Apple Card Savings Accounts Total More Than $10 Billion in Deposits in Just Four Months

Credit: Apple

Credit: Apple

Toggle Dark Mode

Apple Card Savings account customers have deposited more than $10 billion in their Goldman Sachs-managed savings accounts, according to a recent announcement by Apple. The milestone comes a mere four months after the Apple Card Savings account kicked off.

Since the new program launched, 97% of Apple Card Savings customers have opted to have their Apple Card Daily Cash returns automatically deposited into their savings accounts. The accounts currently offer a 4.15 APY.

In a statement in the Apple press release, Goldman Sachs’ Head of Enterprise Partnerships, Liz Martin said that the company is “very pleased” with the success of the Savings account.

“With each of the financial products we’ve introduced, we’ve sought to reinvent the category with our users’ financial health in mind. That was our goal with the launch of Apple Card four years ago, and it remained our guiding principle with the launch of Savings. With no fees, no minimum deposits, and no minimum balance requirements, Savings provides an easy way for users to save money every day, and we’re thrilled to see the excellent reception from customers both new and existing.”Jennifer Bailey, vice president of Apple Pay and Apple Wallet.

The $10 billion deposited amount over just four months is truly impressive when you consider that Apple Card Savings accounts are available only to iPhone users in the US who are also Apple Card holders.

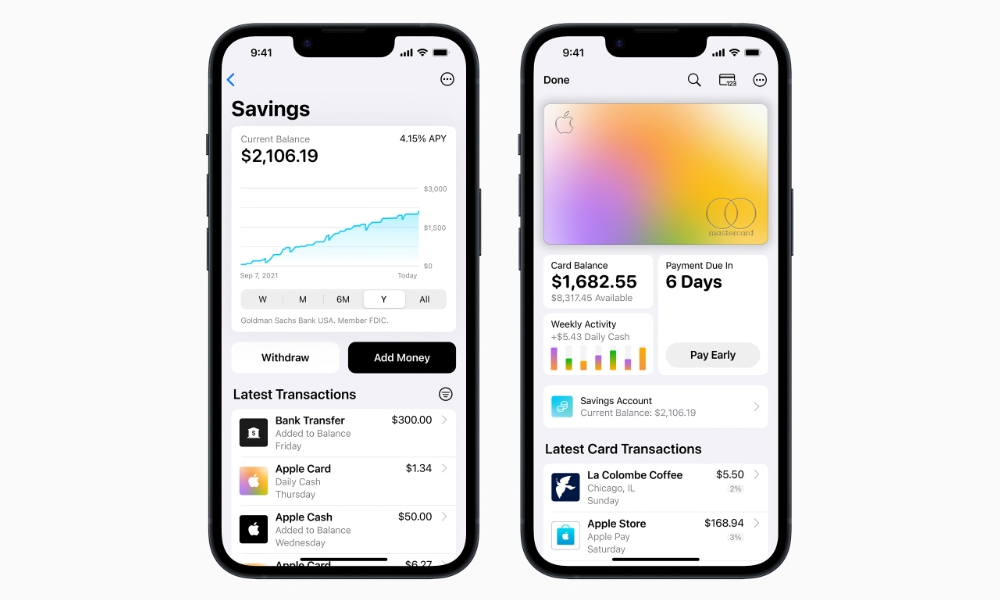

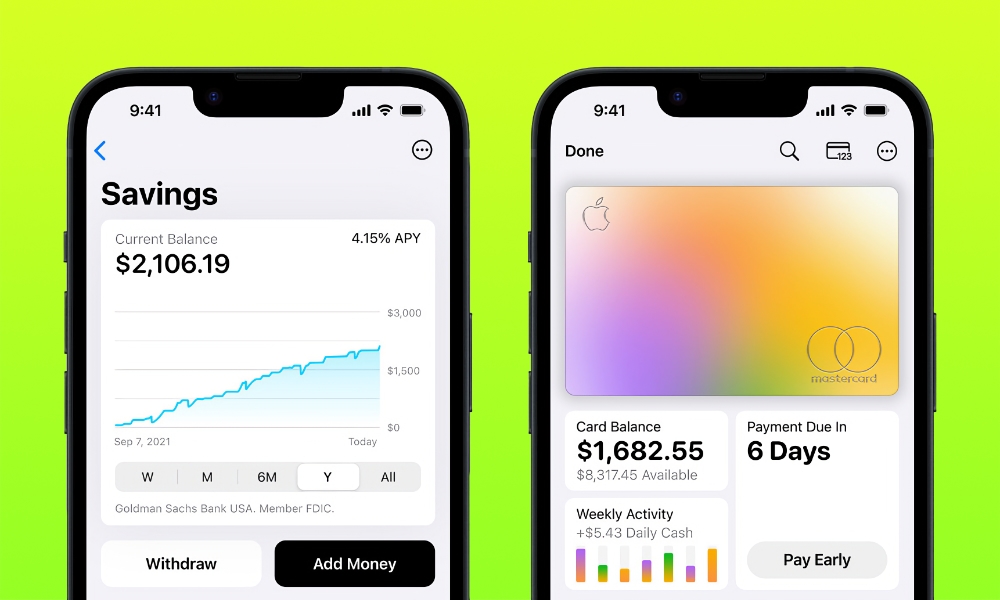

Those who qualify can easily set up and manage their Apple Card Savings account in the Wallet app by accessing their Apple Card and selecting More > Daily Cash > Set Up Savings and following the instructions shown on the iPhone’s screen.

Customers can track their account balance and interest earned via the easy-to-use Savings dashboard in the Wallet app. Additionally, funds can be withdrawn through the Savings dashboard by transferring them to an Apple Cash account or a linked bank account.

The news comes as Goldman Sachs is reportedly looking for a way to pull out of its Apple Card partnership with Apple. Goldman Sachs is the financing partner for the Apple Card credit card in the United States as well as the Apple Savings accounts — a partnership that was once believed to represent the future of the intersection between finance and technology.

The New York Times recently reported that the financial firm is in discussions with American Express about taking over the Apple Card partnership. Goldman Sachs is said to be searching for a way out of its deal with Apple as it’s not making enough money from the deal and it has had issues in dealing with customer service problems.

Goldman Sachs was reportedly hit by more disputed transactions than expected in 2022, as many customers sought chargebacks (refunds) for products and services. Payments consultants say chargeback disputes surged during the pandemic.

It has also been reported that Goldman Sachs was not prepared for the long customer queues that needed to be cleared, and lacked a streamlined process for dealing with customer complaints and other inquiries.

Goldman Sachs had very little experience with the US credit card industry, and the Apple Card was its biggest step yet into dealing with the financial lives of American citizens. The financial company is said to be looking to leave the consumer lending space in general; it’s no longer issuing personal loans through its Marcus online banking business and is trying to sell off a home-improvement lending company it bought last year.