App Store Developers Made $1.1 Trillion from the App Store in 2022

Credit: BigTunaOnline / Shutterstock

Credit: BigTunaOnline / Shutterstock

Toggle Dark Mode

With over 35 million active developers and nearly 300 million active customers, there’s no doubt that a lot of money passes through the App Store, providing developers with a great deal of revenue — both directly and indirectly.

In a news report today, Apple is giving us an idea of just how staggering those numbers are, citing an independent by Analysis Group economists that reveals that over $1.1 trillion in worldwide billings and sales in 2022 were facilitated by the App Store.

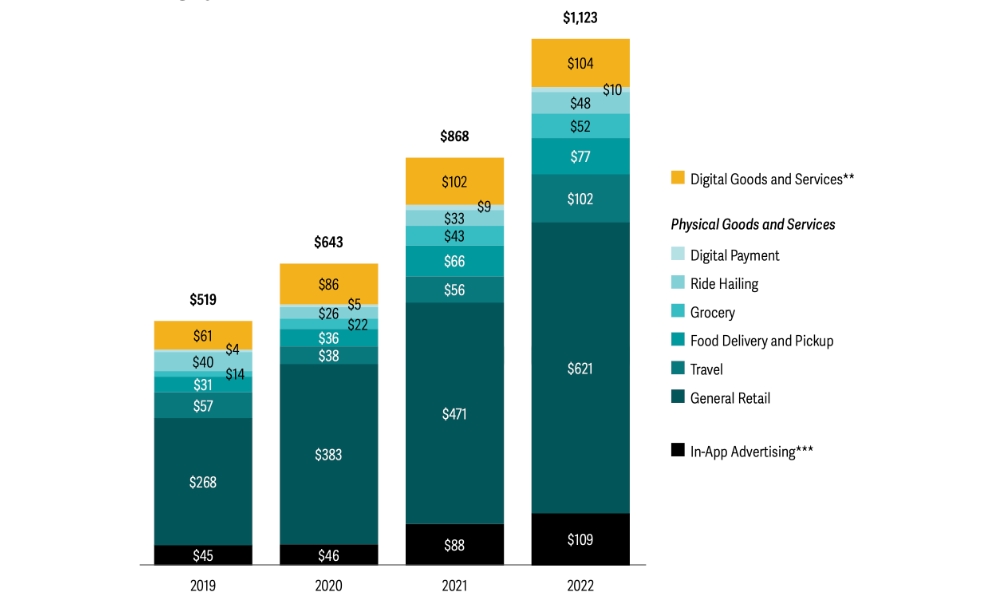

To be clear, this isn’t just about how much folks spend buying apps or purchasing in-game currency like Robux. In fact, those types of sales — known as “digital goods” — accounted for about 9% of that total.

That still works out to $104 billion on digital goods and services, which is nothing to shake a stick at. While the report doesn’t offer any specifics, Apple would have collected its usual 15–30% commission on most of these purchases, putting its 2022 revenue share somewhere between $15.6 billion and $31.2 billion.

That’s not surprising, considering Apple reported nearly $80 billion in Services revenue in 2022. Most analysts believe that App Store commissions account for about a quarter of Apple’s total services revenue, with the rest made up from its lucrative search placement deal with Google and Apple’s own services, which include Apple Music, Apple Arcade, Apple TV+, Apple News+, Apple Fitness+, iCloud+ storage plans, and AppleCare+ subscriptions.

Getting back to the App Store, though, the bulk of the trillion-dollar revenue — $910 billion — came from the sales of physical goods and services purchased through iPhone and iPad apps. This includes services like Uber and Doordash and purchases made from Amazon through the Amazon mobile app. The remaining 10% slice of the pie, which works out to $109 billion, came from in-app advertising run by developers.

Apple collects no commissions on physical goods and services or in-app advertising, and as the report notes, it may not even have collected commissions on some of the digital goods and services. Since the report is about ways in which the App Store “facilitated” spending, the analysis adjusted these services to “include sales from digital goods and services purchased elsewhere but used on apps on Apple devices,” while also subtracting “billings from in-app purchases made via the App Store but used elsewhere.”

In other words, subscriptions to streaming apps like Netflix and Spotify, neither of which allow in-app subscriptions, were counted if the purchaser used those services on an iPhone or iPad. Ditto for Kindle Books purchased from Amazon and read with the iOS/iPad Kindle app.

Since Analysis Group isn’t actively tracking how much time people spend in apps like Netflix, Spotify, or Kindle, it uses a more complicated methodology to calculate what share of usage should be apportioned to the App Store ecosystem.

For example, with streaming apps, it takes the total number of hours streamed on all smartphone, tablet, and smart TV platforms and then uses Apple’s iPhone, iPad, and Apple TV market share to determine how much of that should be attributed to the App Store. The report goes into much more detail about the methodology Analysis Group uses for different types of apps.

Significant Growth

What’s more interesting is how rapidly the App Store ecosystem has grown. The numbers for 2022 reflect a 29% increase over 2021, driven mainly by the sale of physical goods and services, which jumped from $678 billion in 2021 to $910 billion in 2022.

In that category, sales of physical goods and services in travel apps jumped from $56 billion to $102 billion, growing by 84%, likely spurred by the lifting of COVID-19 restrictions. Similarly, while Food Delivery and Pickup apps still increased year-over-year, the $66 billion to $77 billion 2021-2022 increase was considerably more modest than the year before when it nearly doubled in revenue as more folks ordered in.

The economists at Analysis Group directly attribute many of these changes to the COVID-19 pandemic:

“Over the past few years, through the ebbs and flows of the COVID-19 pandemic, the App Store ecosystem grew at a substantial and remarkably steady rate (between 27% and 29% annually), consistent with a flourishing marketplace. This steady overall growth hides important variations within app categories that reflect consumers’ changing habits as the pandemic evolved. For example, some categories grew substantially in 2022 as many people returned to in-person activities, with travel (up 84%) and ride hailing services (up 45%) leading the way. Other categories, such as grocery sales, food delivery, and digital goods and services consumed on iOS apps, grew more modestly in 2022 after booming at the height of the pandemic.”

Nevertheless, General Retail still overshadowed all these categories, accounting for $621 billion in App Store-facilitated sales in 2022. This would include all purchases made in apps such as Amazon, Target, and Walmart.

While Analysis Group makes it clear that “the conclusions and opinions expressed as exclusively those of the authors” — two Vice Presidents of the firm who hold Doctorates in Economics and Public Policy — the study was supported by Apple and it’s clearly using it as an opportunity to tout the success of the App Store.

The trickier part of statistics such as these is whether it’s possible to attribute this revenue exclusively to the App Store and related commerce apps, especially in the case of the purchase of physical goods and services. For instance, while there’s little doubt that the Amazon app makes it much easier to shop on the go — and likely drives a few impulse purchases along the way — it’s not reasonable to suggest that consumers wouldn’t have made at least some of those purchases using another means if an iPhone or iPad app weren’t available.

Still, regardless of the final numbers, it’s hard to argue that the iPhone and iPad haven’t contributed substantially to driving online commerce for physical goods and services. After all, there’s something about surfing through Amazon, ordering up some Doordash, or booking your next vacation from your iPhone that just seems more fluid, and it’s rare to find a website that can provide a better experience for this kind of thing than a mobile app.