The Apple Card Is Switching to Chase

Toggle Dark Mode

That didn’t take long. We’re barely a week into 2026 and it seems that one of the first Apple predictions of the year has already come to pass. After months of speculation and rumors, Apple has officially announced that Chase will become the new issuer of the Apple Card.

However, this is just the first step on what may be a longer journey. While Apple and Chase have come to an agreement, Apple notes that the expected transition won’t take place for another 24 months. Nevertheless, the move represents the final terms of Apple’s divorce with Goldman Sachs — plans that were formally announced over two years ago in late 2023.

“We’re incredibly proud of how Apple Card has transformed the credit card experience for customers by delivering innovative tools that empower users to make healthier financial decisions,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, in the company’s press release. “Chase shares our commitment to innovation and delivering products and services that enhance consumers’ lives. We look forward to working together to continue to provide a best-in-class experience and exceptional customer service with Apple Card.”

What This Means for the Apple Card Today

Sadly, Apple’s press release is scant on details about what this transition will look like after the dust settles. In fact, most of it is devoted to promoting the features of the Apple Card, with a single paragraph at the end noting that it will be business as usual for now.

During this transition, Apple Card users can continue to use their card as they normally do.

Apple

Apple has set up an Apple Card Issuer Transition FAQ page and promises to share more details “as the transition date approaches,” but for now most of the information there is there to reassure users that not much will be changing in the short term. For example:

- For the next 24 months, Apple Card users can continue to use their cards as if nothing has changed — likely because nothing will in the short term. This includes using the Wallet app to manage their account.

- Existing Apple Card users will not need to reapply after the transition.

- Apple will continue to accept new applications for the Apple Card. These will still be processed and issued by Goldman Sachs until the transition occurs.

- Existing Apple Card balances will move to Chase once the transition is complete.

Most of this is because, despite the deal to move to Chase, Goldman Sachs is still holding the bag until all the details are worked out to hand everything over. Today — and likely for at least the rest of 2026 — the Apple Card will still be issued and supported by Goldman Sachs, just like it has been for the past six years.

Since the transition isn’t expected for 24 months, we may not even hear much about the impact of that until next year. Apple implies that there may be card number changes and will likely be new physical cards issued — if for no other reason than to replace the Goldman Sachs logo on the back with a Chase one.

The Longer-Term Plan

While most of Chase’s credit cards are on the VISA network, the bank does offer some Mastercards, and Apple has confirmed in its FAQ that Mastercard will continue to be the payment network. As rumors circulated over the past few months of Chase as a possible Apple Card suitor, many wondered if that would result in a change of payment providers.

Apple isn’t necessarily married to the Mastercard network, as it already uses VISA for the Apple Cash debit card, having switched over from Discover in 2022, but it likely makes things simpler to stay with Mastercard for its credit card.

Sadly, that means the door remains closed for Costco shoppers, which only accepts VISA in its US warehouses (ironically, Costco Canada has an exclusive deal with Mastercard, but the Apple Card isn’t available there — and the Chase partnership makes it even less likely that will happen anytime soon).

However, there’s some good news, as Apple’s FAQ assuages some of the concerns that Chase may offer less generous terms than Goldman Sachs:

- Daily Cash: Apple Card users will continue to earn up to 3 percent unlimited Daily Cash back on every purchase.

- No Fees: The Apple Card will continue to have no fees of any kind — no annual fees, late fees, or foreign transaction fees.

- Apple Card Monthly Installments (ACMI): Apple Card users will be able to continue purchasing Apple products on the company’s monthly installments plan.

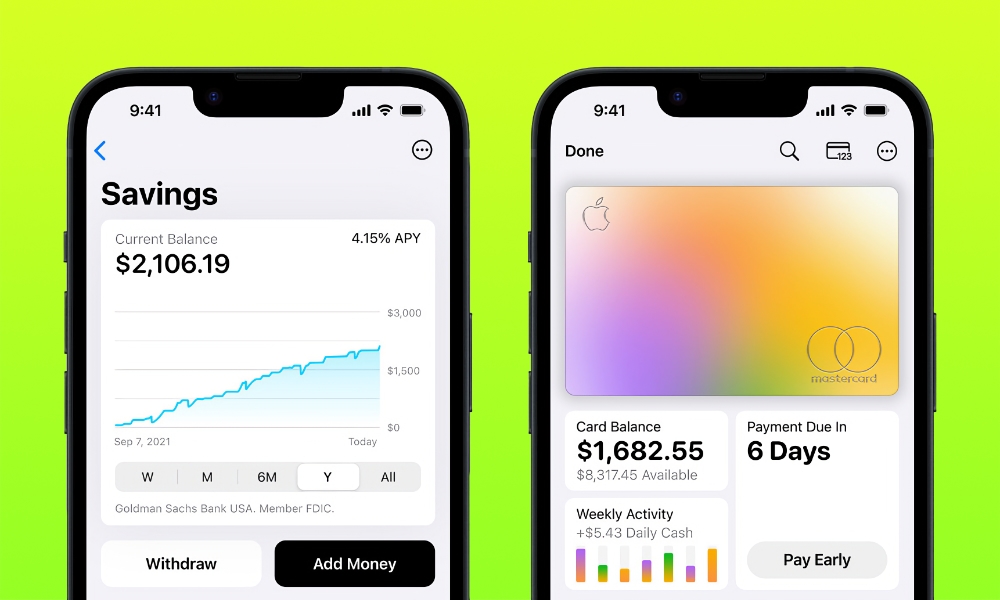

- Apple Card Savings account: Perhaps the most interesting of all is that Apple has promised that “Apple Card users will continue to have access to Savings.”

