AT&T Accuses T-Mobile of Hoarding 5G Spectrum, Calls on FCC to ‘Explain Itself’

Credit: Manu Fernandez / AP Images for T-Mobile

Credit: Manu Fernandez / AP Images for T-Mobile

Toggle Dark Mode

It turns out there may be a reason why T-Mobile has been so wildly successful in launching its nationwide 5G network ahead of its rivals — according to AT&T and Verizon, it seems that the “un-carrier” may have been able to acquire far more spectrum than it should rightfully have been entitled to.

In a new report by Ars Technica, both AT&T and Verizon have raised concerns about the “vast spectrum holdings” that T-Mobile now has in its possession, and are each asking the Federal Communications Commission to start cracking down on allowing the carrier to acquire any more spectrum in the near future.

Back in August, Verizon petitioned the FCC to try and block a lease that was about to grant additional spectrum in the 600MHz in 204 counties across the U.S., and AT&T not only followed that up with its own filing last week making most of the same points, but is actually calling on the FCC to explain how it allowed T-Mobile to acquire so much spectrum in the first place.

Dominating 600MHz

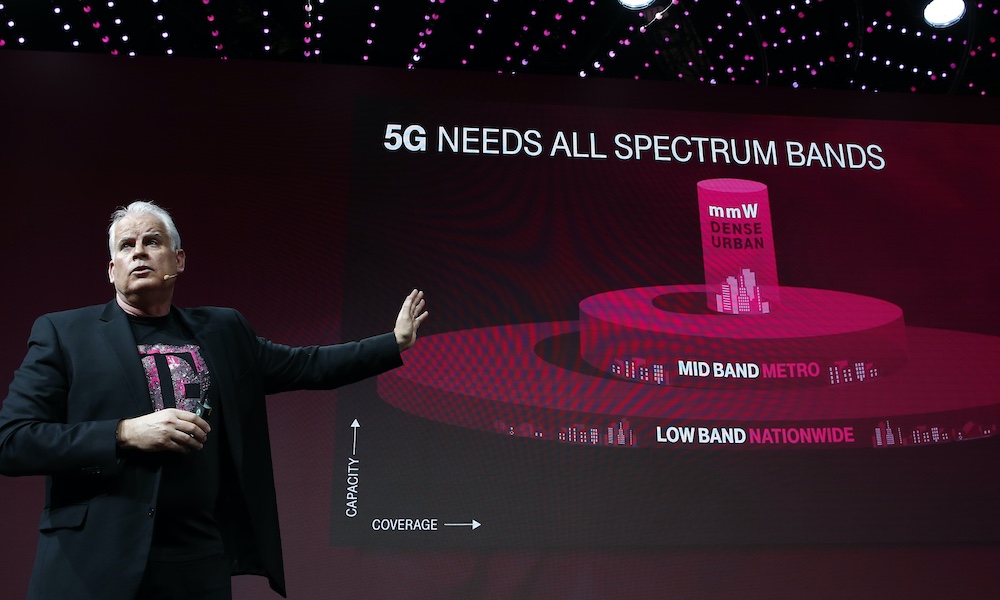

T-Mobile’s nationwide 5G network operates almost entirely on the 600MHz band, which means that while it generally isn’t going to offer the fastest possible 5G speeds, it is able to provide the widest swath of coverage, since lower frequencies travel much further.

Although T-Mobile has started to expand into the 2.5GHz frequencies in order to offer faster 5G service in more built-up areas, the backbone of its nationwide standalone 5G network remains in the 600MHz spectrum.

Even though T-Mobile was once the smallest of the four national U.S. carriers, it was able to surpass rival Sprint and then eventually buy it out to become a serious third-place contender against the big incumbents of AT&T and Verizon. However, as part of its coup, T-Mobile was also able to dominate a 600MHz auction back in 2017, according to Ars Technica, and with the spectrum that it gained in its acquisition of Sprint, the result was that the new T-Mobile ended up holding more spectrum than it would have normally been allowed to acquire on its own.

The combination of Sprint and T-Mobile has resulted in an unprecedented concentration of spectrum in the hands of one carrier.

AT&T, in a Sept 18th filing to the FCC

The Spectrum Screen

In order to allocate spectrum fairly to the various cellular carriers, the FCC has a number of policies, including a spectrum screen by which it reviews which companies are able to acquire spectrum licenses to ensure that all licenses are issued in the public interest and no one company can dominate.

