‘Apple Pay Later’ Available to Select Users Running iOS 16.4

Credit: Apple

Credit: Apple

Toggle Dark Mode

Apple on Tuesday announced that it is inviting “select users” to use the prerelease version of Apple Pay Later. Invitations will appear in the Wallet app, as well as in an email sent to the email address used as their Apple ID.

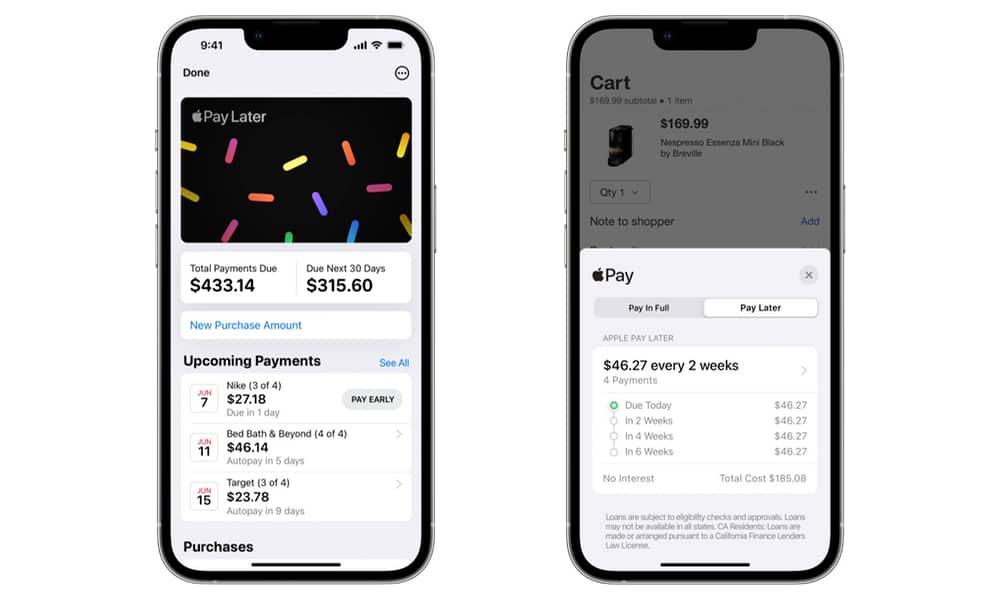

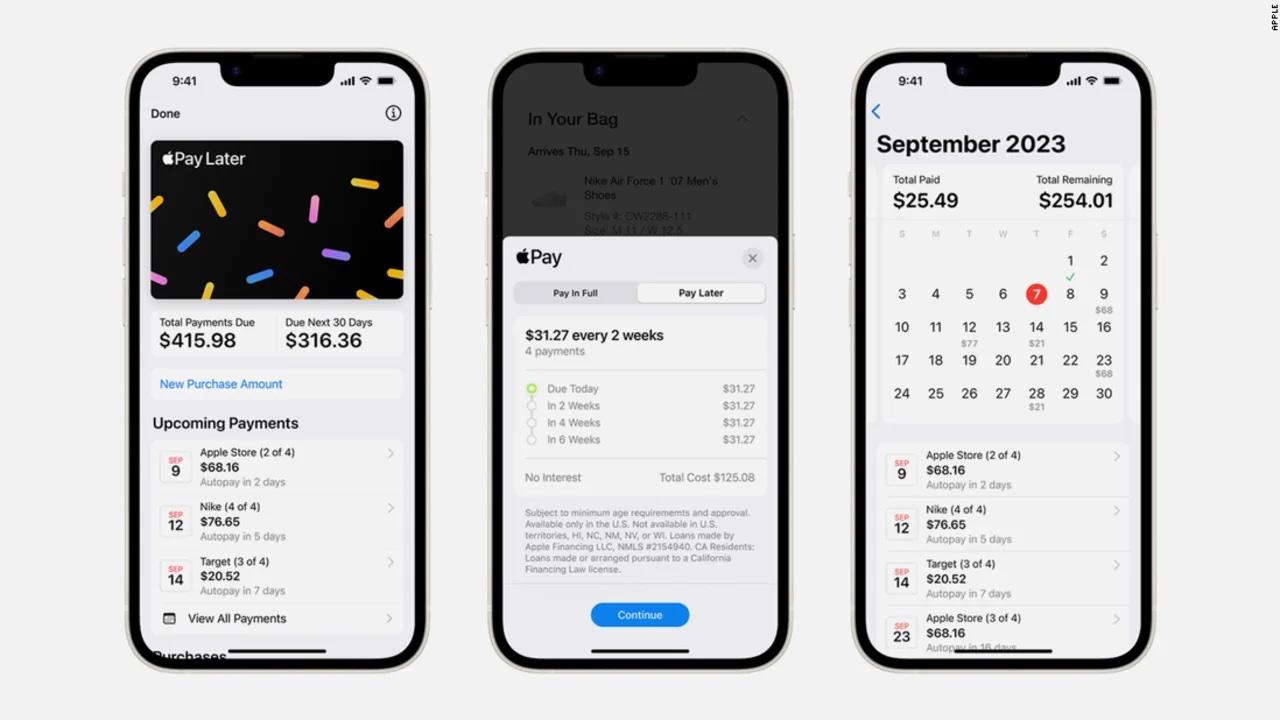

Apple first announced the Apple Pay Later “buy now, pay later” financing option at WWDC 2022. The program allows qualified U.S. customers to split their Apple Pay purchases into four equal payments that are spread over six weeks, without paying any fees or interest.

Users will apply for Apple Pay Later loans ranging from $50 to $1,000. They can then use the short-term loan to make online and/or in-app purchases via Apple Pay on their iPhone or iPad.

Currently, Apple is limiting access to Apple Pay Later to users in the United States and requires iOS 16.4 and iPadOS 16.4 to be installed on the device. Apple says the Apple Pay Later plan will be offered to all eligible iPhone users 18 years of age and older in the “coming months.”

Applications can be made for an Apple Pay Later loan via the Wallet app with no impact to their credit rating. Applicants need merely enter the amount they’d like to borrow, agree to the terms of the program, and wait as a soft credit check is performed. Once the loan is approved, Apple Pay Later will become a payment option in Apple Pay.

Apple Pay Later will be accessible in the iPhone Wallet app, where users can view, track, and manage their loans in one location. Users can view their upcoming payments, and notifications of upcoming payments can be received both in the Wallet app and via email. Payments can be made by debit card. Credit cards cannot be used to make payments on the account.

“There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later.”Jennifer Bailey, VP

All credit assessment and lending is handled by Apple Financing LLC, an Apple subsidiary. If a merchant accepts Apple Pay, customers will see Apple Pay Later as an option at checkout online and in apps.

Restrictions and Requirements for the Apple Pay Later Program

- Users must be 18 years of age or older.

- Users must either be a U.S. citizen or a lawful resident.

- Users must have a valid, physical U.S. address. P.O. Boxes cannot be used.

- Apple Pay must be set up on your device with an eligible debit card. Apple Pay Later down payments cannot be made using a credit card.

- Two-factor authentication must be set up for your Apple ID.

- The user’s device must be updated to the latest version of iOS or iPadOS.

- The user’s identity may need to be verified with a Driver’s License or a state-issued photo ID.

Until today, Apple Pay Later access was part of an early testing program that was limited to Apple retail and corporate employees.

More information about Apple Pay Later can be found in this Apple support document.

This information first appeared on Mactrast.com