AAPL Gets Buy Rating Ahead of iPhone 16 Launch

Credit: dennizn / Adobe Stock

Credit: dennizn / Adobe Stock

Toggle Dark Mode

When it comes to good stock market investments, few companies have the track record, brand loyalty, and consistent innovation that Apple Inc. (AAPL) does.

Yesterday, Apple stock closed at $226.49 per share. However, analysts are giving AAPL a buy rating with target prices ranging between $250 and $295 per share. Beyond Apple’s strong cash flow and healthy balance sheet, let’s take a closer look as to why AAPL is potentially positioned for 10-15% growth.

iPhone 16, iOS 18, and Apple Intelligence

Apple’s iPhone 16 “Glowtime” event will be held on Monday, September 9. Four new iPhone 16 models — the iPhone 16, iPhone 16 Plus, iPhone 16 Pro, and iPhone 16 Pro Max — will likely be available for pre-order by Friday, September 13, with devices available to purchase a week later.

Together with the release of iOS 18 and Apple Intelligence this fall, the iPhone 16 is expected to ignite a substantial upgrade cycle. Apple Intelligence is currently only compatible with the iPhone 15 Pro and Pro Max and iPads and Macs powered by Apple’s M-series silicon, but it’s also expected to come to all four iPhone 16 models, and possibly even some new iPads.

Apple loyalists with perfectly functioning older-model iPhones will likely have a severe case of FOMO (like me and my iPhone 13 Pro). Although iOS 18 is compatible with everything from the iPhone XS/XR and second-generation iPhone SE to the iPhone 15, an ex-Apple employee recently cautioned against downloading iOS 18 on to older devices, saying it could significantly slow performance. This is likely to cause frustration and lead to more upgrades.

More New Products and Customer Loyalty

In addition to the iPhone 16, insiders predict a possible release of an all-new Apple Watch X alongside the iPhone 16. Just today, we learned of a potential new iPad mini, and there’s a good chance it will be accompanied by a standard 11th-generation iPad, both of which are likely to gain Apple Intelligence support.

Everyone loves shiny new Apple devices. If we’re hit with three or four next month, many consumers will likely at least plan their path to an upgrade.

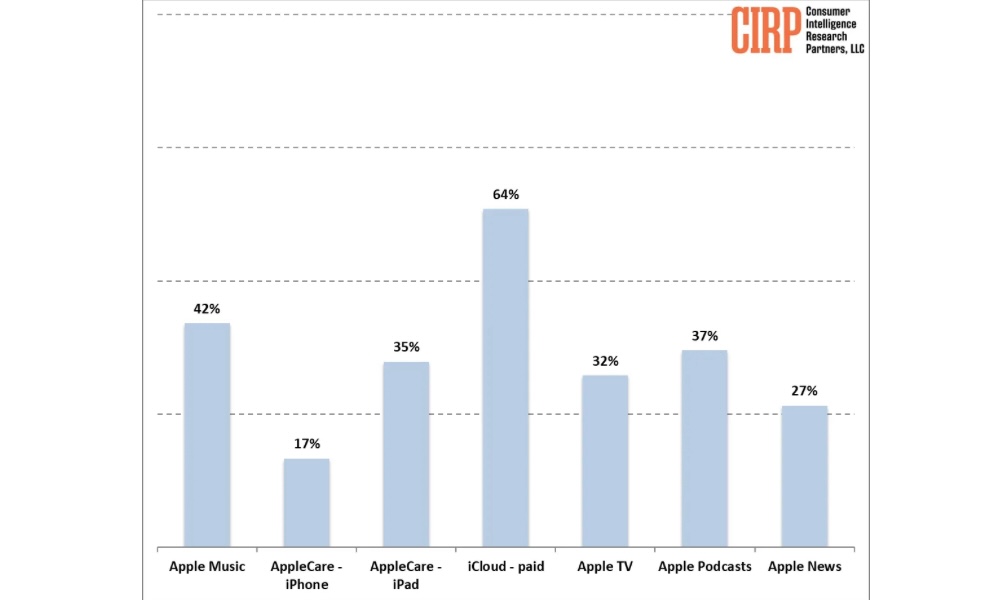

More new devices lead to sales of subscription services like Apple Care+, Apple TV+, and Apple Music. In the second quarter of 2024, Apple’s subscription services accounts for 28% of its overall revenue.

Future Growth Opportunities

In addition to Apple’s core offering, we’ve covered rumors about new products and markets like smart rings, home automation, robots, and a more affordable version of the Vision Pro headset. Despite Apple’s size, there’s still room for significant growth opportunities. This is especially true when considering Apple’s push into emerging markets like India.

These optimistic analyst projections are based on strong financial performance, innovative products, artificial intelligence, and an expanding services ecosystem coupled with Apple’s shareholder-friendly policies. AAPL is already the most valuable company in the world, with a market cap of well over $3 trillion.

It seems AAPL is a compelling buy and well-positioned for growth and stability, but don’t take our word for it — we’re not qualified to give financial advice, so we strongly recommend consulting a professional financial advisor before making any moves.