Apple’s Foldable iPhone Could Give the Market a Needed Boost

Credit: ConceptsiPhone

Credit: ConceptsiPhone

Toggle Dark Mode

When Apple’s competitors began releasing foldable smartphones a few years ago, they were considered the next big thing. Apple was even criticized for not releasing a foldable iPhone quickly enough to compete with the Android foldables. Unfortunately, customer interest in foldable smartphones has waned a bit. However, all that could change if and when Apple debuts a foldable iPhone, according to display analyst Ross Young.

In a report on the current foldable smartphone market and how it has stalled recently, Young says that Apple is expected to “enter the foldable market” in the second half of 2026. He says the iPhone maker’s “dominant position in flagship smartphones” could boost the foldable smartphone market in 2026, possibly resulting in a record sales year for foldable devices.

Young expects the foldable phone market to grow by more than 30% in 2026 and continue to grow at 20% in 2027 and 2028.

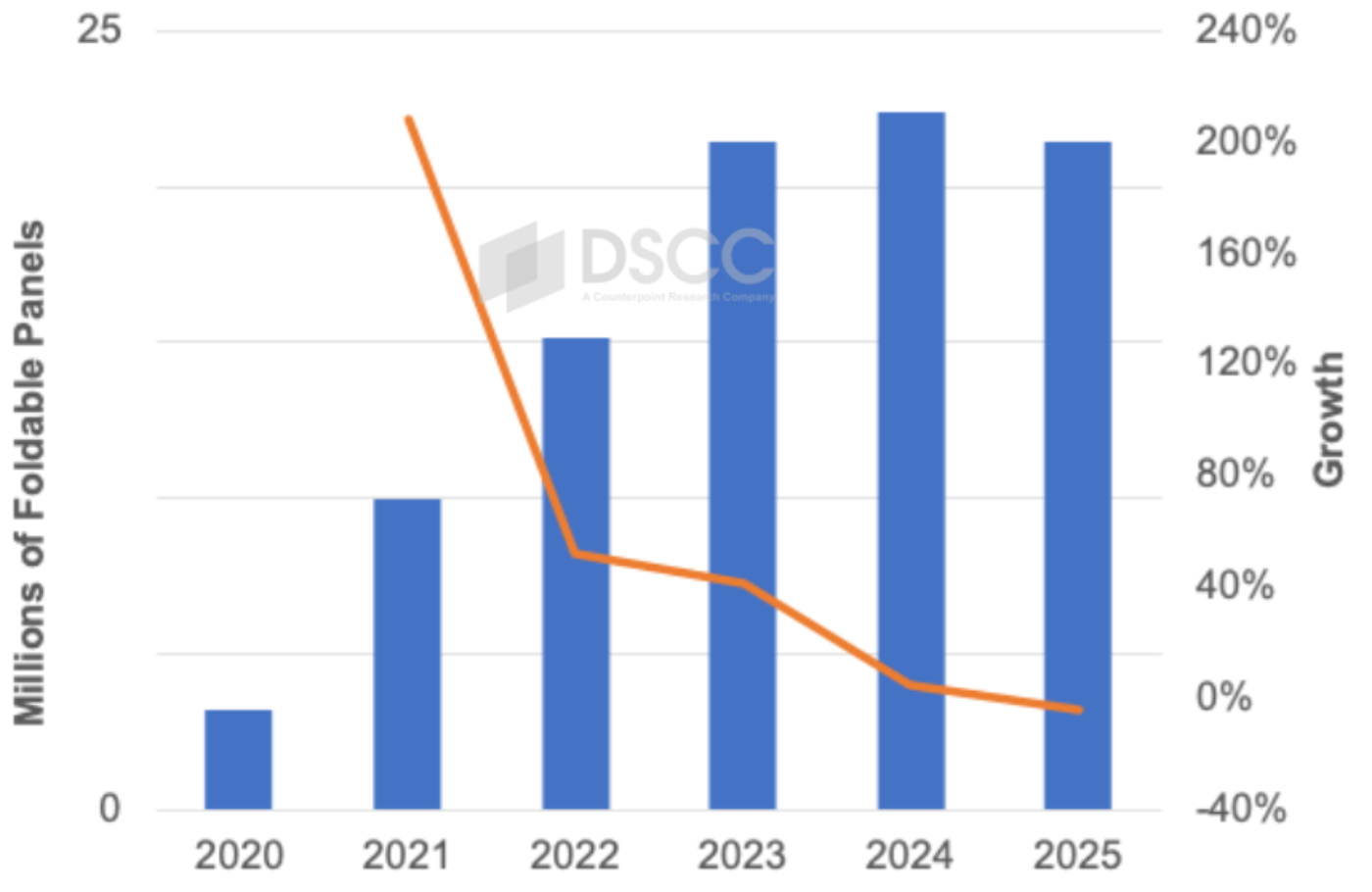

Young’s comments about the stalling foldable smartphone market and the possibility of a boost from a foldable iPhone come as the foldable smartphone display market has seen its yearly growth rate slow from double digits to single digits.

The foldable smartphone display market enjoyed at least 40% annual growth from 2019 to 2023. However, a recent IDC analysis indicates the market has slowed in 2024, with foldable phone models grabbing headlines “despite the low volumes in the market” only because they’re unique and interesting.

Young believes the market will see just a 5% increase in 2024 and fall by 4% in 2025. Foldable display demand has stalled at around 22 million panels. Foldable smartphone display procurement fell 38% year-over-year in the third quarter of 2024 and is expected to be down in four of the next five quarters.

Samsung, the leader in foldable smartphones, has seen slower-than-expected adoption of its Galaxy Z Flip 6 clamshell smartphone. Demand for the company’s older foldable models has also suffered. 2024 Z Flip 6 panel shipments are expected to fall more than 10% below Z Flip 5 smartphone panel shipments in 2023.

While foldable demand remains high in Korea and Europe, the devices have struggled in the US and Chinese markets. The Z Fold 6 is expected to outsell the Z Fold 5 by single digits in 2024, but Samsung’s total foldable panel orders are expected to fall by over 20%, hitting the lowest level since 2021. While Samsung is still expected to be number one in foldable smartphone panel procurement in 2024, it will have a 40% share, down from 52%.

Huawei’s second-half 2024 panel procurement has also disappointed, as its share has slipped from 30% in Q2 2024 to 13% in Q3 2024. This is mainly due to the late debuts of the company’s Mate X6 and Pocket 3 devices, which delayed panel shipments. Mate XT panel procurement is also lower than expected. Huawei will still see more than 90% growth in foldable panel procurement in 2024. Its market share is expected to grow from 18% to 33%. However, Huawei is also being forced to deal with restrictions on importing advanced processors in China, putting Huawei at a disadvantage when it comes to top-of-the-line smartphones.

Rumors about a foldable iPhone have long circulated in the Apple-sphere, with several false starts. However, Young and several other analysts believe Apple is finally on track to debut its first model in late 2026.

Rumors about the device’s size indicate it will be between 7.9 and 8.3 inches, and it may have a “clamshell” design similar to Samsung’s Galaxy Z Flip device, making it more of an iPhone Flip.

[The information provided in this article has NOT been confirmed by Apple and may be speculation. Provided details may not be factual. Take all rumors, tech or otherwise, with a grain of salt.]