How Apple’s 4.15% Interest Savings Account Compares to the Rest

Credit: Alexander Mils

Credit: Alexander Mils

Toggle Dark Mode

Apple changed the rules when it released a brand new savings account seemingly out of nowhere, offering an impressively high 4.15% annual percentage yield (APY). According to Apple, that’s a rate that’s ten times higher than the national average.

Still, even though a high-yield APY is rare in savings accounts, Apple’s account isn’t the only one that offers this perk. There are many other high-yield savings accounts that are nearly as easy to set up — and don’t require that you have an Apple device to do so.

Let’s take a look at some of the best and most popular savings accounts and see how they compare to what Apple is offering.

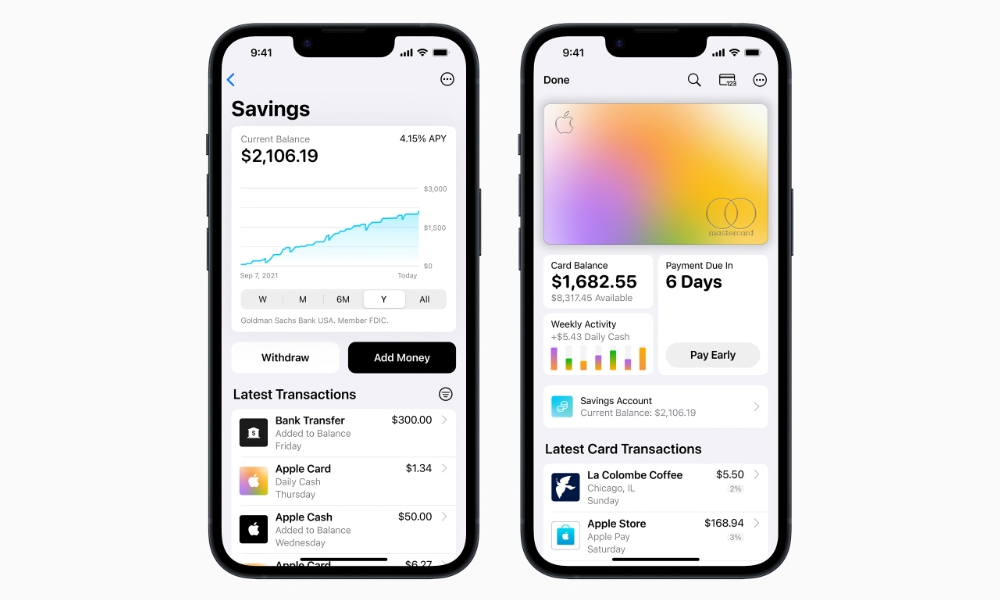

What Apple’s Savings Account Has to Offer

Apple’s savings account is backed by the Goldman Sachs Group, which is one of the biggest financial institutions and investment firms in the world.

To open an Apple Savings account, all you need is an iPhone and an Apple Card that you’re the owner or co-owner of. Technically, you also need to be over 18 years old and a resident of the United States, but you already have to meet those requirements to be an Apple Card owner/co-owner in the first place.

If you have all that, you can create an Apple Savings account from your iPhone in a matter of minutes. You don’t have to make any minimum deposits or have a minimum balance to keep your account open, but it does have the standard FDIC-insured deposit limit of $250,000.

It’s also worth mentioning that Apple’s Savings account doesn’t have any fees, hidden or otherwise, and, of course, the best part is that this account gives you a 4.15% APY.

Now that you know what Apple is offering, let’s see what the competition has to compare.

