You Can Now Get 3% Cash Back Using Your Apple Card at These Retailers

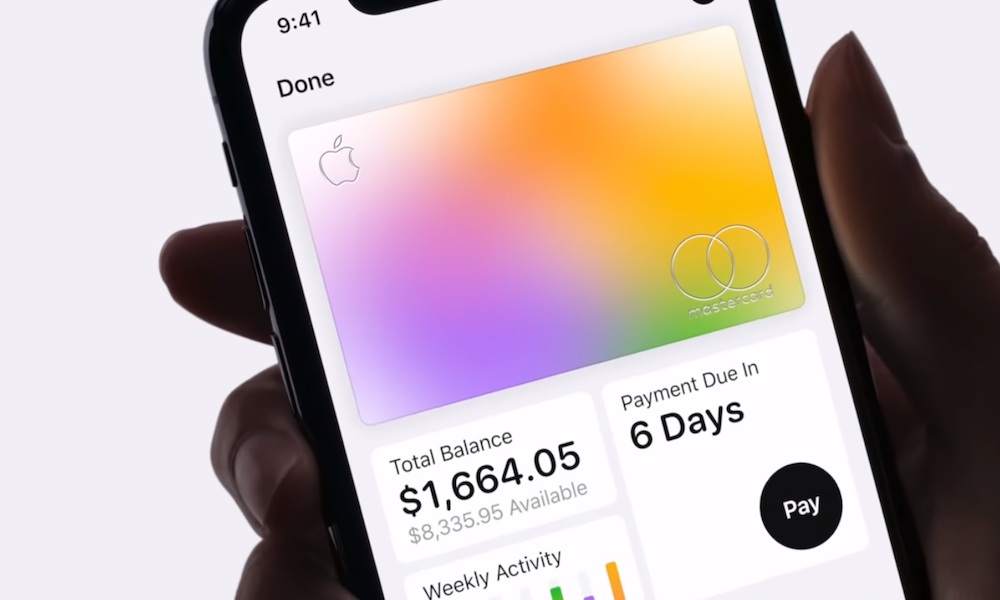

Credit: Apple

Credit: Apple

Toggle Dark Mode

The Apple Card sports some innovative features, although its cash back rates are thoroughly average (depending on if you use Apple Pay or not).

But the Cupertino tech giant is apparently looking for partners to change that. Since launch, Apple has added a slew of new companies to its 3 percent cash back roster. Here’s what you should know.

Additional Cash Back Partners

This week, Walgreens announced in a press release that it will offer 3 percent daily cash on purchases made with the Apple Card at its physical locations (which also includes Duane Reade stores).

That rate, as you might expect, only applies to Apple Pay transactions — not purchases made with the physical titanium card.

Walgreens joins Uber and Uber Eats, which also offer 3 percent cash back for purchases made with the Apple Card.

At launch, the Apple Card only offered 3 percent cash back on Apple purchases. That included transactions at Apple Store locations, the App Store and Apple’s own Services.

Beyond Walgreens, Uber and Apple, whether or not Apple Card purchases earn a decent cash back really depends on how many retailers near you accept Apple Pay.

Purchases made through Apple Pay on an iPhone or Apple Watch earn 2 percent cash back. Anything you buy with the physical titanium card only earns a somewhat lukewarm 1 percent cash back rate.

What This Means for Apple Card

When Apple announced the Apple Card, it didn’t make any indication that it could change cash back rates as time went on. The recent additions to the 3 percent rate suggest otherwise.

As mentioned earlier, most of Apple Card’s benefits really only apply to Apple Pay transactions. That’s fine for consumers in areas with plenty of Apple Pay availability, but there are still plenty of places where the tap-to-pay system is still uncommon.

Of course, contactless payment systems and mobile wallets are likely only going to become more common as time goes on. So the Apple Card may be futureproof in that respect.

Presumably, Apple will continue to partner with retailers and companies to offer additional cash back. That could make the Apple Card much more competitive in a competitive credit card market — and an increasingly attractive option for consumers.