AAPL Falls Below $151, Officially Enters ‘Death Cross’ Territory

Credit: CNBC

Credit: CNBC

Toggle Dark Mode

It was back on August 2, 2018, less than five months ago, when news of Apple’s milestone achievement (of becoming the world’s first publicly-traded company with a market capitalization of over one trillion dollars) began circulating the web like wild-fire.

The news was epic, but to the bedazzlement of investors, even more astounding was the slow but steady surge Apple’s stock (NASDAQ; AAPL) enjoyed, riding all the way up to its all-time high of $232.07 per share back in early October.

Shifting Tides

Unfortunately, from that point on it’s seemingly been one bad thing after another for Apple, with a barrage of decisively dismal reports about low iPhone demand and corroborations citing slashed production have clearly stirred a sense of panic on Wall Street.

According to a CNBC report out this week, since hitting its record all-time high back on October 3, AAPL has shed just over 36 percent of its value. As a result, according to Blue Line Futures president, Bill Baruch, the company’s stock has officially entered a “death cross.”

“Apple has gone lower than I thought it would,” Baruch offered on CNBC’s “Trading Nation” earlier this week. “You’re getting a death cross. It’s one of the many different stocks out there that are seeing a death cross.”

What on Earth Is a “Death Cross”?

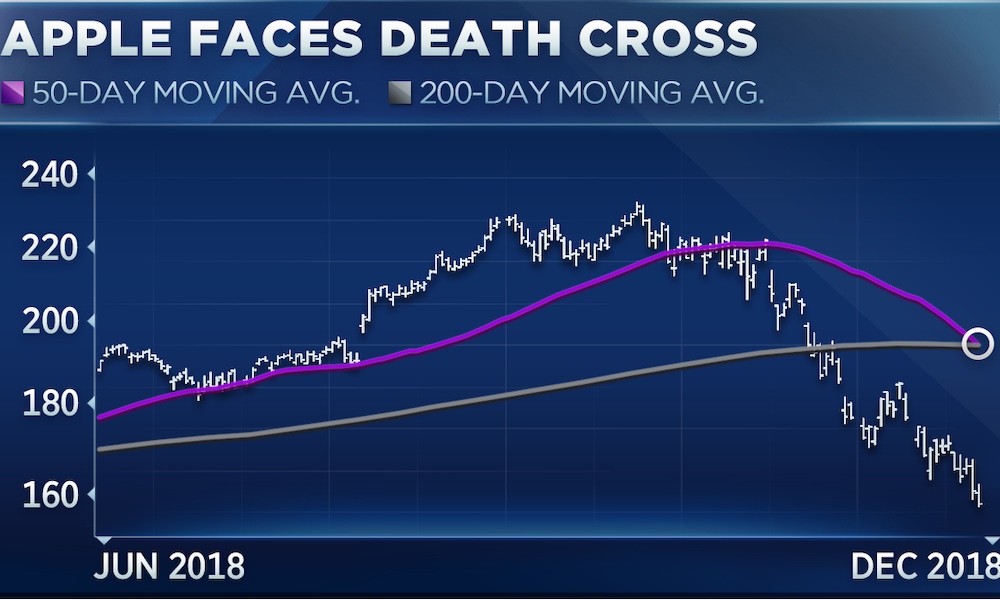

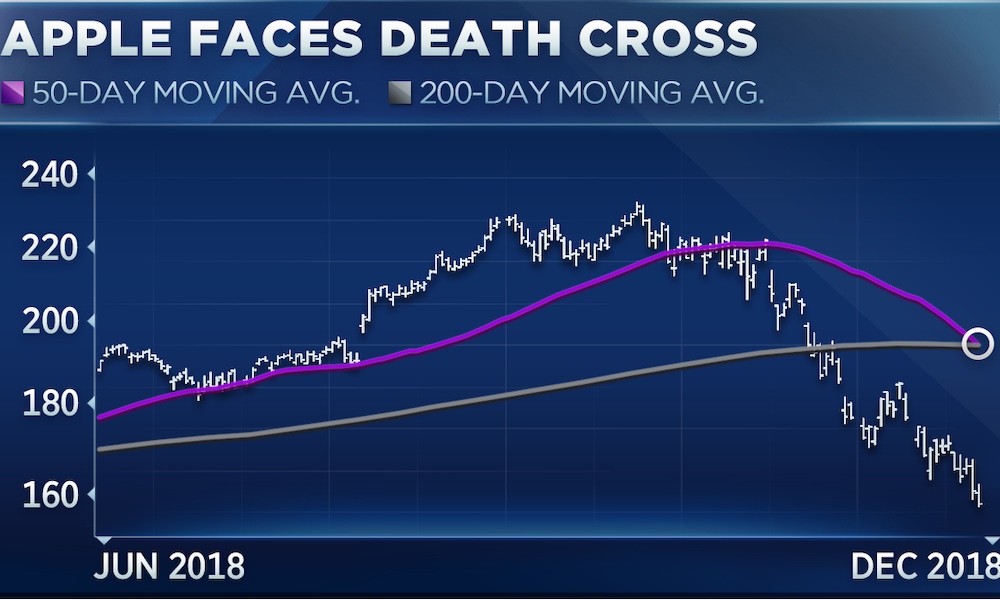

Despite its seemingly Satanic overtures and the sheer fear it may invoke, a death cross, in stock speak, is a rare point at which “a stock’s 50-day moving average crosses below its 200-day moving average,” as illustrated by the analysis provided courtesy of CNBC below.

According to the report, Apple is just one of several FAANG stocks — Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Alphabet (GOOG) — which appear headed in a similar direction.

While some of the downward trend seen with these top tech stocks can be attributed to broader pessimism amid a contracting market, as we noted previously, AAPL’s massive decline can independently be attributed to concerns over reports of falling iPhone demand and slashed production.

At the time of this write-up, AAPL was trading at $150.73 per share, marking significant losses of just over 36 percent from its all-time high.

Worth pointing out, is that while these losses may seem insurmountable to a short-term investor — and while “death cross” is really just a cringe-worthy idea to get behind — in no way, shape or form do these matters indicate that AAPL is in trouble.

This is actually the company’s second time entering a “death cross” in the last few years, according to CultofMac, and follows a previous episode back on August 25, 2015 when AAPL closed at $109.69 per share — down 17.5 percent from its annual high of $133.

Of course, let’s remember to keep in mind this is Apple, Inc. we’re talking about. And while the company, currently valued at around $744.2 billion, is still far below its record-smashing trillion-dollar breakout, there’s also still plenty of new Apple products and brand-new services coming down the pike, which, if history is any indication, should help balance out the books.