The Apple Card Takes First Place for Customer Satisfaction

Credit: MKBHD

Credit: MKBHD

Toggle Dark Mode

The Apple Card may not be a good fit for Goldman Sachs anymore, but it continues to take top honors when it comes to customer satisfaction.

In a newsroom post today, Apple announced that J.D. Power has named the Apple Card the Best Co-Branded Credit Card for Customer Satisfaction with No Annual Fee, marking the third consecutive year that Apple’s credit card has received the number one ranking in that segment.

Of course, there are a lot of qualifiers in that particular award. For instance, the Apple Card wasn’t competing against cards with an annual fee, nor was it up against standard credit cards that aren’t co-branded with other non-banking companies. In other words, generic MasterCard, Visa, and American Express cards aren’t on the same playing field.

Still, there are a lot of co-branded credit cards out there, and it’s not easy to find ones that offer as much as the Apple Card does without charging annual fees, so it’s not a big surprise that Apple keeps leading the pack in this category.

Since the start, we’ve been committed to delivering tools and services that help users live healthier financial lives, and it’s been rewarding to see customers using and finding value in the benefits of Apple Card. We are honored that Apple Card has been recognized as a leader in customer satisfaction.Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet

For instance, Apple provides some pretty generous cash-back rewards for a zero-fee card, with up to 3% cash back on all Apple purchases, from hardware like a new Mac or iPhone to in-app gaming purchases on the App Store. Since those cash-back rewards come daily, it’s like getting a 3% discount across the board on everything you buy from Apple.

The 3% Daily Cash also applies to other select merchants, including Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. Everywhere else, you’ll get 2% Daily Cash Back as long as you use the card with Apple Pay, or 1% for those times you have to resort to pulling out the physical titanium Apple Card.

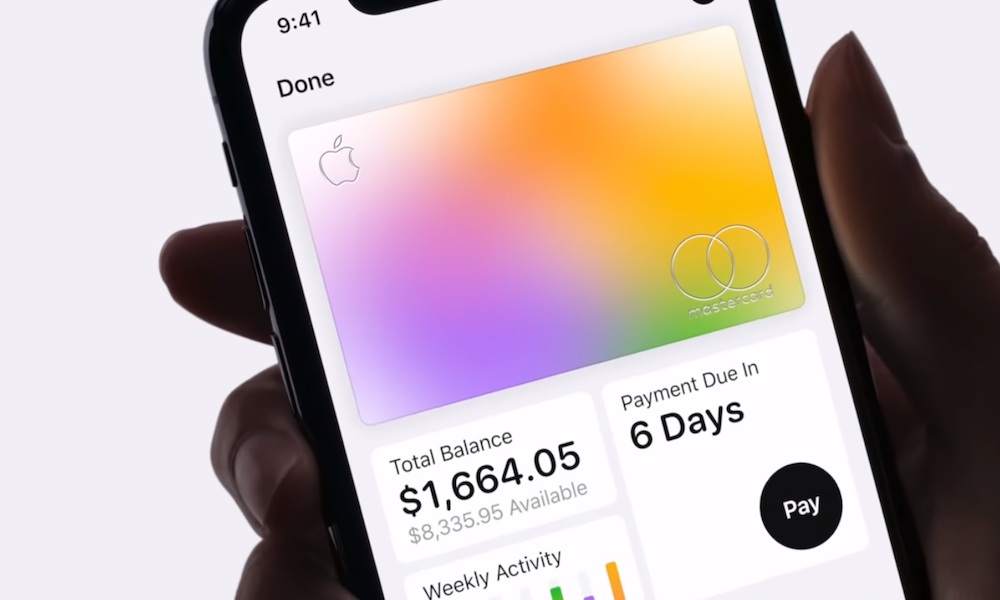

The Apple Card also provides an unprecedented level of digital integration for iPhone users, who can monitor and administer their Apple Card account directly in the iPhone Wallet app. This includes not only tracking purchases but also managing spending, calculating potential interest charges, making payments, and setting up interest-free financing for Apple product purchases.

Earlier this year, Apple also took its co-branded credit card a big step further with the new Apple Card Savings Account, offering a place to park your Daily Cash Back while earning a 4.15% APY. The new savings account, which requires an Apple Card to open, was an overnight success by financial industry standards, attracting $10 billion in deposits in just four months.

In partnership with Goldman Sachs, we are continuously working to expand the value users receive from Apple Card, most recently with the launch of Savings, and we look forward to continuing to develop tools and services that put our users and their financial health first.Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet

The CEO of Goldman Sachs, Apple’s banking partner for the Apple Card, once praised it as the most successful credit card launch ever, but over the years, it seems that the relationship has begun to cool off, with reports that Goldman is looking for a way out.

However, the customer enthusiasm for the Apple Card underscores the idea that Goldman’s reluctance to continue its partnership with Apple might have more to do with an overall change in business strategy than dissatisfaction with its performance.

With Apple Card, we have had a shared focus on delivering a great experience and providing value to our customers since the beginning. As we have brought new offerings and benefits to customers, we are honored to once again be recognized by them and J.D. Power.Liz Martin, Goldman Sachs’s head of Enterprise Partnerships.

While there have been indications that the deal has been a money-losing proposition for Goldman — Bloomberg reported in January that the Apple Card partnership had cost Goldman over $1 billion since its 2019 launch — the bank didn’t visibly waver in its support until more recently, when it became clear that its end game is a much broader exit from the consumer lending business.

Even as The Wall Street Journal (Apple News+) reported in February that Goldman was canceling plans for other co-branded cards with T-Mobile and Hawaiian Airlines, the company’s CEO, David Solomon, shared expectations that the Apple Card deal would provide a “meaningful dividend for the firm over time.”

However, more recently, the firm has been taking steps to divest itself of its consumer lending business. Although it’s still taking deposits for its Marcus online banking brand, it stopped issuing personal loans earlier this year, and it’s also been trying to sell off a home-improvement loan company that it acquired last year. The Apple Card may simply end up being the last to go — assuming Goldman can find a partner to pick it up.

If popularity were the only metric, it shouldn’t be hard to find a new banking partner for the Apple Card, but of course, just because cardholders love the services and features the Apple Card offers doesn’t mean it’s good business for a bank. After all, those generous cash-back payments have to come from somewhere, and with no annual fees or other surcharges, that leaves interest payments from Apple Card holders and merchant fees as the only other direct sources of revenue from the card itself.