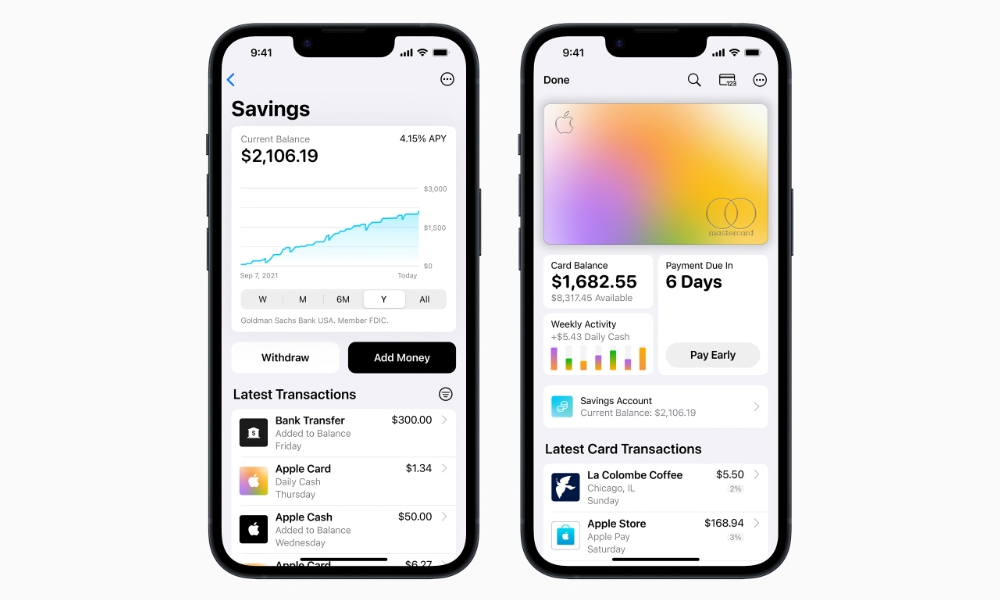

While Amex, Chase, and Citi all gave a hard pass to the Apple Card, that was when it was essentially an untried experiment. As Gurman notes, “the Apple Card of today is different: For all its struggles, the offering has millions of users and more than $10 billion worth of deposits in related savings accounts.”

That latter part could be Apple’s ace in the hole in finding a new partner. Goldman is working hard to divest itself from its consumer lending business in general, and while the $10 billion in Apple Card Savings account deposits is tempting, holding on to that comes with too high a price — specifically that Goldman would have to continue financing the loans behind the Apple Card, which are undoubtedly an even higher number.

However, for an established consumer bank like Chase, handling consumer loans through credit cards is par for the course; if it can pick up an extra $10 billion in deposits, that’s icing on the cake. However, it may be less keen to continue offering a 4.15% APR on those funds.

The same can be said for Amex, which is reportedly already being courted by Goldman as its potential replacement. As Gurman points out, Amex not only has a history of credit card partnerships, but its CEO also “golfs with Apple services chief Eddy Cue.”

There’s no word on the status of those talks, although some industry analysts have suggested that the premium Amex brand that would fit so well with Apple also makes it a poor partner; the two companies may have a hard time agreeing on which brand should be more prominent and in control of the customer experience — an area that Amex prides itself on far more than most other credit card companies.

However, Gurman makes a case that Chase is a more likely partner because it “already has a significant relationship with the iPhone maker,” and it can offer the Apple Card some perks that Amex can’t.

For one thing, Apple already banks with Chase corporately, and it was one of the first out of the gate to support Apple Pay when it launched (as was Amex, to be fair).

However, Chase has also teamed up with Apple in ways that aren’t too different from what the Apple Card offers, including its Ultimate Rewards program that offers discounts on Apple hardware to its customers. Chase also uses the Mastercard network, which would make for a smoother transition, avoiding a switch to Visa or Amex.

Gurman suggests that such a partnership could even see the Apple Cash card move over to Chase from Green Dot Bank, which may be something Apple is already looking to do; Goldman Sachs holds the Apple Card Savings Accounts, while Apple Cash accounts are at Green Dot, which adds a layer of complexity. Chase already has a debit card network that could even allow for ATM access, although it’s unclear if Apple Cash would remain on the Visa Debit network if that happened.

The biggest obstacle to such a deal would be the Apple Card Savings Account, a high-yield account that doesn’t fit into the pattern of what Chase typically offers.

Unlike Goldman and some other banks, Chase only offers peanuts when it comes to interest for savings accounts. So, assuming Chase won’t get into high-yield accounts to secure a deal with Apple, there will need to be another solution for that product.

Mark Gurman

Even though Apple and Goldman have treated the Apple Card and its related Savings Account as a package deal, that’s not strictly necessary. Apple could find other banking partners willing to provide a high-yield savings account. Gurman suggests that Apple could even split the deposits among multiple banks if necessary. However, such a move might complicate things and likely wouldn’t be Apple’s preferred approach.

Either way, even if Goldman accepts Apple’s breakup proposal — which seems likely — the two companies still have at least a year to figure this out and wrap things up in a way that will guarantee the seamless transition for customers that Apple is undoubtedly looking for.

[The information provided in this article has NOT been confirmed by Apple and may be speculation. Provided details may not be factual. Take all rumors, tech or otherwise, with a grain of salt.]