Apple to Move $9 Billion iTunes Business to Ireland, Despite $14.5 Billion in Unpaid Irish Taxes

Toggle Dark Mode

Apple has maintained operations in Ireland since 1980. It’s since grown to become the world’s most valuable company.

Recently, the company’s activities in the Emerald Isle became the subject of unwanted publicity when the European Commission slapped the company with a gargantuan $14.5 billion fine plus interest for back taxes. The Commission found that Ireland had been under-taxing the Cupertino-based company, which constitutes both illegal state aid and a major incentive for Apple to work there, Ireland’s many other charms notwithstanding. Both Apple and Ireland have stated that they will appeal the decision– the latter, out of fear that its allure to foreign companies will be undermined and the former, because it does not want to fork over more than $14.5 billion to Irish tax authorities.

For its part, Apple has denied that it enjoys a special corporate tax rate in Ireland and that the fine represents a “devastating blow” to rule of law in Europe. CEO Tim Cook, in a letter to The Irish Times also hastened to remind readers that the company’s continued presence has driven job growth in Ireland.

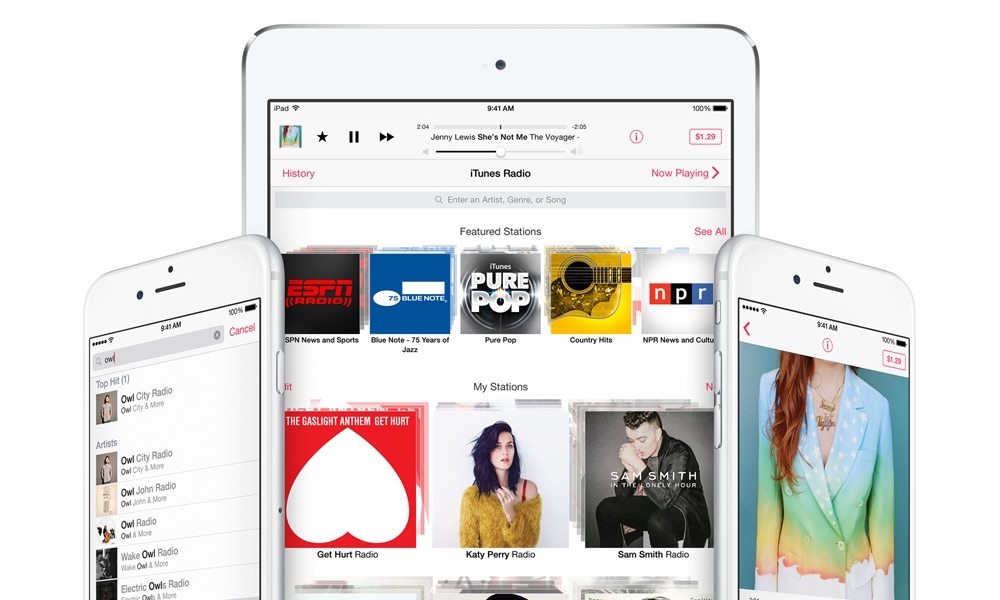

Undeterred by the ruling, Apple has announced that it is transferring its $9 billion iTunes business from Luxembourg, where it is currently based, to greener Irish pastures. The transfer brings with it a sizeable amount of intellectual property. The iTunes service has a catalogue of 43 million songs, 700,000 apps, over a million podcasts, and 40,000 music videos. Apple, which currently employs approximately 6,000 workers in Ireland, was also recently granted approval to hire 1,000 more and expand its operations in Holyhill.

“Apple has been operating in Ireland since 1980 and now employs nearly 6,000 people. As we continue to expand our operations in Cork, we are moving our iTunes business there and will support content stores for more than 100 countries from our campus at Hollyhill,” a company spokesperson said.

The move is expected to bring tens of millions in tax revenues to Ireland, if it collects.