Apple Reports Record-Breaking Q1 2025 Revenue and Profits (Again)

Credit: Shutterstock

Credit: Shutterstock

Toggle Dark Mode

Apple’s first-quarter results for 2025 are out, with the company reporting more all-time records for total company revenue, earnings per share (EPS), and gross margin — although not all individual product categories did as well as expected.

Apple reported quarterly revenue of $124.3 billion for the first quarter of 2025, which covers the last three months of 2024, ending on December 28, since the company’s fiscal year runs from October to September.

That revenue is a four percent increase over the year-ago quarter, marking the most significant bump Apple has seen since the COVID-19 pandemic when it gained 11.2% in Q1 2022 and a staggering 21.4% in Q1 2021 — the quarter where it first crossed the $100 billion revenue threshold.

This has pushed the diluted earnings per share (EPS) to even greater heights of $2.40 per share, gaining 10 percent over last year’s Q1.

This also marks the first quarterly earnings call helmed by Apple’s new Chief Financial Officer, Kevan Parekh, who took over from Luca Maestri at the beginning of the year (with a nice bump to a $1 million annual salary). Maestri is sticking around to lead Apple’s Corporate Services teams, which handle things like IT and real estate development projects.

Our record revenue and strong operating margins drove EPS to a new all-time record with double-digit growth and allowed us to return over $30 billion to shareholders. We are also pleased that our installed base of active devices has reached a new all-time high across all products and geographic segments.

Kevan Parekh, Apple’s CFO

Apple’s board of directors has once again declared a cash dividend of $0.25 per share of the Company’s common stock that will be payable to shareholders on February 13, 2025.

The Numbers

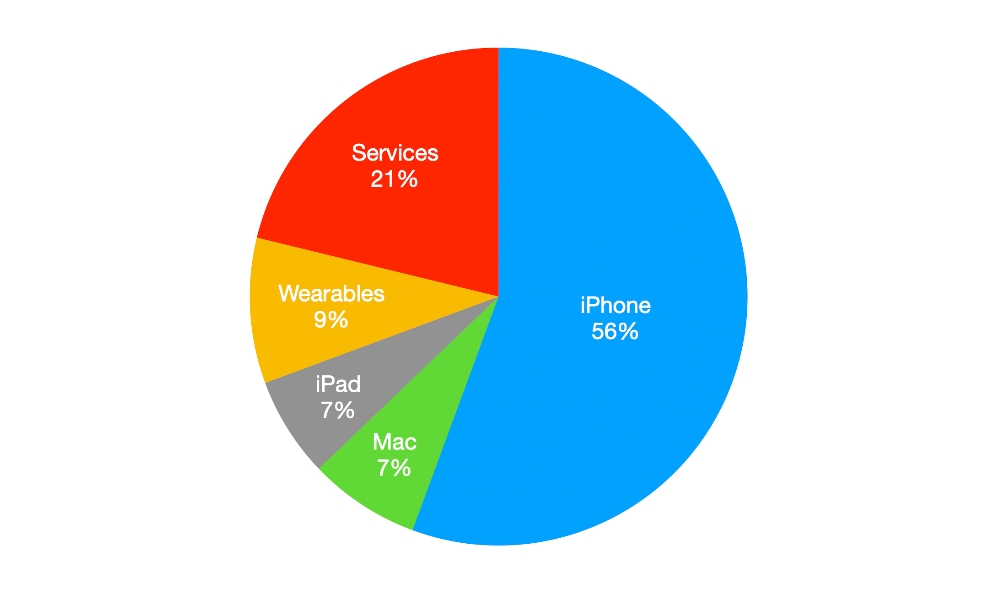

As usual, the bulk of Apple’s revenue comes from the iPhone. For this quarter, iPhone sales made up 55.6% of the total, which isn’t surprising considering the launch of the iPhone 16 lineup. That’s a nice boost from the last quarter, where it hovered just below the 50% mark, but it’s still a slight drop from the year-ago quarter when the iPhone 15 lineup was released, when it accounted for 58% of total revenue.

