Add Family to Your Apple Card and Get Up to $100 in Daily Cash

Credit: Apple

Credit: Apple

Toggle Dark Mode

Apple has been on a roll lately with promotional offers for Apple Card members, and the latest new deal that showed up today could give you some free money just for adding new members to your Apple Card Family.

Shared today by AppleInsider, there’s a new Daily Cash bonus of up to $100 available for Apple Card holders who add new family members to their account.

Specifically, Apple is offering $25 for each new family member you add, up to a maximum of four. The catch? Those new cardholders have to spend at least $25 on their own family Apple Card in the first 30 days. They must also be added by September 12, 2023 — coincidentally, the same day Apple is expected to announce the iPhone 15 lineup.

These one-time bonuses are in addition to the standard Daily Cash that each Apple Card will earn for everyday purchases, which includes 3% for anything bought from Apple, whether that’s a physical product, a subscription such as Apple Music, or any in-app purchase on the App Store.

This 3% rate is also offered when spending money on the Apple Card from select partners, including Exxon, Mobil, Nike, Panera Bread, Uber, Walgreens, and more. All other purchases earn 2% if you’re using Apple Pay or 1% if you need to pull out the physical card or use the number for an online purchase that doesn’t support Apple Pay.

How Apple Card Family Works

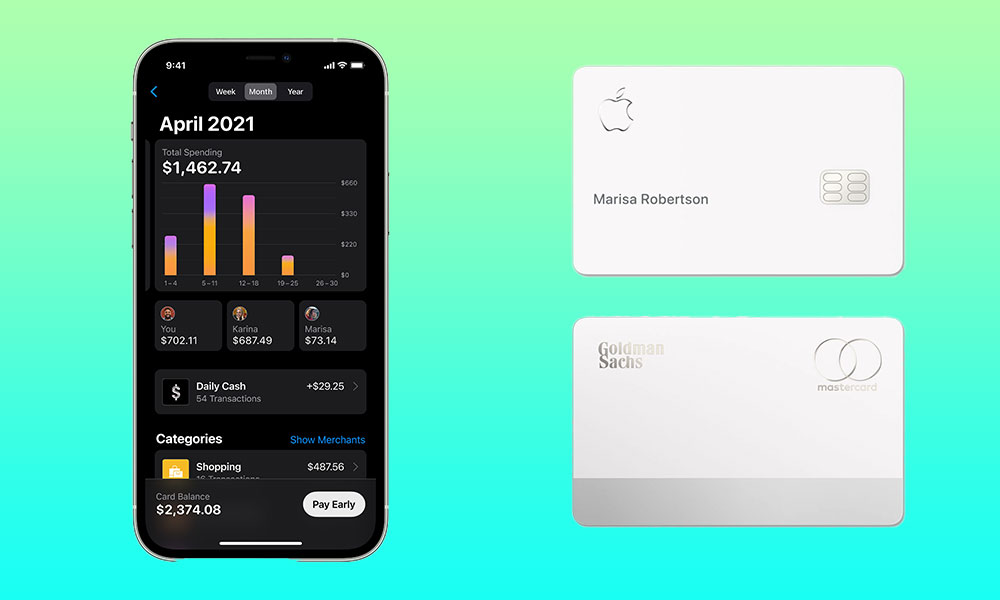

Introduced with iOS 14.6 in early 2021, Apple Card Family was a long-awaited expansion of the original Apple Card program that finally allowed Apple Card holders to add co-owners and supplementary cards to their accounts.

Before that, each person in your family who wanted an Apple Card had to apply for their own, leading to some unusual situations where spouses in joint financial relationships found themselves declined for the Apple Card even after their partners had been accepted. Even legendary Apple co-founder Steve Wozniak was hit by the oddity, although he seemingly shrugged it off as how things are with “big tech in 2019.”

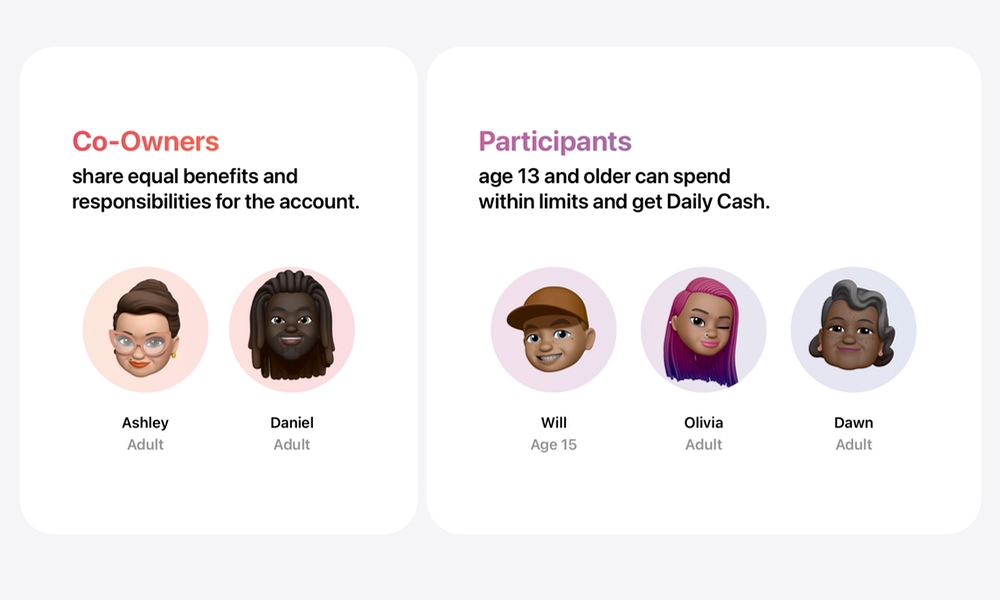

Thankfully, Apple Card Family changed all that, allowing Apple Card holders to share their accounts with a co-owner such as a spouse or other domestic partner, and add up to four “Participants,” which is Apple’s term for what other credit card companies usually call supplementary or additional cardholders or authorized users.

While co-owners share responsibility for an Apple Card account, build credit equally with the primary owner, and must also pass the same application process, participants can be as young as 13 years old and do not have any responsibility for payments on the account. One bonus is that participants who are over 18 years old can use their Apple Card to build their own credit history.

Regardless of age, owners and co-owners can set transaction limits on a participant’s spending or lock their cards to pause their spending at any time. Like other Apple Card features, this is all managed through the Wallet app.

Owners and co-owners can also open individual Apple Card Savings accounts to save up their Daily Cash, while participants’ Daily Cash goes to each person’s own Apple Cash account, which will have to be set up by the family organizer for those cardholders under 18 years of age.

The other catch is that while Apple doesn’t require co-owners or participants to have any specific familial relationship, Apple Card Family is tied to Apple’s other Family Sharing features, meaning everyone you add must be part of the same Family Sharing group, which includes sharing Apple subscriptions and purchases from the App Store, iTunes Store, and Apple Books stores and sharing a common payment method for all Apple services.