Apple Pay Will Finally Be Compatible with Mobile Websites Later This Year

Toggle Dark Mode

Apple Pay can definitely be considered a success, kick-starting the mobile payment business and fast becoming a preferred way for people to pay for things.

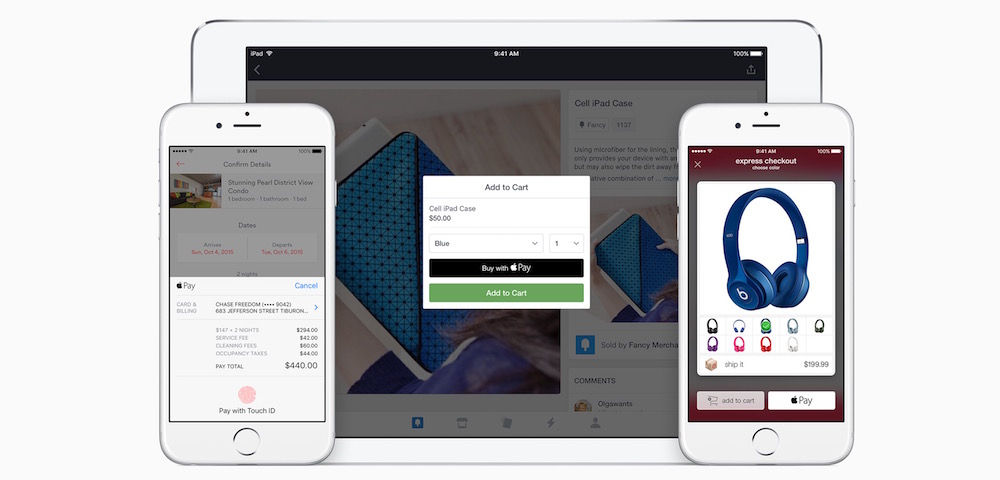

Unfortunately and the infrastructure still has a long way to go before you can start leaving your wallet at home, but soon one of the things Apple needs to do to make it a go-to for all payments will be accomplished. Apple Pay will soon move beyond compatibility with in-store terminals, and apps on the iPhone, and will be usable on a vast variety of mobile websites.

The news comes from reports that Apple has told potential partners that Apple Pay will be expanding to websites later in the year. The service will be available within the Safari browser on the iPhone and iPad, however it will only be available on devices that have Apple’s Touch ID fingerprint sensor.

Apple has also reportedly considered bringing the service to its computers, however its not yet clear if the company will actually launch this feature, or if it will wait. Reports indicate that Apple wants to make Apple Pay within the browser available sometime before the holiday season. The announcement could come at WWDC this year, which will take place sometime in June, although the company could also launch the feature at its September event in time for the shopping season.

Of course, while many iPhone users most likely use Safari, many also use the likes of Google Chrome and other web browsers available to the device. The fact that Touch ID will only be available to Safari is sure to frustrate some users, and it would be nice to see Apple open up the service to other browser, however that is extremely unlikely.

The move will put Apple up against other web-based payment services, most notably PayPal, which has become one of the best ways to pay for goods and services online. PayPal offers payment services on countless websites, and is also used by over 250 of the top 500 online retailers. Apple Pay, however, is touted as being one of the easiest to use payment services, and its ease-of-use could give it an edge over PayPal, despite the fact that many already use PayPal.

Apple Pay itself is now available in the U.S., U.K., Canada, Australia, and China, and is set to roll out to other countries later in the year. Among other rumors, it is also expected that Apple will also roll out a person-to-person payment feature, another feature that could help it compete better against the likes of PayPal.

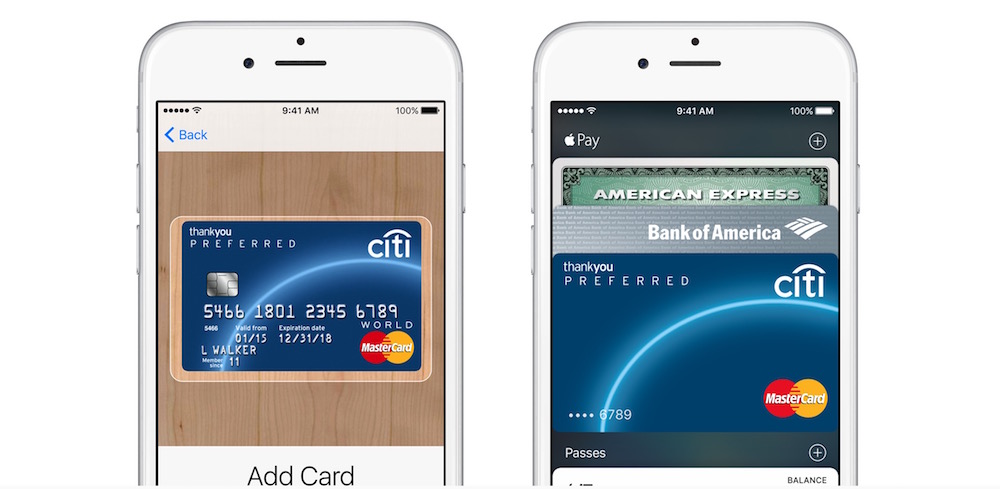

One of the great things about Apple Pay is that it is one of the safest ways to pays for goods and services, online or off. It is far safer than using something like a credit card, largely because of the fact that it uses a tokenized payment system, meaning that a user’s credit card information isn’t actually given to a retailer, but rather a one-time set of information that is generated by Apple Pay for the purpose of that particular payment. If a hacker is able to get that information, it doesn’t really matter because the information was only used for that payment and can’t be used to make other transactions.

Of course, Apple Pay has spurred the creation of plenty of other mobile payment services. Perhaps most notable of those is Android Pay, which effectively works the same as Apple Pay, however Samsung also has its own service, aptly named Samsung Pay. Samsung Pay is slightly different from the others, as it uses a magnetic technology to make payments the same way as any credit card – meaning that it can be used at any payment terminal that would accept a credit card, with users not having to only look for payment terminals that use NFC technology. This really is a smart way to do things, and while it does mean that some of the security advantages of systems like Apple Pay are bypassed, the compatibility is perhaps Samsung Pay’s biggest advantage.

It will be interesting to see if the likes of Android Pay follow suit and offer users the ability to pay for items from mobile websites. Of course, if we had to guess, we would say that they eventually will.

How often do you use Apple Pay? Has it been a blessing or a curse? Let us know in the comments below!

Learn More: 5 Innovative Apps to Automate Your Busy Life