Apple to Transfer Massive International iTunes Business to Ireland in February

Toggle Dark Mode

Late last year, Apple announced that its entire international iTunes business would relocate to Cork in Ireland, and transferred some $9 billion worth of iTunes intellectual property from Luxembourg to the island tax haven shortly thereafter. Now, Apple has announced that the official move-in date has been set for February 5.

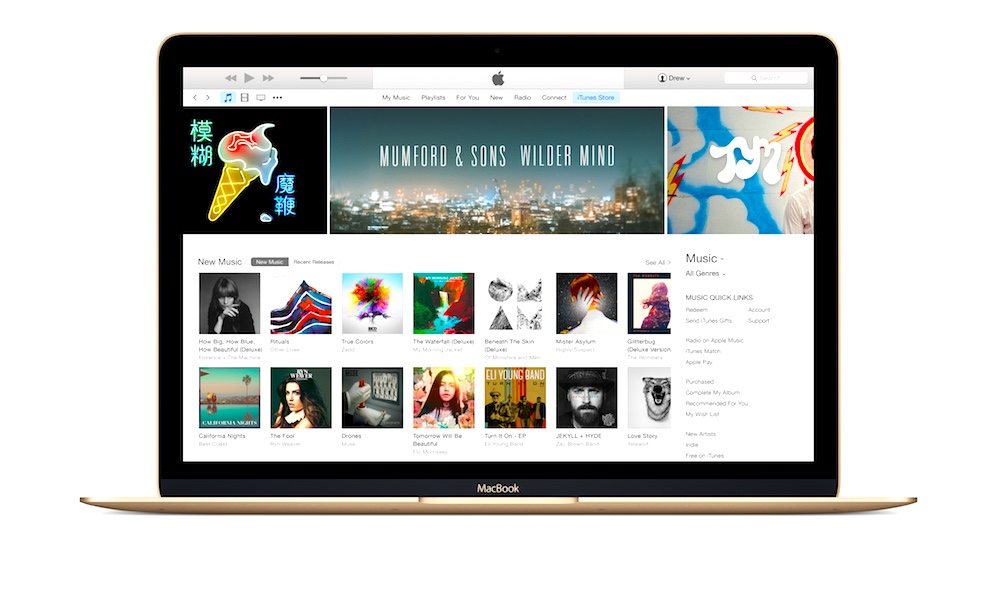

The move entails a transfer of its non-US iTunes operations serving more than 100 countries, and covers Apple Music, the iTunes Store, the App Store, and the iBooks Store. Apple’s Luxembourg business will be shuttered on February 4.

Although Apple informed developers of its intentions and moved all developer contracts to one of its Irish subsidiaries, Apple Distribution International, back in September, the move still comes as something of surprise and a slight to European regulators.

Apple’s cozy relationship with Ireland has been embroiled in controversy for some time. In August, the European Union (EU) ordered Ireland to collect close to $14 billion in back taxes plus interest from Apple following a years-long investigation. The EU concluded that the ultra-low tax rate Apple enjoyed constituted illegal state aid that gave Ireland an unfair competitive advantage over other EU member states, which may explain Apple’s decision to leave Luxembourg. Ireland levies a 12.5 percent corporate tax rate, whereas the US demands 35 percent. In 2014, however, Apple paid an effective corporate tax rate of just 0.005 percent on its European profits– well below Ireland’s standard corporate tax rate.

Apple and Ireland have locked arms and stridently denied the accusations, with both vowing to challenge the EU ruling. Apple has operated in Ireland since 1980 and currently employs around 5,500 people in Cork, making it the city’s largest private employer, with plans to expand by 1,000 more. By some estimates, Apple’s Irish operations generate nearly $24 billion in salaries, taxes, and investment.

Some local legislators fear that collecting the sum could frighten other foreign multinational corporations away from Ireland, a nation in which roughly 10 percent of the workforce is employed by overseas companies. Others accuse the EU of interfering in Ireland’s affairs, agreeing with Apple’s position that the fine was “politically motivated.”

However, Ireland’s decision to refuse billions in back taxes from Apple has attracted criticism from some within its government, who argue that the money could go a long way toward ameliorating the effects of harsh cutbacks imposed under fiscal austerity.