While the policy doesn’t provide a hard limit on how much spectrum a given carrier can acquire, it’s definitely part of the FCC’s analysis, and the fact that T-Mobile has exceeded its 250MHz limit by about 136MHz — or effectively more than 50% — has definitely raised concerns for its competitors.

While AT&T has stopped short of outright accusing the FCC of any wrongdoing, it does want it to provide an explanation for how T-Mobile was able to exceed these limits by so much.

Although AT&T takes no position on whether T-Mobile’s lease applications were properly accepted by the FCC, it believes that the Commission should provide an explanation of why it permitted T-Mobile to further exceed the spectrum screen. Typically, if an assignment, transfer, or lease of spectrum would cause the applicant to exceed the spectrum screen, the Commission issues a written order that includes competitive analysis supporting whatever decision it reaches. Here, however, the Commission approved the leases without conducting any public-facing competitive analysis.

AT&T, in a Sept 18th filing to the FCC

In its own filing last month, Verizon also made the point in its own filing that T-Mobile has been able to acquire so much spectrum on the lower-end that it now has more than all of its major rivals combined.

T-Mobile already holds licenses for 311 MHz of low- and mid-band spectrum nationwide. That is more than the low- and mid-band spectrum licensed to Verizon and AT&T combined.

Verizon, in an Aug 7th filing to the FCC

T-Mobile’s Response

While T-Mobile hasn’t yet offered up a response to AT&T’s claims, it did file an opposition to Verizon’s claims last month in which it accused the carrier of being “disingenuous” by failing to demonstrate how T-Mobile’s spectrum holdings actually damaged Verizon in any way.

Verizon does not even try to demonstrate any harm to itself from the 600 MHz spectrum leases—a requirement for petitioners who did not participate in an earlier stage of the proceeding. As a company that elected not to participate in the Commission’s 600 MHz auction and currently touts its massive millimeter wave spectrum holdings as support for 5G superiority, it is simply disingenuous for Verizon to now complain that T-Mobile’s addition of 600 MHz spectrum to its portfolio is somehow anticompetitive.

T-Mobile, in an Aug 17th filing to the FCC

In short, T-Mobile is saying that not only was Verizon not competing in the 600MHz spectrum auction in the first place, but it’s not even on the same 5G battlefield anyway, since all of its rollouts have been in the much higher frequency mmWave spectrum, and Verizon should therefore have no right to quibble over T-Mobile holding license for frequencies that it doesn’t intend to use anyway.

Further, while Verizon has tried to argue that T-Mobile’s large holdings of spectrum in large cities is disproportionate to its own mmWave spectrum holdings, T-Mobile has countered that Verizon still has considerably more usable spectrum due to the higher bandwidth offered by mmWave frequencies.

Of course, the truth of this claim is somewhere in the middle, since while mmWave 5G is definitely far faster than the 600MHz used by T-Mobile, which barely exceeds 4G LTE speeds in many cases, it’s also significantly shorter in range and doesn’t penetrate buildings or solid objects nearly as well, meaning that it only does Verizon customers good in those areas where they can actually get access to it.

T-Mobile has also added that it plans to use its spectrum for more than merely mobile services; it also expects that it will be able to boost competition for wireless home internet services, an area that’s currently dominated by Verizon, particularly in more rural areas.

What This Means for You

The reality of the situation is that the FCC is unlikely to claw back on any of T-Mobile’s existing spectrum, which means that the carrier is mostly free to continue its massive network rollouts, and in the near future it’s not likely going to run out of the spectrum it already holds licenses to.

Further, even T-Mobile’s faster 2.5GHz 5G service comes largely as a result of the spectrum licenses that were held by Sprint, which operates its entire 5G network in those frequency ranges. While T-Mobile has been decommissioning Sprint’s 5G towers, that’s largely been so that it can redeploy the 2.5GHz 5G strategically as part of its new combined 5G network, and it probably isn’t about to run out of 2.5GHz spectrum any time soon.

What AT&T and Verizon are calling for at this point is for the FCC to impose limits on T-Mobile acquiring any more spectrum license in the near future, which could hamper the carrier’s plans in certain rural areas, especially as the demand for 5G coverage increases in the wake of Apple’s upcoming 5G-capable iPhone 12 lineup.