Apple Stock Plummets After Company Reports Worst Quarter in 13 Years

Toggle Dark Mode

“What goes up must come down.” So goes the age-old expression. After a remarkable 13 year run, Apple has posted its first year-over-year decline. No, the company isn’t doomed but there has been quite a few negative repercussions to the news.

Most notably, the company’s stock took an 8% tumble following the announcement. The result is a cool $40 billion loss in market valuation.

As it always seems with the stock market, investors tend to jump ship at the slightest sign of trouble only to realize later they acted prematurely. Despite this quarter’s decline, there is no reason to panic. There are plenty of positives to be taken from Apple’s Q2 earnings as well.

Breaking Down the Numbers

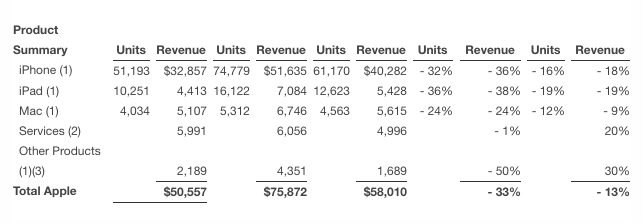

It’s important to emphasize Apple’s Q2 was the first “year-over-year” quarterly revenue decline in 13 years. The company has consistently increased revenue quarter after quarter, but in 2015 Apple made an unfathomable $54 billion in profit.

It was only a matter of time before the company’s revenue was going to stall. Unfortunately, the most important factor to Wall Street is growth. Apple failed to grow this quarter, and we’ve seen the result.

However, let’s not get ahead of ourselves. Apple posted $10.5 billion in profits this quarter alone, a number most companies can only dream of. It seems counterintuitive, but Apple shot itself in the foot by having such a successful 2015, at least from an investment standpoint.

Potentially, the most worrisome news is iPhone sales in Q2 decreased for the first time since the iPhone has existed. But again, the decrease can mostly be chalked up to the ridiculous iPhone sale numbers Apple posted last year.

The Silver Lining

Apple CEO, Tim Cook, hasn’t broke a sweat despite the company’s rough quarter.

During Apple’s earnings call, Cook explained why the Q2 numbers aren’t exactly as they seem. He said 67% of Apple’s Q2 sales were international, which resulted in the strong U.S. dollar contributing to the disappointing numbers. Cook also said, “The smartphone market…is currently not growing. However, my view of that is it’s an overhang of the macroeconomic environment in many places in the world, and we’re very optimistic that this too shall pass.”

Another silver lining is although iPhone sales fell for the first time, they still beat out Wall Street expectations. The same was true for iPad sales, which also beat Wall Street expectations, but still fell year-over-year.

Final Thoughts

Even though it’s the first time the company has posted a decline in revenue, Apple has had low quarters before. The company usually bounces back, and there’s no reason to believe the same won’t happen this time around.

With the iPhone 7 due to release this fall, it’s hard to believe things won’t turn around quickly for Apple. The company continues to seem like an excellent investment for the foreseeable future, especially now as the stock price is down. It certainly won’t stay that way.

DISCLAIMER: Neither iDrop News nor the author of this post have any financial interest in Apple, Inc. The content found here is for informational, entertainment and educational purposes only and should not be construed as investment advice. Any investments made on the basis of any information found in this article are made at your own risk.

How fast do you think Apple will bounce back? Or will they? Let us know what you think in the comments.