Apple Is Still Working to Replace Venmo for Good

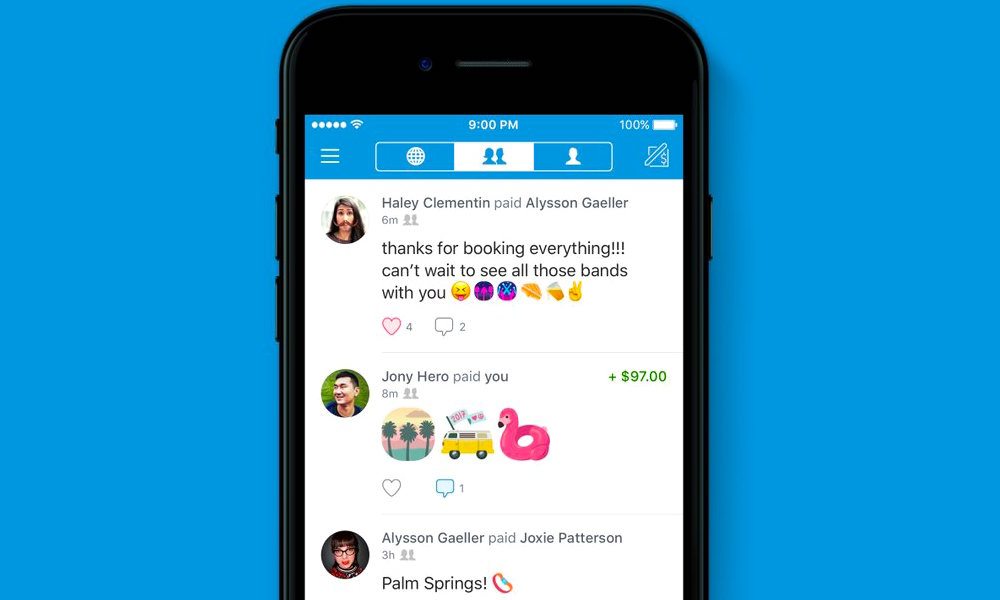

Image via Venmo

Toggle Dark Mode

Apple has once again been flirting with the idea of launching its own Venmo-style digital payments platform, which would enable iPhone owners to send cash payments directly to other iPhone owners via a peer-to-peer interface, according to sources familiar with the company’s plans who spoke exclusively to Recode.

Apple has allegedly been having discussions with a number of payments industry partners, including Visa who also indicated that while no official launch window has been established as of yet, Apple could potentially announce the new service later on this year, or possibly sometime time in 2018, depending on various factors.

This wouldn’t be the first time that the rumor mill has floated an Apple-branded peer-to-peer payments service. Cupertino was granted a patent back in 2015, for instance, which could pave the way for an iMessage-based peer-to-peer payment platform, similar to how Venmo and SquareCash for iMessage function. However, that concept never took off, and we have not heard anything else about a service along those lines until now.

Possibility of an Apple Pay Visa Card

Sources also told Recode that Apple has sat down with Visa to discuss the plausibility of creating an Apple-Visa prepaid debit card, which would operate on the vast Visa debit card network that’s already in place, while being tied to the Cupertino-company’s own peer-to-peer service. For example, each registrant to the service would be given their own digital Visa debit card number, from which they would immediately be able to send or receive payments to or from other cardholders without waiting for the funds to clear.

An Apple-Visa solution along these lines would be great for college students and younger adults, for example, who may not have access to a traditional bank account but still want to have control of their finances from the convenience of their iPhones. In this way, parents would be able to send their students money, for instance, which would go straight to their digital debit account somewhat like PayPal.

But Apple Has Stiff Competition

It’s worth noting, however, that if Apple were to actually launch a peer-to-peer mobile payment system at this time, it would be competing with a rather large consortium of firms who’re already well established in the arena. These include the PayPal owned and operated subsidiary, Venmo, whose annual payment volume exceeded $17.6 billion last year, as well as similar offerings from commercial banking-giant’s — such as J.P. Morgan Chase’s ‘QuickPay’ service, which processed a whopping $28 billion in peer-to-peer transfers last year alone.

New entrants into the field, therefore, would face steep competition from well-established players like PayPal, SquareCash, and similar offerings from larger U.S. banking institutions; although an iPhone to iPhone service, if implemented intuitively, could still be a winner for Apple in the end, especially as we progress towards the “next-generation” of increasingly digital payment and personal finance solutions.

Both Apple and Visa declined to comment on this report, however Apple, in recent months, has tried to further penetrate the mobile payments space with Apple Pay. According to Piper Jaffray analyst, Gene Munster, Apple Pay processed as much as $36 billion in mobile payments last year, despite falling short of estimates. Still, most analysts remain hopeful about the future of Apple Pay, particularly on the web and via apps, seeing as how the service eliminates the need for users to manually enter their shipping and payment information every single time they go to make a purchase.

[The information provided in this article has NOT been confirmed by Apple and may be speculation. Provided details may not be factual. Take all rumors, tech or otherwise, with a grain of salt.]