Here’s Why You Could Be Rejected for the Apple Card

Credit: Apple

Credit: Apple

Toggle Dark Mode

Although it may be easier to get approved for the Apple Card than you think, as Apple wants to be as inclusive to its customers and fans as possible, it’s still by no means a sure thing. Apple’s financial partner, Goldman Sachs, is still required to stay within the realm of regulations and responsible lending, which means that sometimes, they’re going to have to say no.

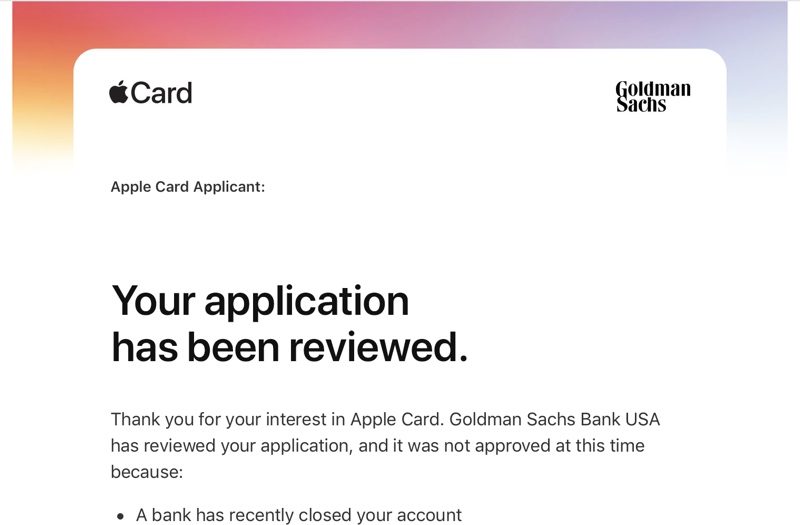

The good news, however, is that Apple and Goldman are being amazingly transparent with regard to this process. Unlike many banks and credit card issuers, if you’re declined, you’ll actually get a clear reason why, providing you with an opportunity to rectify the situation — if possible — and reapply.

In addition, Apple has published a comprehensive support document, explaining in clear language the requirements to get an Apple Card, the process that Apple and Goldman follow in approving or declining applications, a list of reasons why your application could be declined, and even some advice on what you an do in the event that it does happen to you.

It’s another great indication of how Apple is trying to “think different” from the relatively monolithic financial industry by putting a friendlier face on things — a priority that’s also shared by Goldman Sachs — and trying to be as inclusive and optimistic as possible in encouraging applicants. This is clearly a document from a company that wants to say “Yes” to as many people as possible.

How The Process Works

The support document also explains how credit card scores are determined, and notably it mentions that only a “soft inquiry” is used by Goldman Sachs when requesting an Apple Card, meaning that your credit score will not be impacted unless you actually accept the Apple Card, at which point a hard inquiry will be done.

Why You Could Still Be Declined

Most of the reasons why you might be declined should be fairly obvious, but Apple does a good job of spelling them out, and there are certainly a few that might not readily occur to everybody.

Fairly obvious reasons listed by Apple include having past due debts — either current or in your recent history — as well as checking accounts that have been closed by your bank, two or more “non-medical debt obligations” that are past due, along with tax liens, court judgements, bankruptcies, and repossessions.

However, Apple also notes that you could be declined if you don’t have sufficient disposable income relative to your other debt obligations, you tend to keep your other credit cards maxed out, or if you’ve recently applied for a lot of credit cards (whether you’ve been approved for them or not).

What To Do If You’re Declined

Again, Apple and Goldman are being very transparent about telling applicants who are denied as to specific reasons why, giving them an opportunity to fix the problem.

If the application is denied for financial reasons, Apple suggests getting a copy of your TransUnion credit report, with instructions on how to do so provided in the emails sent to those who are declined. The document also suggests checking for common errors in your credit report, and attempting to resolve these with TransUnion if there’s some inaccuracy that may have impacted your application.

Apple says you could also be rejected simply due to Goldman not being able to verify your identity, in which case it offers several recommendations on how to make sure that your information is accurate and that scans of your identification show that they’re current and the names match up.

At this point, the Apple Card is still in an invitation-only public preview, although Apple mysteriously sent out a bunch of new “invites” earlier this week, these seem to have been as a result of a glitch in the system, as some were received even by users in countries where the new card isn’t even available. Regardless, Apple still seems to be on track to open up applications to the public in the U.S. later this month.