Meanwhile, Apple’s Services category continued in second place, covering 21.2% of the total revenue, a jump from the year-ago quarter when it sat at 19.3%, but down from 26% of Q4 2024.

It’s also noteworthy that the iPhone saw a 0.8% decrease in sales over Q1 2024, or about half a billion dollars, while services still grew by 13.9%. However, the real winners were the Mac and iPad, both of which grew just over 15% from last year. Here’s the breakdown:

- iPhone: $69.1 billion (down 0.8%)

- Mac: $9 billion (up 15.5%)

- iPad: $8 billion (up 15.2%)

- Wearables, Home, and Accessories: $11.7 billion (down 1.7%)

- Services: $23.1 billion (up 13.9%)

Sales of Wearables, Home, and Accessories also took a hit despite the release of the Apple Watch Series 10 and AirPods 4 in September, which would have been on sale throughout the holiday quarter. The lack of a new Apple Watch Ultra probably didn’t help. The Home part of that category has nothing new to offer, but that area has been stagnant since the 2022 release of the third-generation Apple TV 4K, which came in Q1 2023 — a quarter in which Apple reported $13.5 billion in Wearables, Home, and Accessories sales, undoubtedly also spurred along by the AirPods Pro 2 and three new Apple Watch models.

The Mac and iPad categories were undoubtedly bolstered by a solid lineup of M4-powered Macs that not only included new MacBooks but also an iMac and a significant refresh to the Mac mini. The iPad mini 7 was also released during the quarter, but it’s hard to imagine that this accounts for a 15% increase on its own; more likely, the M2 iPad Air and M4 iPad Pro made it onto many people’s holiday shopping lists this year.

Today Apple is reporting our best quarter ever, with revenue of $124.3 billion, up 4 percent from a year ago. We were thrilled to bring customers our best-ever lineup of products and services during the holiday season. Through the power of Apple silicon, we’re unlocking new possibilities for our users with Apple Intelligence, which makes apps and experiences even better and more personal. And we’re excited that Apple Intelligence will be available in even more languages this April.

Tim Cook, Apple’s CEO

Apple’s CEO offered some insight into the poorer iPhone sales performance in an interview with CNBC, revealing it didn’t sell nearly as well in China, where sales fell by 11.1% — a decline he attributes to the lack of Apple Intelligence features in that country.

As Cook explained to CNBC’s Steve Kovach, iPhone sales were the strongest in the countries where Apple Intelligence is available, which leaves out most non-English speaking countries. Although Apple Intelligence is blocked in China and the European Union right now, iPhone buyers in other countries can only use it if they set their device language to English, which isn’t something most folks can be bothered doing.

During the December quarter, we saw that in markets where we had rolled out Apple intelligence, that the year-over-year performance on the iPhone 16 family was stronger than those markets where we had not rolled out Apple intelligence.

Tim Cook

Cook added that half of the sales decline in China was due to “a change in channel inventory,” which refers to iPhones sitting in warehouses and on store shelves. While Cook didn’t elaborate, this likely means that Chinese distributors and retailers stocked up on iPhone 16 models after they were released in late September — the end of Q4 — and didn’t need to replenish that inventory during the holiday quarter. Since Apple’s sales figures are based on “sell-in” — the number of iPhones sold and shipped to distributors and retailers — those sold from store shelves don’t move the needle.

Cook added that “the operational performance is better” in China, so Apple believes sales of the iPhone 16 units are moving faster in China than the 11% decline would suggest, but Chinese retailers didn’t need to replenish as much of their stock during the quarter. If this is accurate, sales of iPhone 16 models into China should see a boost in Q2 2025.

Perhaps the most significant number is Apple’s gross margin of 46.9% of total revenue, or $58.3 billion. That’s the profit Apple made after accounting for the cost of goods and services that it sold, and it’s the highest on record, beating the previous 46.6% margin from Q2 2024. That’s not net profit as Apple still has to account for operating expenses, which accounted for $15.4 billion: $8.3 billion for research and development and $7.2 billion for other expenses like advertising, marketing, and administrative salaries. After providing for income taxes, which Apple estimated at $6.3 billion for the quarter, the company reported a net profit of $36.3 billion.