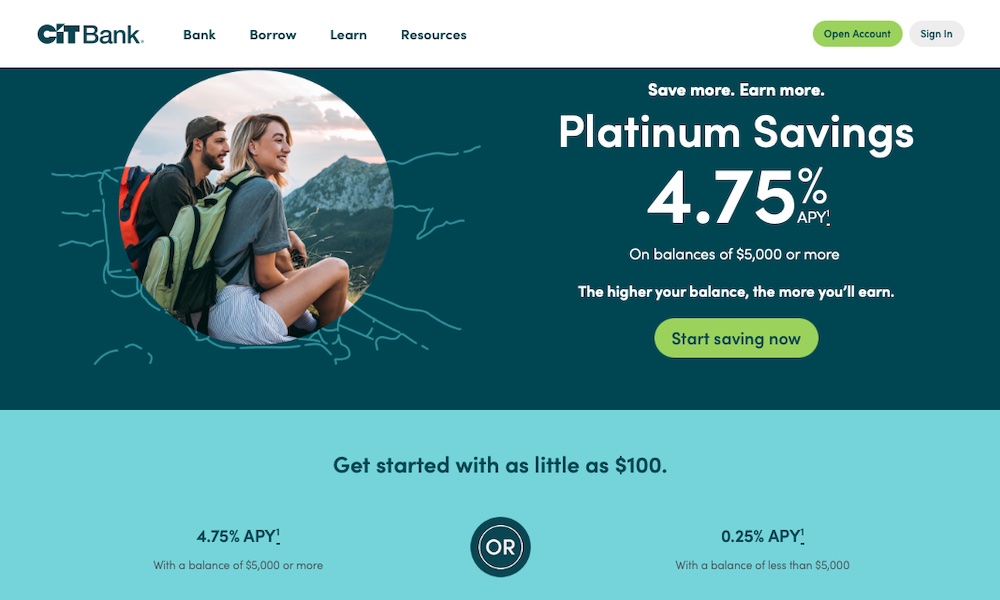

Cit Bank Platinum Savings Account

Cit Bank is one of the best options when it comes to high-yield savings accounts. What makes Cit Bank great is that it offers a crazy 4.75% APY on its savings account, which is way better than Apple’s Savings account. Not only that, but this account also doesn’t have any hidden monthly fees you’ll need to worry about. All you need to open this account is to make a deposit of at least $100.

The only downside, if you can call it that, is that you’ll need to keep a balance of $5,000 or more to get that 4.75% yield. If you fall below the $5,000 mark, the rate drops to 0.25% APY, which is quite a difference.

If you don’t have a lot of money that you want to leave in your account, you’ll be better off with Apple’s savings account or one of the other options on our list.

