Nearly $1 Billion Has Been Deposited in Apple’s New High-Yield Savings Accounts

Credit: Apple

Credit: Apple

Toggle Dark Mode

It’s been only two weeks since Apple officially opened the floodgates on its new high-yield savings account, and sources say it’s already attracted nearly $1 billion in deposits from Apple users eager to cash in on its lucrative 4.15% Annual Percentage Yield (APY).

The numbers, which have not been publicly disclosed, come from two “sources familiar with the matter” who shared them with Forbes. According to those sources, the new account, which requires an iPhone and an Apple Card, drew nearly $400 million in deposits on the first day alone. In the three days following the launch, an additional $590 million in deposits have shown up, bringing the total to $990 million before the week ended.

While that sounds like a lot of money — and it is on its own — it’s also spread across a large number of customers. One source told Forbes that approximately 240,000 accounts were opened in the first week, which would put the average deposit amount at less than $4,200.

Still, it’s a pretty significant uptake for an account that requires holders to not only have an iPhone but also already be the owner or co-owner of an Apple Card. What’s less clear, though, is how much of that money was transferred in from other bank accounts and how much was simply a result of people shifting their Daily Cash balances into the new Apple Savings account.

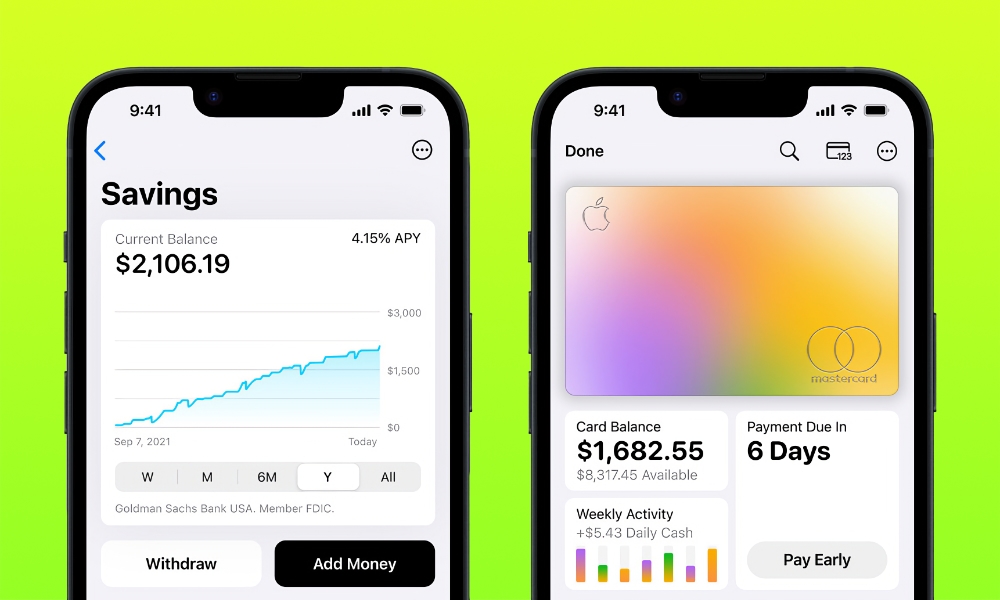

When setting up a new Apple Savings account — something that can be done in under five minutes straight from your iPhone’s Wallet app — any Daily Cash that’s accumulated from Apple Card purchases can be automatically transferred into the Apple Savings account, where it goes from earning zero percent interest to a 4.15% APY.

All future Daily Cash rewards also get funneled into the Apple Savings account, from the 1% cash back from purchases made with the physical card to the 3% from Apple Store purchases, plus other Daily Cash promotions.

Under those terms, it would be almost insane for an Apple Card owner not to set up an Apple Savings account, which probably accounts for such a rapid uptake. On top of that, as Forbes’ Emily Mason points out, the 4.15% makes it an attractive destination for other savings even beyond Daily Cash — and it’s ironically higher than Apple’s banking partner’s own high-yield savings account.

The account’s eye-catching 4.15% annual return, plus the ubiquity of iPhones, is likely the main driver for account openings, especially when the average bank is paying less than half a percent.

Emily Mason, Forbes

Long before it partnered with Apple to back the Apple Card, Goldman Sachs had created a consumer brand of its own known as Marcus. Mason notes that this brand also offers a high-yield savings account — but at a relatively meager 3.9%.

Needless to say, at 4.15% APY, Apple’s Savings account is a big deal. While there are competing services like Robinhood that do slightly better, these are part of more comprehensive — and complex — packages for savvy investors. By contrast, the Apple Savings account is a no-frills high-yield account that follows the company’s “just works” philosophy and can be set up in minutes by anybody with an iPhone and an Apple Card.

It also looks like this initial billion dollars is just the tip of the iceberg. According to Crone Consulting, a payments firm cited by Forbes, an estimated $3.8 billion in Daily Cash rewards have flowed into the Apple Cash accounts annually. Since the vast majority of Apple Card users are likely to sign up for an Apple Savings account and opt to have their Daily Cash land there, it’s fair to say that most of that $3.8 billion will end up in Apple Savings accounts, which will likely be added to as customers choose to move their savings over from lower-yield accounts and investments to take advantage of Apple’s 4.5% APY.