Apple Has Abandoned Its Plans for a ‘Hardware Subscription’

Hadrian / Shutterstock

Hadrian / Shutterstock

Toggle Dark Mode

Apple has shelved its plans to create a new hardware subscription service, according to a new report by Bloomberg’s Mark Gurman. The move reportedly comes as a result of shifting priorities in Apple’s payment services group, which has spearheaded similar buy-now-pay-later initiatives over the past few years.

Gurman first reported on Apple’s plans in early 2022, suggesting the new initiative would be an expansion of the iPhone Upgrade Program that’s been around since 2016 to encompass iPads, Macs, and possibly more. The goal was to “make device ownership similar to paying a monthly app fee.”

It wasn’t entirely clear how Apple planned to price it. Gurman speculated that Apple might somehow tie it into its Apple One bundles and AppleCare. Still, it was too early to say whether this meant a higher-tiered Apple One subscription could include hardware or whether Apple One would simply be bundled into the new hardware program.

Customers in the US can already get interest-free financing on most Apple purchases through the Apple Card, a co-branded Mastercard backed by Goldman Sachs. Apple has also partnered with the buy-now-pay-later (BNPL) service Affirm in several countries to offer low-interest financing.

However, a subscription model would have presumably worked more like the iPhone Upgrade Program, supplying customers with new devices at regular intervals. That could have been a step beyond even what the iPhone plan offers since customers aren’t required to upgrade their iPhone every year under that program — they can opt to keep their iPhone and pay it off in the second year instead.

By contrast, a subscription implies that new hardware devices would come automatically on a pre-determined schedule. Think of it as a recurring leasing deal where you’re paying for the depreciation of the devices and regularly trading them in for new ones every one to three years.

According to Gurman’s 2022 report, hardware subscriptions were also expected to encompass more than just mainstream products. Accessories such as the AirPods, Apple Pencil, and Magic Keyboard would also be included. AppleCare+ would have likely been mandatory to ensure that the value of the devices was protected, but it may have also been built into the subscription price.

Apple had hoped to launch by the end of 2022 or early 2023 and start with the iPhone before expanding into other products. However, we heard little after Gurman’s initial report. Now we know why: Gurman’s sources say that the team behind it has been “disbanded and reassigned to other projects,” suggesting the initiative is dead in the water.

The change in plans seems to be related to Apple’s decision to shutter Apple Pay Later earlier this year. Apple announced the BNPL service at its 2022 Worldwide Developers Conference, around the same time Gurman reported on its hardware subscription plans. However, it took longer to arrive, starting its rollout in April 2023 and not gaining widespread availability until iOS 17 shipped last fall.

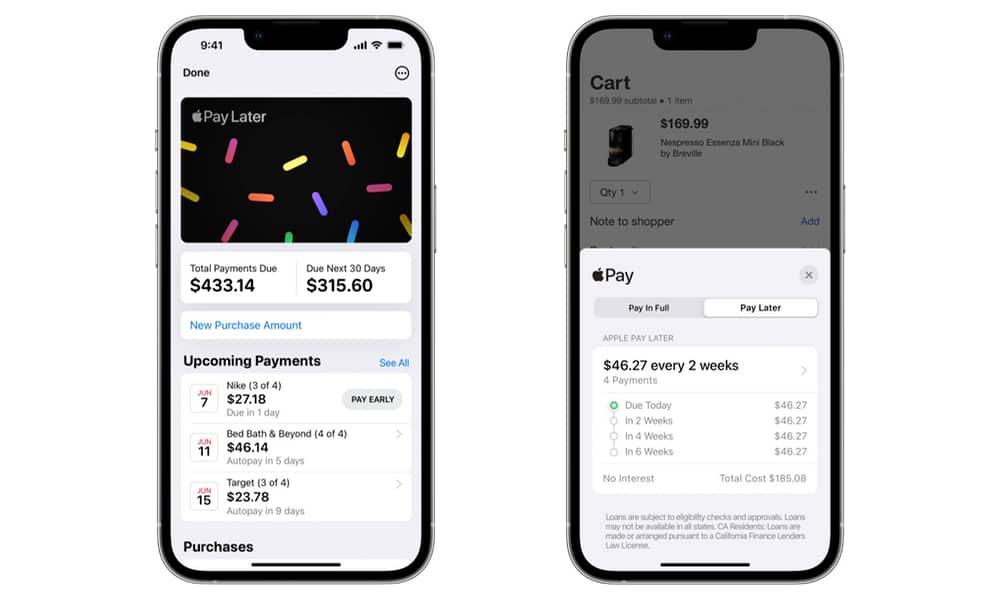

As the name implied, Apple Pay Later integrated with Apple Wallet and Apple Pay to let you split qualifying purchases into four equal installments over six weeks. You’d pay the first installment at the time of purchase, with the other three billed to your payment method at two-week intervals. The magic of Apple Pay Later was that it presented a Mastercard-style virtual payment card to the merchant, so stores received the full payment immediately and didn’t need to know you were using a BNPL service. Apple financed these short-term loans through one of its subsidiaries rather than relying on Apple Card partner Goldman Sachs.

Still, there were doubts about whether Apple Pay Later was a good idea, and for whatever reason, Apple shut it down after less than a year on the market. Instead, it used the technology to partner with other BNPL services like Affirm and let them integrate into Apple Wallet in much the same way.

Gurman’s sources say the hardware subscription service got far enough to reach internal testing among employees in Apple’s Pay group, and also involved the App Store billing and online store teams, since it would have integrated both of those services to handle the payment infrastructure. Unlike Apple Pay Later, which deducted the installments directly from a selected debit card, the hardware subscription service was to be billed through the user’s Apple Account, like subscriptions to other Apple services.

One possible reason for Apple’s decision to cancel the program may have been fears of alienating its carrier partners by taking them out of the loop. Apple’s eagerness to involve third-party financing partners in Apple Wallet in iOS 18 suggests that Apple Pay Later may have suffered a similar fate. However, Apple also reportedly didn’t want to deal with the headache of new rules by the Consumer Financial Protection Bureau for what was essentially a small bonus feature for Apple Pay users. Ultimately, sources suggest Apple decided it was easier to let partners like Affirm and Klarna deal with the financial regulatory issues. Gurman says it may pursue new partnerships for a hardware subscription plan in the future, but it “has no current plans to go it alone.”