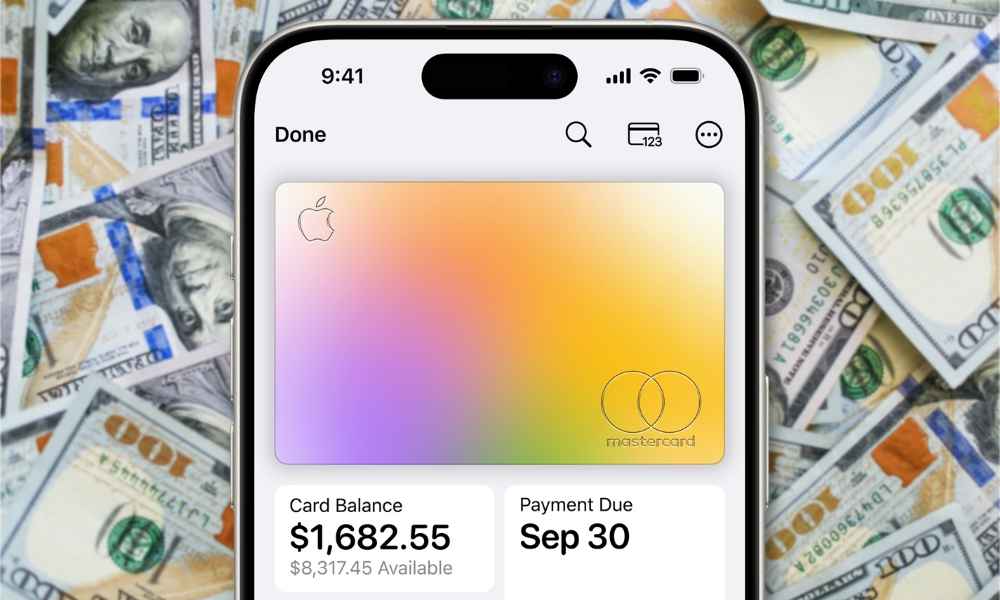

The Apple Card Paid Out a Cool $1 Billion in Cash Back Last Year

Credit: Giorgio Trovato / Apple

Credit: Giorgio Trovato / AppleToggle Dark Mode

The ongoing uncertainty in the relationship between Apple and Goldman Sachs hasn’t slowed down the Apple Card’s momentum, with Apple reporting that its customers spent enough on the credit card last year to net a cumulative $1 billion in Daily Cash rewards.

To put that in perspective, this would work out to over $33 billion in purchases at the Apple Card’s highest normal cash back rate — 3% at Apple and other select merchants like Exxon, T-Mobile, Nike, Uber, and Walgreens — although Apple does offer higher cash back promotions from time to time.

Still, that’s a lot of money spent through the Apple Card, although perhaps not as remarkable when you spread it across the number of cardholders — a number that Apple has now shared for the first time in the credit card’s almost five-year history.

In a recent newsroom announcement, Apple shared that the Apple Card now has more than 12 million customers. More than one million of those Apple Card users also share their accounts with their Family Sharing Group through the Apple Card Family feature that was introduced in 2021.

We designed Apple Card with users’ financial health in mind, and it’s rewarding to see our more than 12 million customers using its features to make healthier financial decisions. We’re proud of what we’ve been able to deliver to Apple Card customers in just five years. As we look at the year ahead and beyond, we’re excited to continue to innovate and invest in Apple Card’s award-winning experience, and provide users with more tools and features that help them lead healthier financial lives.

Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet

Apple says there are also 600,000 other users who haven’t embraced the family sharing capabilities but are still “building credit equally with their spouses, partners, or another trusted adult” through a co-owner card.

The company also took the opportunity to tout its relatively new Savings account, which reached over $10 billion in deposits just a few months after it became available and recently saw an interest rate increase to 4.5% APY.

Today, the vast majority of users auto-deposit their Daily Cash into Savings, and nearly two-thirds of users have deposited additional funds from a linked bank account to further help them save for the future.

Apple

Apple also shared how its Path to Apple Card program has helped many folks who were previously declined for the Apple Card find a way to get one, with over 200,000 users subsequently approved for the card after they followed the program’s personalized steps to improve their financial health.

The Apple Card was introduced in 2019 as a joint venture between Apple and Goldman Sachs, with the latter stepping up to provide the necessary financial backing for the primarily Apple-branded card. While Goldman’s CEO praised the Apple Card launch as the “most successful credit card launch ever,” it was an odd pairing between the two companies.

At the time, many believed it was the future of finance and technology, but it doesn’t seem to have worked out as well for Goldman as its executive once hoped. Instead of helping the investment bank conquer the high-end consumer market, it’s throwing in the towel and leaving that side of things almost entirely.

Nevertheless, the Apple Card won’t be getting canceled any time soon, especially with numbers like the ones Apple shared today. Goldman may not be the right partner, but Apple has been courting others who would likely be eager to pick it up — the only question is whether they’ll be willing to do so on Apple’s terms.