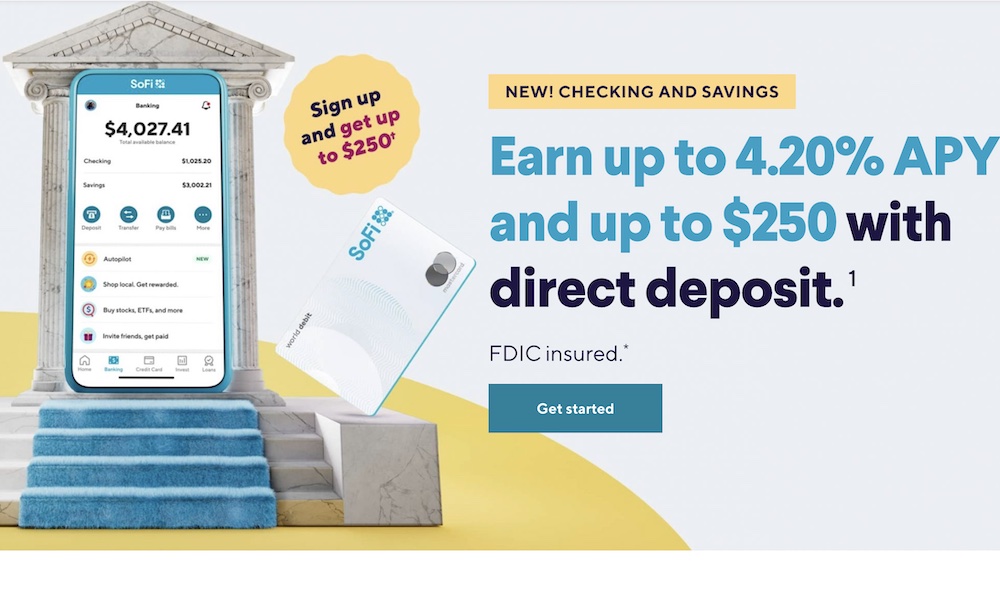

SoFi Savings Account

Another great high-yield interest option is SoFi’s savings account. With a 4.20% APY, you’re looking at a competitive savings account that has no monthly fees and is easy to access from your iPhone. Plus, you can get up to $250 just for signing up.

Of course, this account isn’t perfect. While it doesn’t have any monthly fees, you do have to pay a fee if you plan to make cash deposits. However, it can also be hard to find a good place to deposit cash into this account, so it works best if you only work with direct deposits anyway.

While it might not be ideal for everyone, if you’re looking for a big bonus just for opening your account, this might be a better option than Apple’s savings account.

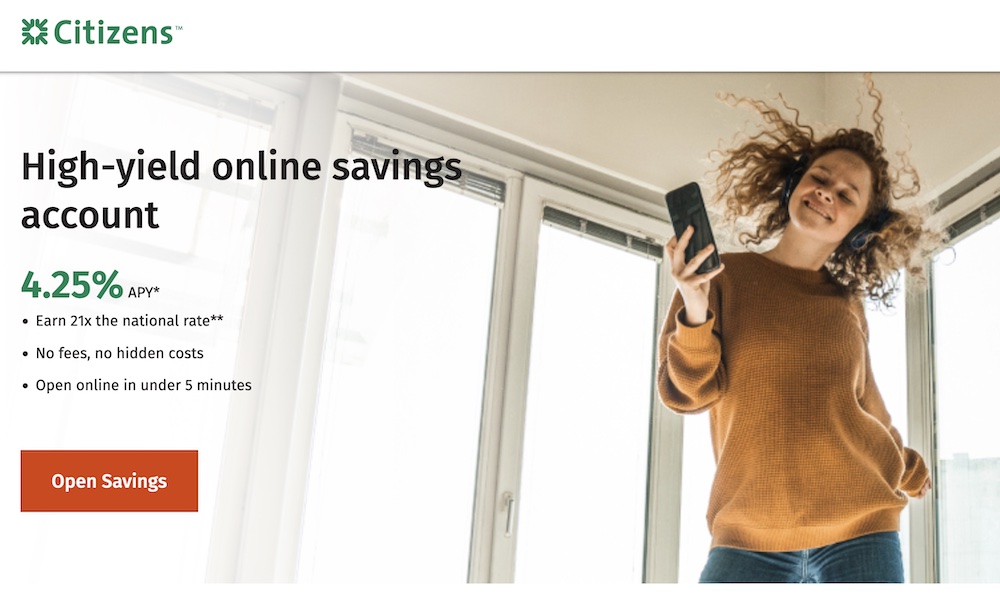

Citizens High-Yield Online Savings Account

If you meet all the requirements, you can create an Apple savings account in just a few taps, but if you don’t want to rely on Apple to keep your money safe, you might be better off with a Citizens savings account.

This is an online savings account that you can open in just a few minutes, and when it comes to its yield, it gives you a 4.25% APY, which is still a bit better than Apple’s savings account.

Not only that, but unlike its competitors, you only need one cent (yes, one cent) to open your account and get the high-yield APY. Granted, you won’t get much of a return on only a single cent, so be sure to make a bigger deposit whenever you can.

It’s also worth mentioning that Citizens’ online savings account doesn’t have any maintenance or hidden fees. Overall, this account is just as good as Apple’s savings account, if not better. If you don’t want to give Apple more of your money, this might be your best option.

