Want to Finance Your New iPhone with Apple Card? You’ll Have to Activate It with One of the Big Three

Credit: Apple

Credit: Apple

Toggle Dark Mode

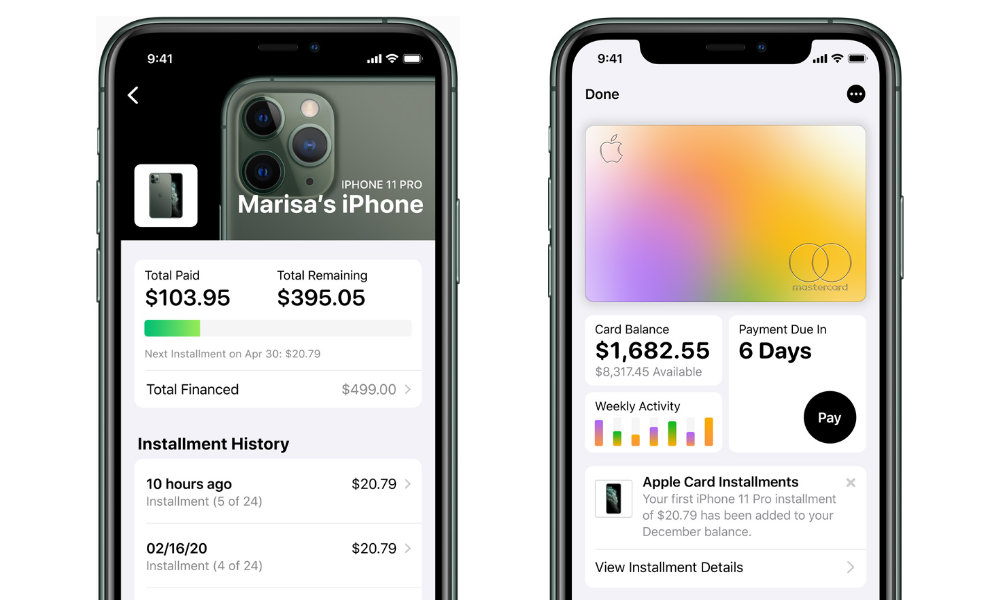

One nice perk to having an Apple Card is the ability to purchase a new iPhone and pay for it over 24 months with zero-interest monthly payments. Not only that, but Apple even gives you 3% cash back on the full purchase price of the iPhone right away.

This also applies to other Apple products, but one of the big advantages of using it for an iPhone is that you could pick up a SIM-free model online, effectively getting the benefits of carrier financing plans on a mobile operator of your choice. For instance, you could buy a new iPhone 14 at an Apple Store, pay monthly installments on your Apple Card, and then go and activate it on Mint Mobile, Google Fi, or any number of other carriers.

Sadly, though, it looks like this particular benefit may be coming to an end. According to an updated footnote on Apple’s “Buy iPhone” page discovered by the sharp folks at 9to5Mac, Apple will soon begin requiring carrier activation for all iPhone purchases made with Apple Card Monthly Installments (ACMI), whether in-store or online — and you’ll be limited to activating on AT&T, T-Mobile, or Verizon.

Currently, carrier connection with AT&T, T-Mobile, or Verizon is required for all iPhone purchases made with ACMI from Apple Store locations only. Starting August 15, 2023, carrier connection with AT&T, T-Mobile, or Verizon is required for all iPhone purchases made with ACMI. Apple

While this has always been the case for in-store purchases, buying an iPhone online when using ACMI offered an “Activate with any carrier later” option on the checkout page. According to an Apple Retail employee posting on Reddit when it first showed up three years ago, this was intended to be “a pilot program only available for online orders and in store pickup orders.“ Although it wasn’t normally offered for in-store purchases, the employee added that they had helped “several in store customers” order a phone through the Apple Store App for in-store pickup to bypass the requirement to activate on one of the big three carriers.

The new policy effectively means that if you want to take advantage of the Apple Card’s zero-interest financing to buy a new iPhone — and get the bonus 3% cash back — you won’t be able to use them with any prepaid or discount carriers. Technically speaking, the iPhones should still be unlocked, but you’ll need to go through the process of connecting to whichever carrier you chose during checkout — AT&T, T-Mobile, or Verizon — once you receive your phone.

Further, Apple is also reducing the length of Apple Watch financing, noting that “starting August 15, 2023, the ACMI installment term for new Apple Watch purchases will change from 24 months to 12 months.”

The good news is that neither of these changes takes effect for another two months, so you still have time to grab an iPhone 14 with Apple Card Monthly Installments on a carrier of your choice or an Apple Watch Series 8 with a longer payment term. Sadly, that won’t work out so well if you’re planning to upgrade to a new iPhone 15 later this year. While other financing options are available, they aren’t nearly as simple or attractive as the Apple Card since you have to apply separately, and there’s no 3% cash-back bonus.