Apple Pay Rolls out In Canada with Major Limitations

Toggle Dark Mode

If you live in Canada and happen to own the right iPhone, you can now use Apple Pay.

The feature was enabled in Canada just recently, making the country the third to be able to use Apple Pay, following the US and the UK, which got the service back in July. The service requires an iPhone 6 or later to properly work, and allows users to pay for goods in-store through the NFC chip in their phone.

he announcement follows a number of deals that Apple has made with banks over the last few months in the US to use the service. All four major banks in the US have also agreed to the use of the service. While the service is growing in the US, if Apple truly wants to expand the service it needs to become available outside of the select few countries that currently use it.

he announcement follows a number of deals that Apple has made with banks over the last few months in the US to use the service. All four major banks in the US have also agreed to the use of the service. While the service is growing in the US, if Apple truly wants to expand the service it needs to become available outside of the select few countries that currently use it.

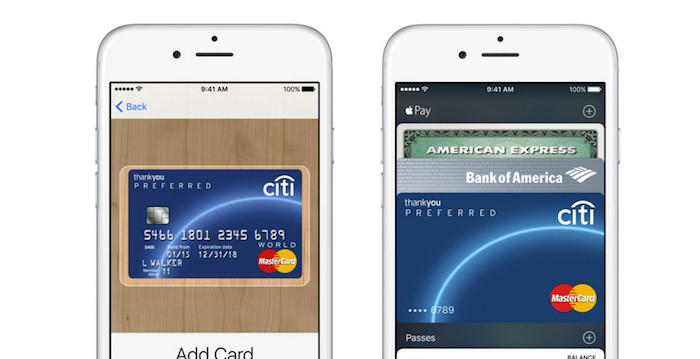

It’s important to note that initially, Apple Pay will be somewhat limited in use in Canada. Neither Visa nor MasterCard will work with the service just yet, with the only service that is compatible being American Express. Even then, only Amex cards issued by American Express itself will work with the new payment service. Not only that, but only a handful of retailers will accept the use of the service, including McDonald’s, Staples, Tim Hortons and Petro-Canada.

Of course, it is likely that the use of the service will expand significantly in Canada as time goes on, as it has done and continues to do in the US.

The news comes after Apple had been rumored to be in talks with the six largest Canadian banks with a goal of rolling out Apple Pay in November. At the time of these reports, which surfaced in April, it was suggested that Apple had to bypass these banks and a number of major credit card companies because of the fact that negotiations were taking too long.

This is reportedly representative of troubles that Apple has been facing in a number of countries when it comes to the rollout of Apple Pay. In the US, Apple Pay, according to reports, gets a 15 cent cut for each $100 transaction made. Banks in Australia and China, however, have reportedly been unhappy with these fees.

Recent rumors suggest that Apple may, however, launch Apple Pay in Australia as early as this week.

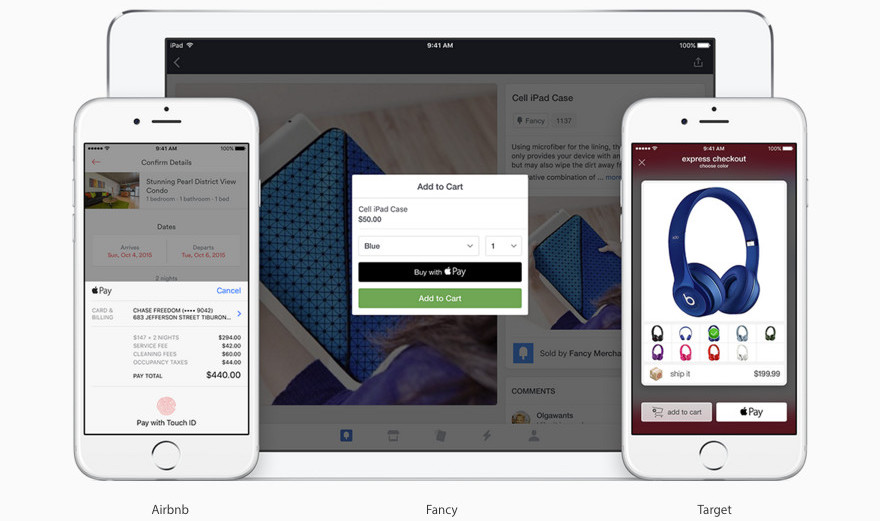

Canadians that want to give Apple Pay a shot and have the right card and phone can head to the Wallet app within iOS 9.1 and tap on “Add Credit or Debit Card.” Users will then be able to scan their card or manually enter the information after which they can use the service to pay for goods using their phone.

There are a number of reasons that users might want to turn to Apple Pay whenever they possibly can. Perhaps the most important is the fact that the service is much safer than other payment methods because of the fact that it uses a tokenized system. When a credit card is swiped, the information changes hands a number of times before the transaction is ultimately approved. The first is the merchant, who collects things like the card number, the expiration date, PIN code, and so on. That information is then sent to the merchant’s bank, who then forwards the request to the card issuer. The charge is either accepted or denied, and the appropriate cards are sent back.

With Apple Pay, however, the credit card number is replaced with a “token,” which can be thought of as a temporary card. Rather than receiving a code, the merchant receives a token that is specific to the user’s device, along with a one-time security code. That information is encrypted until it gets to the user’s payment network, meaning that only the bank and the payment network will have the user’s banking information.

[image3]

Only time will tell to what extent Apple is able to expand Apple Pay, however it will certainly roll out slower than other Apple products because of the fact that Apple has to form partnerships with banks and networks in the particular countries that end up getting the service. Over the next few years we will surely see more countries get Apple Pay.