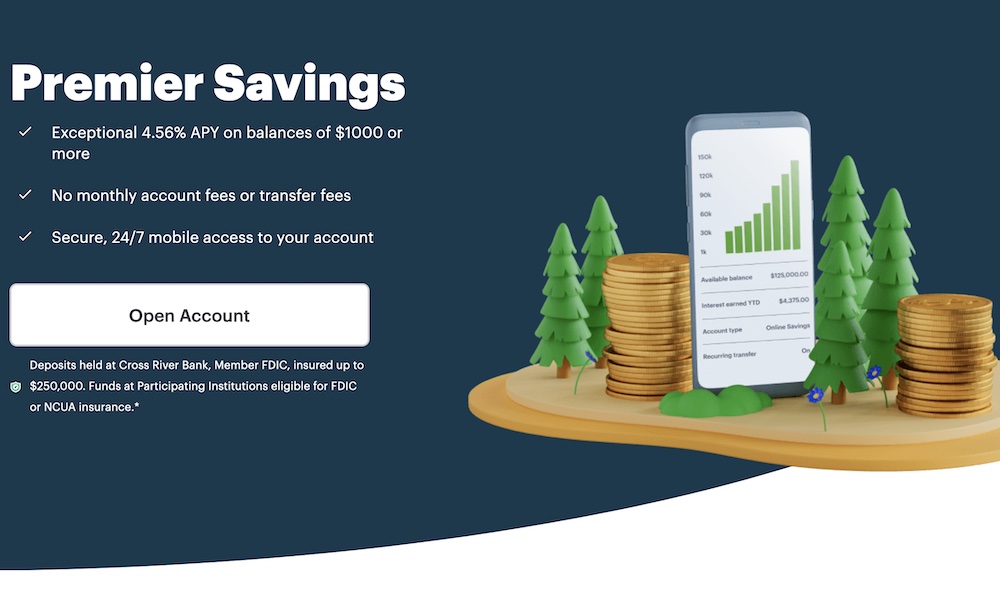

Upgrade Premier Savings Account

Another savings account with a great, high-yield APY is Upgrade’s Premier savings account.

This account gives you a 4.56% APY — way better than Apple’s 4.15% — and you can open your account with any minimum deposit you have available. Not only that but just like Apple’s savings account, you have 24/7 access to your account with your smartphone.

Further, this savings account doesn’t have any monthly fees to worry about. The biggest downside is that if you want the 4.56% APY, you need to keep at least $1,000 in your account. Again, if you don’t have that kind of money at the moment, you’ll be better off with a different option from the list.

PNC High Yield Savings Account

PNC’s savings account is an amazing option, but sadly not everyone has access to it. What makes this savings account so great is the high-yield APY and low minimum balance. PNC’s savings account offers a 4.30% APY, and it doesn’t require any minimum balance or has any monthly service fees.

However, the catch is that his account is only available in California, New Mexico, Colorado, Texas, Arizona, and West Virginia. While that still covers a lot of people, if you aren’t in any of these places, you’ll need to look at an alternative.

CFG Bank Personal Savings Accounts

When it comes to high yield, there is no better account than CFG Bank’s savings accounts. These accounts can offer up to 5.02% APY, which is the highest on the list.

Depending on the account you go for, you might need to make a $500 or $1,000 deposit, and some accounts will even ask you to keep at least $1,000, or else you’ll need to pay a monthly fee.

Overall, when it comes to fees and requirements, CFG Bank’s savings accounts are a bit more strict than other options on the list, but for such a high yield, the minimum $1,000 deposit might be worth it.

Which Savings Account Should You Choose?

While Apple’s savings accounts offer a great APY and seamless integration with your iPhone and Apple Card, there are many other high-yield savings accounts you can go for that offer an even better APY with nearly the same requirements.

If you want a similar savings account, Citizens Online might be your best bet. On the other hand, if you have some money saved and are looking for a great high-yield APY, then one of CFG Bank’s personal savings accounts will give you much better returns.