AirPods Made up 71 Percent of True Wireless Headphone Revenue in 2019

Credit: Fadhli Adnan / Shutterstock

Credit: Fadhli Adnan / Shutterstock

Toggle Dark Mode

Apple’s AirPods are continuing to take the wireless headphone industry by storm, and last year’s introduction of the second-generation AirPods with ‘Hey Siri’ support, followed by the noise-cancelling AirPods Pro has only made Apple an even more dominant force in the market.

In fact, a report in late November that arrived a few weeks after Apple’s release of the AirPods Pro revealed that Apple couldn’t make the new AirPods fast enough to keep up with demand, but it predicted that despite this the company would still ship more than 60 million AirPods by the end of the year — a number which includes both the AirPods and AirPods Pro models, but not Apple’s Beats-branded Powerbeats Pro.

While this prediction sounded a bit optimistic, it shouldn’t have been all that surprising, considering that the AirPods have never stopped selling like hotcakes. Since they were first released in 2016, they’ve been flying off the shelves, and accounted for 25 percent of all wireless headphone sales within weeks of their launch, which was even more surprising considering how hard it was for anybody to get their hands on a pair back then. This demand never really died down, either, and the original AirPods were still dominating the market two years later, long after the novelty had worn off and rumours were swirling of a second-generation version on the horizon.

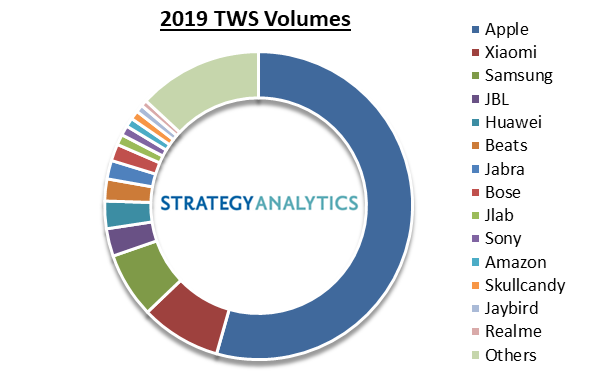

Now a new report from Strategy Analytics reveals that Apple’s AirPods met the target originally predicted by Bloomberg’s sources last year, not only selling 60 million units in 2019, but also capturing a market share of more than 50 percent of all “Totally Wireless” (TWS) Bluetooth headphones. Sales of AirPods also completely dwarfed every other competitor, with Xiaomi and Samsung roughly tying for a very distant second place, with less than 10 percent each.

What’s more interesting is that according to the report from Strategy Analytics, sales in the TWS category actually grew by 200 percent in 2019, meaning that Apple is capturing a large chunk of an even bigger market, and suggesting that the vast majority of sales of AirPods weren’t from existing users upgrading, but rather those completely new to truly wireless earbuds.

Apple’s AirPods are the dominant Bluetooth headset in terms of sales volumes and revenues in the TWS segment. Even as other vendors enter the TWS segment, Apple will remain the dominant vendor in the category through the middle of the next decade.

Strategy Analytics

The report goes on to say that it expects Apple to retain its dominance in the TWS market for the next several years, even as the market itself continues to grow. While Strategy Analytics credits Apple with creating the TWS category, that isn’t technically true, but there’s no doubt that Apple brought it into the public consciousness with a product aimed at the mass market.

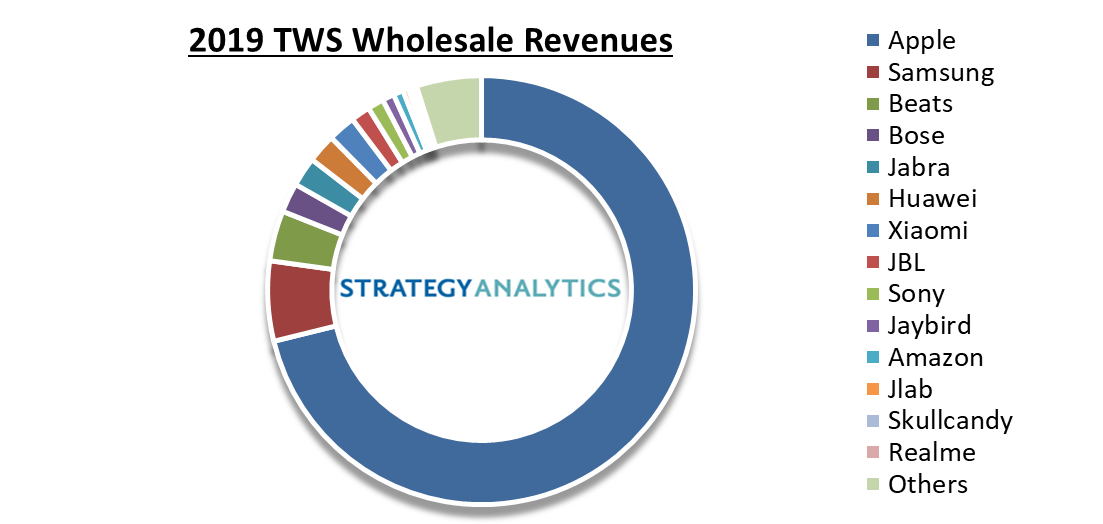

Not surprisingly, since Apple’s AirPods are sold on the higher-end of the price spectrum, Apple did even better in terms of its revenue share, gobbling up 71 percent of the revenue from truly wireless headphone sales, which also grew over 200 percent in 2019. This also suggests that most consumers aren’t extremely price conscious when shopping for truly wireless earbuds, and will buy the best they can afford.

With wholesale revenues of TWS headsets expected to grow to $100 billion by 2024, this means that AirPods alone could easily become a $75 billion business for Apple. A report earlier this month claimed that AirPods made as much money as Spotify, Twitter, Snap, and Shopify combined, and while that number has been disputed, there’s no doubt that Apple made billions of dollars on the sales of AirPods alone, and there’s still a ton of room for AirPods to grow even further, and analysts predict it will make up a substantial portion of Apple’s non-iPhone revenue going forward, especially since the real limiting factor right now seems to be the ability of Apple’s supply chain to actually keep up with consumer demand for its wireless earbuds, which has showed no signs of dying down this year any more than it did back in 2017.