Is Walmart Pay Really Overtaking Apple Pay?

Toggle Dark Mode

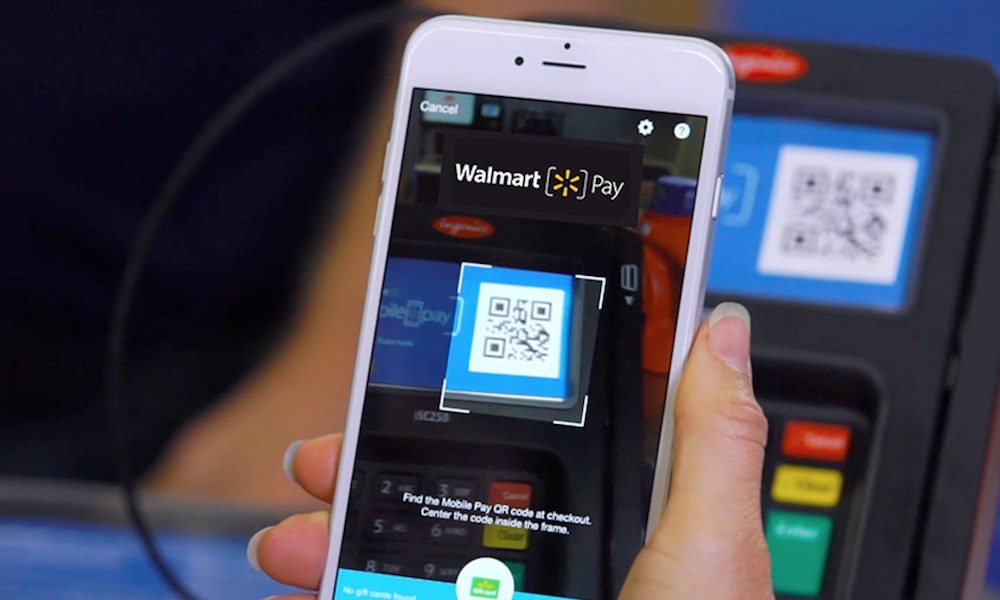

Walmart made headlines back in December, 2015, when it launched Walmart Pay — its proprietary, in-store mobile payment solution which instead of contact-based near-field communication (NFC) relies on scanning a QR code at the register to conduct mobile wallet transactions exclusively at Walmart stores.

Loosely-based on technology championed by the failed mobile payments upstart, CurrentC, Walmart Pay is essentially the retail-giant’s direct response to Apple Pay, which it ultimately decided not to integrate at its stores even despite having the infrastructure.

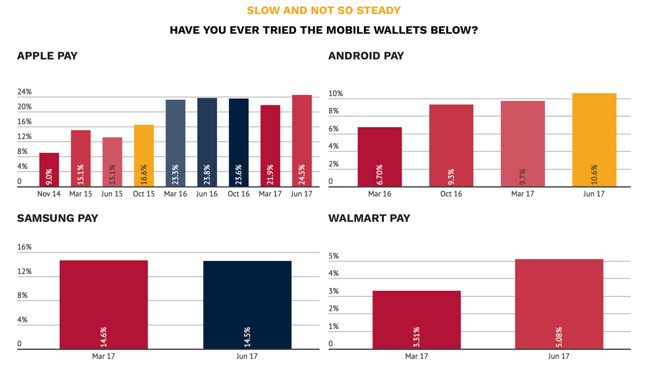

We haven’t heard much about Walmart Pay since those early days; however the latest mobile wallet adoption data collected via a recent Pymnts Survey, which was then analyzed by market research firm Crone Consulting LLC., revealed that Walmart Pay is intriguingly “on track to surpass Apple Pay” within the next year, as reported by Bloomberg.

Richard Crone, CEO of Crone Consulting, says that based on the present data, Walmart Pay will surpass Apple Pay by sometime in 2018 with regards to its base of “active users” (those who conduct at least two transactions per month) in the U.S.

Unsurprisingly, Walmart’s SVP of Services and Digital Acceleration, Daniel Eckert, wholly agreed with the assessment, adding that Walmart Pay is currently seeing enrollment of “thousands of new users a day,” an estimated two-thirds of which, he says, have gone on to use the payment solution a second time within the same 21-day period.

“If daily enrollments don’t slow down, I think that’s pretty well in the cards shortly,” he said. “I would have to imagine we are getting pretty close.”

Unreasonable Reasoning?

It appears from a mere glance at Pymnts data that Walmart Pay is, in fact, inching closer and closer to “overtaking” Apple Pay in the U.S.

There’s just one problem with the logic: the metric used to assess adoption rate seeks to quantify “growth” based on an inherently flawed assumption, failing to consider the much broader implementation of Apple Pay in relation to Walmart Pay, which is only available to customers shopping at one of the retail-giant’s 4,774 Stores or Supercenters in the U.S.

Granted, Walmart Pay’s adoption rate was hovering around 5.1 percent as of June, 2017 — while Apple Pay’s, in comparison, was marginally higher at 5.5 percent. However the data is essentially presumptive of the idea that Walmart’s retail presence is economically and/or voluminously superior to the millions of retail stores, restaurants, institutions and other places that already accept Apple Pay instead. Oh, the absurdity!

Just to put it in perspective: thousands of popular stores, retail chains, and restaurants currently accept Apple Pay at their registers — including, just for example, McDonalds, Starbucks, Chick-fil-A and Dunkin’ Donuts, whose stores alone number around 31,000+. And that’s not even considering all the other places that accept Apple Pay and not Walmart Pay.

What’s interesting and worth pointing out, of course, is that Walmart Pay did enjoy a sizable, 1.7 percent jump in its adoption between March and June, which is likely one of the reasons why Crone and Eckert are so optimistic. Of course, Walmart Pay could, theoretically, “surpass” Apple Pay on the metric of percentage-rate, alone. However, as far as the number of Walmart shoppers using WM Pay, by volume, being greater than the collective of all other people using Apple Pay? Well, that’s just preposterous.