While this last one could lead us to assume that Chase will be taking over the Apple Card Savings account and its billions of dollars in deposits from Goldman, it’s what Apple isn’t saying here that’s significant, and the devil is in those details.

The Elephant in the Room: Apple Card Savings

The Apple Card Savings Account offered by Goldman Sachs is a high-yield account with an Annual Percentage Yield (APY) that’s ranged from as high as 4.5% in early 2024 to its current low-water mark rate of 3.65%. It’s an open question whether Chase plans to offer interest rates that are quite that generous, which would be an unusual move for a bank that has never offered high-yield savings accounts for everyday consumers.

This was also believed to be a major sticking point in the deal. A bank that traditionally offers a 0.01% APY would be understandably reluctant to start paying up to 4% on billions of dollars in deposits. Goldman Sachs was willing to offer high interest rates to attract new cash from affluent consumers. That’s unlikely to be a priority for one of the largest consumer banks in the US. Chase may create a special higher-yield tier exclusively for Apple Card users, but even insiders haven’t provided any insight into what this will look like.

The Wall Street Journal reports from its sources that Chase will launch a new Apple savings account, but existing customers will be able to remain at Goldman if they so choose. Depending on how things play out, customers may want to stick with Goldman in the short term, but one of the reasons for this whole divorce is the investment bank’s desperation to get out of the consumer banking business, so we wouldn’t be surprised if it starts pressuring account holders to move their funds elsewhere.

That lines up with Apple’s somewhat vague “access to Savings” phrasing. However, all it’s saying for now is that “further information regarding Savings will be communicated with users as the transition date approaches.”

The Apple Card Fire Sale

While the terms of the deal haven’t been disclosed, most analysts were expecting that Apple and Goldman would need to sharpen their pencils and offer a sweet deal to find a suitable new home for the Apple Card. Anonymous sources speaking to CNBC and The Wall Street Journal suggest that Chase paid about $1 billion less than the value of the Apple Card portfolio, which is estimated to be worth around $20 billion. That’s a significant move that’s almost unheard of in the finance and banking industry.

With most co-brands, balances sell at a premium of up to 8%, a figure that can run into the double digits for the strongest programs. Discounts are rare and are reserved for the most challenged cases.

The Wall Street Journal

However, this is almost certainly happening because of the higher risk involved in taking on the Apple Card balances and continuing to offer Apple’s generous Daily Cash back and no-fee initiatives, which are equally rare among co-branded credit cards.

Chase will be taking on $20 billion in potential receivables, but also facing the risk of not being able to collect on all of it — and it won’t even be able to charge late fees to try and make up for it. One of the irreconcilable differences in the Apple-Goldman partnership was reportedly the iPhone maker’s insistence on approving higher-risk applicants, known as “subprime borrowers.” That’s resulted in delinquency rates well above the norm: 4% for the Apple Card versus a 3.05% average for the credit card industry as a whole.

To put this in raw numbers, that means Chase would be buying $800 million worth of debt that it’s unlikely to collect on — 4% of the $20 billion portfolio.

This WSJ notes that this was enough of a sticking point that it slowed down talks on a deal that could otherwise have been completed months ago.

However, JPMorgan Chase ultimately decided that it was willing to take the risk, and it seems that it’s not much of one considering that it’s not really paying for that potentially bad debt.

Nevertheless, CNBC notes that the bank has already committed to booking a $2.2 billion provision for credit losses when it reports its fourth-quarter 2025 results next week, taking the hit now to prepare for the eventual transition. That’s a legal requirement under CECL accounting rules for any finance company taking on a new loan portfolio, so it doesn’t necessarily represent a loss — just Chase being conservative. Despite this, it still expects the deal to boost its earnings overall.

Sources told the WSJ that with its long record of underwriting and managing risk, JPMorgan executives became confident that they “could absorb the Apple program and grow it meaningfully.” Raw dollars aside, there’s a lot of marketing and goodwill value that comes with the Apple brand. While Goldman was hoping to leverage Apple to build a premier-tier consumer banking franchise, Chase is already well-established in that business, which means it’s more likely to know what to do with a loyal base of Apple customers. It’s also a win for Apple, which gets to partner with a much stronger consumer bank without diluting its brand any more than necessary.

“Apple is an iconic brand recognized globally for its innovation, design excellence, and commitment to delivering exceptional customer experiences,” said Allison Beer, Chase’s chief executive officer of Card & Connected Commerce shared in Apple’s announcement. “We share a commitment to supporting consumer financial health, and we’re proud to deepen our relationship by welcoming them as the newest partner in our industry-leading co-brand credit card program. We’re excited to innovate together in the future.”

With the actual “switch day” likely not coming until early 2028, the physical titanium Goldman Sachs Apple Card will continue to be a “vintage” item for a couple more years. While nobody’s sure what the new Chase-branded Apple Card will look like, perhaps Apple will use the change as an opportunity to re-issue “Recycled Titanium” versions.